Volume 148

Published on October 2025Volume title: Proceedings of the 3rd International Conference on Applied Physics and Mathematical Modeling

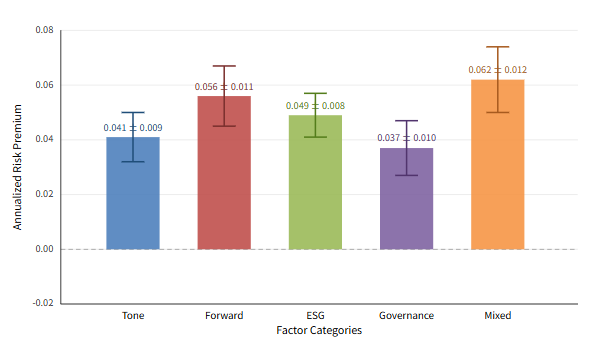

The emergence of large language models (LLMs) has introduced a novel methodology for constructing factors in asset pricing. Whereas conventional approaches emphasize financial ratios or price-based indicators, LLMs allow for the systematic conversion of unstructured financial text into economically interpretable constructs that may capture latent risk perceptions. This study evaluates the pricing ability of LLM-generated factors in explaining U.S. equity cross-sectional returns from 2000 to 2024. Using a dataset of 220,000 earnings call transcripts, 180,000 10-K filings, and 1.2 million analyst reports, we extract 68 candidate factors through GPT-4 prompted financial text analysis. These include tone consistency indices, ESG disclosure emphases, governance accountability markers, and forward-looking orientation metrics. Econometric testing employs Fama-MacBeth regressions, generalized method of moments (GMM), and Bayesian shrinkage with horseshoe priors. The LLM-derived factors improve adjusted R² by +0.034 relative to Fama-French 5-factor benchmarks and reduce mean absolute pricing errors from 0.812 to 0.545. Out-of-sample Sharpe ratios of factor-mimicking portfolios rise from 0.42 (FF5) to 0.61 (LLM factors), and Hansen-Jagannathan distances fall by -0.052. Robustness checks through adversarial textual perturbations, rolling-window sub-sampling, and sectoral decomposition confirm stability, with persistent contributions from narrative consistency, forward-looking ratios, and ESG-litigation emphasis. Findings indicate that LLMs provide not only interpretable but also quantitatively robust innovations in factor design, marking a methodological shift for empirical asset pricing research.

View pdf

View pdf

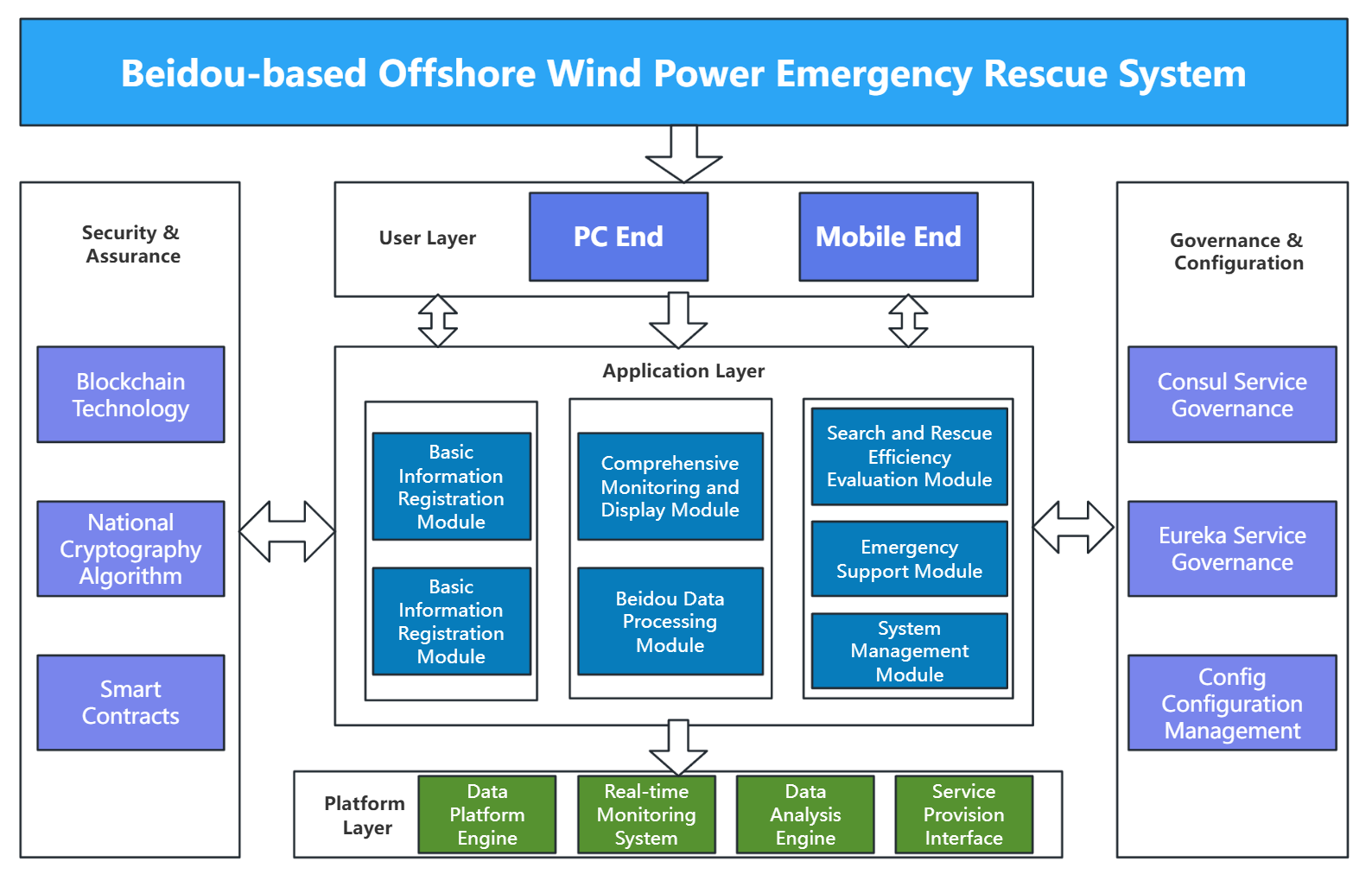

Under the guidance of the carbon peaking and carbon neutrality goals, the global energy structure is being reshaped, and offshore wind power has become an important means for China to promote energy transformation. "Communication lines are lifeline." In response to the high safety risks of offshore operations and the difficulty of ensuring communication for maritime rescue, a marine emergency search and rescue system integrating monitoring, positioning tracking, and emergency rescue based on Beidou has been designed. The system based on the high-quality services of Beidou, has independently developed the marine emergency search and rescue system (software) as well as supporting hardware products such as personal portable beacons, ship-borne beacons, and positioning navigation tracking terminals. It ensures smooth communication and positioning tracking during the search and rescue process, providing solid technical support for offshore operations related to offshore wind power. The marine search and rescue system provides the last line of technical support for the safety of offshore personnel and vessels, enhances the safety awareness of offshore personnel, reduces maritime accidents, and protects people's lives and property.

View pdf

View pdf