Volume 217

Published on September 2025Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

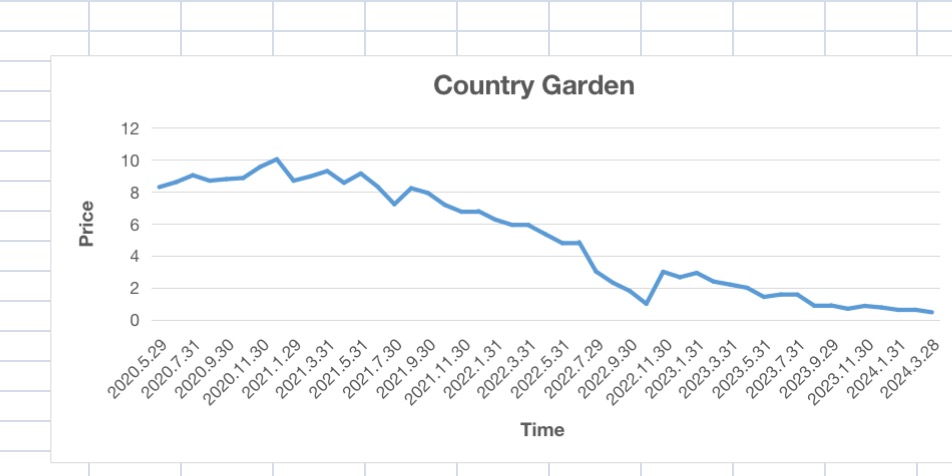

The importance of the real estate sector to the Chinese economy has grown along with the country's economic growth. Many real estate have previously had some degree of difficulty owing to the combined effects of internal issues like high leverage and external causes like the pandemic. This article first delivers a survey of the contemporary Chinese real estate market situation. In its second section, this article examines the reasons behind insolvent real estate companies. The article then evaluates the sustaining strength of the non-bankrupt real estate ventures by comparing and analysing them. This article continues to provide options and suggestions on how to enhance the property industry's current state. This article aims to provide a valuable reference for government decision-making, enterprise operation, and research by examining the past, causes, and solutions of the real estate firm's conundrum.

View pdf

View pdf

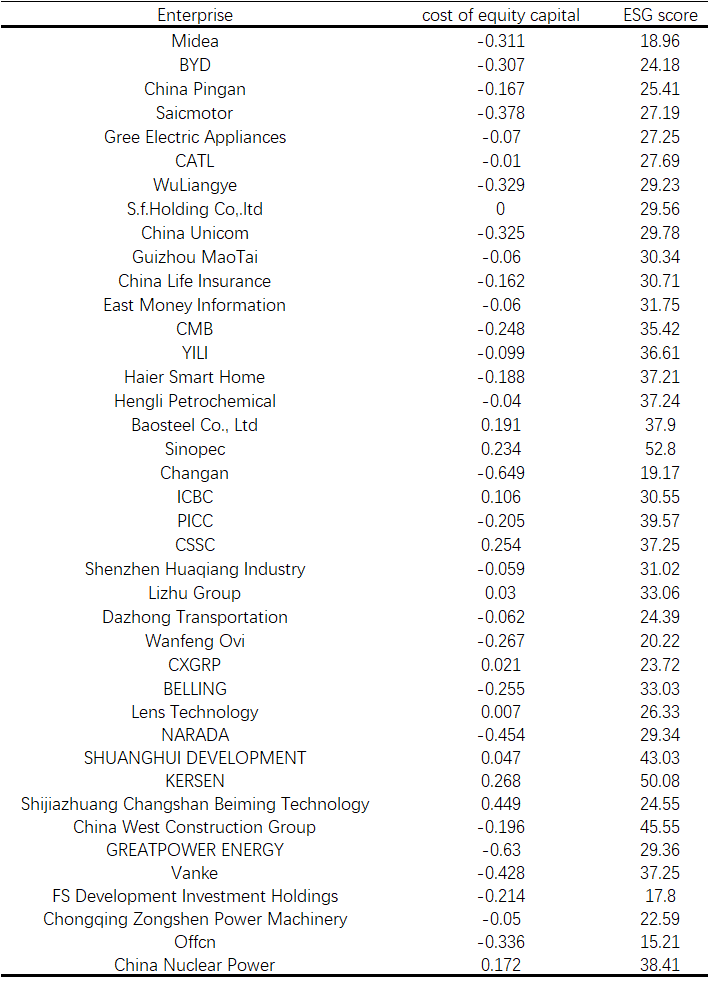

This paper delves into the impact of environmental, societal, and governance (ESG) excellence at the expense of equity capital. This research scrutinises the correlation between the costs associated with equity funding and ESG excellence by utilising MSCI ESG ratings, encompassing a sample of 40 firms listed in China. Grounded in the principles of signalling theory, stakeholder theory, the concept of information asymmetry, and the framework of corporate risk mitigation, the research constructs a theoretical model and conducts a regression examination. The findings indicate an inverse relationship between equity financing costs and ESG excellence, suggesting that superior ESG ratings are linked to reduced equity financing expenses. This inquiry contributes to a better understanding of how ESG excellence influences financing choices, underscores the significance of ESG criteria in corporate financial strategies, and aids in the ongoing enlargement of ESG-related scholarly work. Furthermore, the research underscores the necessity of refining ESG transparency and reporting mechanisms to bolster investor trust and foster more sustainable and accountable investment behaviours.

View pdf

View pdf

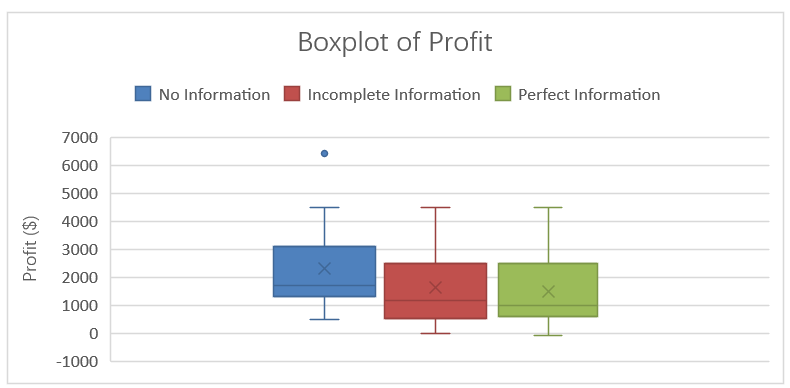

This paper investigates the influence of different levels of information provision on advertisement bidders and search engines that own the advertisement places under a generalized second price auction mechanism. Three settings of the level of information are given: no information, incomplete information, and complete information. The study examines specific categories of data collected from the experiment: total profit, individual profit, individual revenue, total revenue for the search engine, and others. With statistical analysis and ANOVA tests, it can be found that increasing the availability of information to consumers would increase their actual payments, thus decreasing their profits and total profits while increasing the total revenue for the search engine. This paper provides a deep understanding of the effects of information on bidders and search engines, giving practical advice to both sides in bidding for advertisement places.

View pdf

View pdf

At present, there are various types of pet locators and pet health detectors on the market with different functions. However, many products have certain shortcomings in terms of positioning accuracy, ease of use, or health monitoring for pets of different age groups. To overcome the above challenges, we have designed a new personalized intelligent collar. This intelligent collar can not only monitor the health of pets in real time, but also effectively prevent pets from getting lost. Personalization mainly refers to: young pets need to monitor their exercise status, while older pets need to monitor their physical functions. In addition, this smart collar can also transmit various information about pets into the community, making it convenient for pet owners to exchange experiences with each other. It is worth noting that our product supports pet owners to DIY the appearance of the device. Therefore, our product achieves personalized customization by meeting various requirements of pet owners.

View pdf

View pdf

This work studies whether the net present value (NPV) is a more effective investment appraisal tool than other traditional methods like internal rate of return (IRR) and payback period in forecasting the financial success of tech startups. The major task for financial forecasting is due to volatility, fast growth of tech startups, varying consumer preferences. Our study assesses these valuation methods not only by statistical regression analysis but also by examining various companies like Airbnb and Booking.com as a case study. The findings indicate that although NPV can be very informative about financial performance in the long run, the analysis is enriched when IRR and period of return are also included. Using this holistic method in technology investment valuation should minimize risk and improve decision-making, especially in the high-risk field of rapidly growing technology firms.

View pdf

View pdf

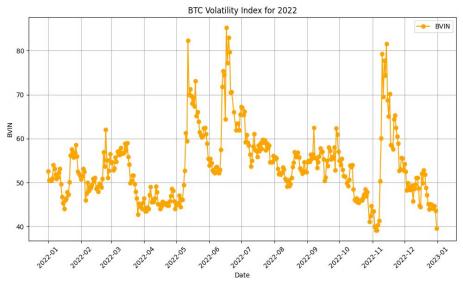

With the global economic downturn, investors need to make increasingly cautious investment decisions, making volatility analysis of financial products more critical. However, relying on a single data source or index often fails to provide comprehensive market insights, thereby affecting the rationality of decision-making. The Bitcoin Volatility Index (BVIN) has been proven to effectively reflect the volatility of the Bitcoin market. This study adopts the BVIN algorithm to calculate the volatility of a single stock (using Apple Inc. as an example) and the VIX index and evaluates the effectiveness of these indices in reflecting market performance. The results show that the BVIN algorithm cannot only be applied to the Bitcoin market but can also be extended to stocks and broader financial products, providing investors with a new tool for market performance evaluation.

View pdf

View pdf

Efficient computation of option prices is essential for making quick trading decisions. This paper investigates the use of deep learning to expedite the accurate calculation of European option prices within a local volatility framework that utilizes five parameters. We compared the predictions of the deep neural networks against results obtained from the Monte Carlo method across various scenarios. Our numerical experiments indicate that the approximation network achieves satisfactory accuracy. The network performs exceptionally well within the core region of the parameter domain.

View pdf

View pdf

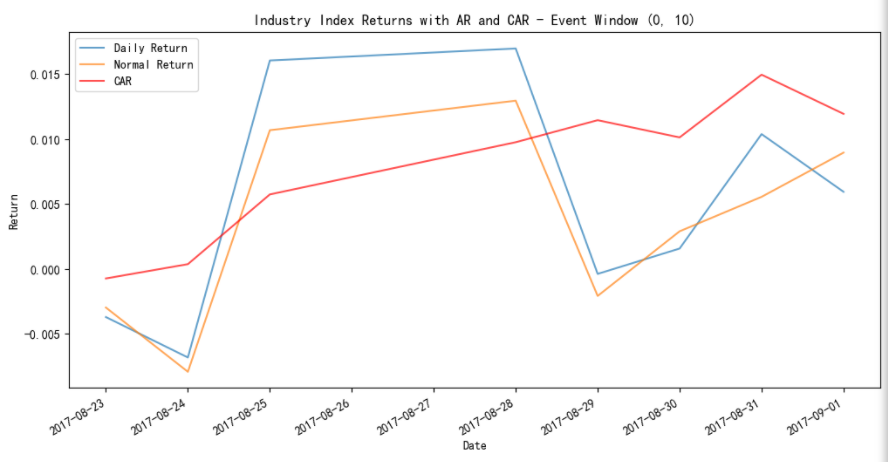

As climate change continues to intensify, it has become increasingly important to assess the impact of extreme weather events on financial markets. This study examines the impact of typhoon landfalls on China's A-share market from 2014 to 2023. The study employs event study methodology, Carhart's four-factor model, and intervention analysis to examine and assess abnormal returns during five major typhoons in key sectors: Hato, Higos, Doksuri, Rammasun, and Maria. The findings suggest that typhoons can have a short-term negative impact on stock market performance, causing temporary market volatility, but the Chinese stock market recover quickly after a typhoon, thus mitigating the long-term financial consequences. These results highlight the resilience of the A-share market and provide valuable insights into how investors and policymakers can better manage the risks associated with climate-related disruptions.

View pdf

View pdf

This literature review explores the role of information asymmetry in Initial Public Offering pricing, focusing on how companies impact their informational advantage over investors to underpricing shares. Information asymmetry creates an adverse selection problem, leading firms to underprice IPOs to attract institutional investors and reduce risks. Signaling theory suggests that underpricing can also signal a firm’s quality with high-quality firms absorbing short-term losses to gain long-term benefits. Empirical evidence, including studies by Jain and Kini (1994) and Rock (1986), demonstrate how underpricing compensates uninformed investors for higher risk. Additionally, the allocation process is influenced by market sentiment, firm size, and underwriter reputation, with institutional investors often receiving favorable allocations in high-demand IPOs, leading to better outcomes for them.

View pdf

View pdf

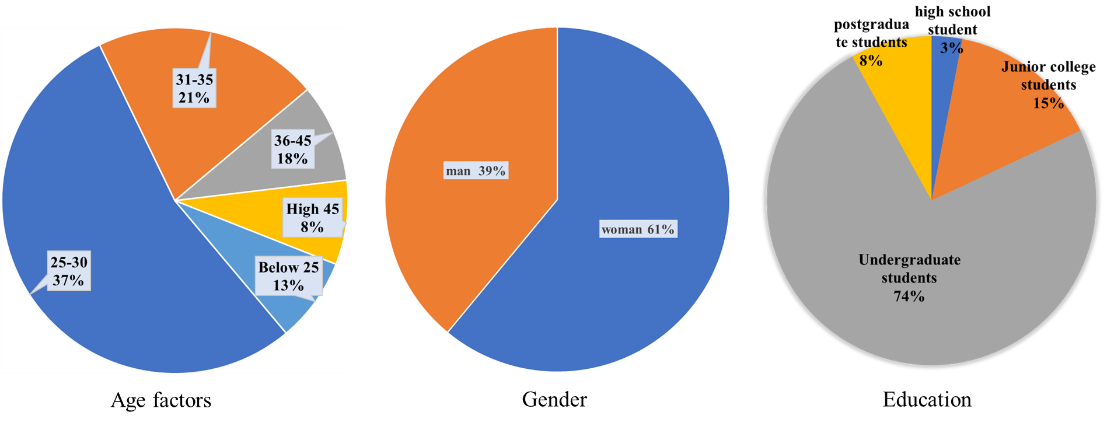

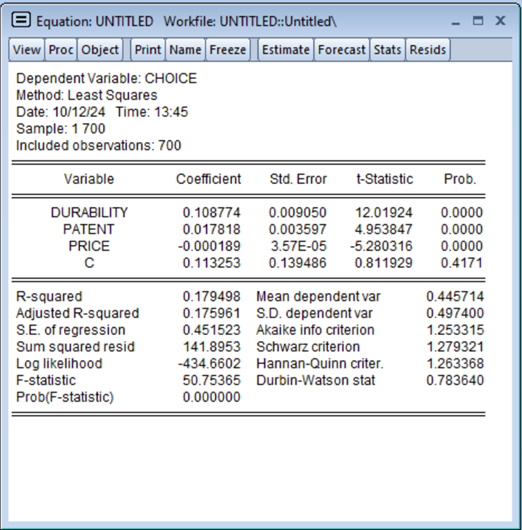

This article aims to understand and analyze the impact of modern market dynamics on the performance of emerging luxury brands like Alexander Wang. The study explores how these brands are transforming their business models in the Internet era, shifting from traditional offline physical store operations to online digital strategies to navigate rapid changes and fierce competition. We specifically focus on Alexander Wang and compare it with competing brands Balenciaga and Bottega Veneta to comprehensively assess its positioning and competitiveness in the luxury market. The research employs methods such as SWOT analysis, competitor analysis, questionnaires, and regression models to provide a detailed overview of Alexander Wang's market competitiveness. Using variables such as price, durability, and patent numbers, we develop relevant hypotheses to understand how these factors influence consumer purchase decisions. The pricing strategy starts by referencing the price of ready-to-wear products on the brand's official website while also considering consumers' expectations for product durability and the increasing number of brand patents to explore Alexander Wang's core competitiveness.

View pdf

View pdf