1. Introduction

1.1. Research background

With the rapid evolution of digital technologies and the explosive growth of platform economies, human economic and social life is undergoing a profound transformation centered on the internet and data as core production factors. In the era of the digital economy, internet operators have begun to employ algorithmic technologies for pricing activities, leveraging their control over massive volumes of consumer data to construct user profiles and implement precision marketing strategies characterized by "personalized pricing for every user" [1]. In this process, the phenomenon of “big data-enabled price discrimination against familiar customers” has gradually emerged from obscurity into the public spotlight, becoming a contentious issue straddling the realms of economic efficiency and legal fairness. At its core, this phenomenon involves platform enterprises using algorithmic decision-making systems to implement differential pricing strategies for consumers with varying willingness to pay or behavioral characteristics. It not only reflects the emergence of price discrimination in the digital economy but also exposes the structural dilemmas faced by legal regulation in the face of opaque algorithmic processes. This paper is grounded in the operational logic of transactions within e-commerce platform economies. It aims to move beyond the surface of “price discrimination against familiar users” to explore its economic drivers and the institutional shortcomings of the e-commerce ecosystem. By deconstructing the technological pathways, market impacts, and rights-based mechanisms underlying big data-enabled price discrimination, this study seeks to provide a theoretical foundation for developing a regulatory framework that balances efficiency optimization with rights protection.

1.2. Definition of core concepts and research significance

From a theoretical standpoint, “big data-enabled price discrimination against familiar customers” can be defined as follows: a platform operator with a dominant market position uses non-public personal consumer data and machine learning algorithms to implement systematic price differentiation for essentially identical goods or services across different consumers, where such price differences cannot be reasonably justified by cost variations or legitimate commercial reasons. This definition includes three key elements: First, market dominance of the actor—without which differentiated pricing would simply fall within the bounds of normal market competition; Second, reliance on non-public, privately obtained data as the basis for pricing decisions, rather than publicly available market information; Third, systematic and concealed nature of the pricing discrepancies, which distinguishes them from temporary promotional strategies and is reinforced by technological barriers. From an economics perspective, this behavior constitutes third-degree price discrimination enhanced by algorithmic capabilities in the internet context. Its particularity lies in the fact that, whereas traditional price discrimination was constrained by the costs of information collection and could only coarsely segment consumers, algorithms now enable micro-level “one person, one price” strategies. From a legal perspective, the primary concern lies in the erosion of the right to fair transactions. When consumers are compelled to pay a premium due to opaque algorithms, the principle of freedom of contract becomes ineffective in the face of algorithmic power.

The theoretical and practical significance of this study lies in its effort to overcome the fragmented limitations of existing research. Economic literature has primarily focused on the efficiency debates surrounding algorithmic pricing—such as Pigou’s welfare model, which posits that price discrimination can enhance producer surplus and meet long-tail demand. However, many argue that under conditions of data monopoly, the transfer of consumer surplus to platforms suppresses overall market demand. Legal scholarship, meanwhile, has mainly concentrated on the difficulties of applying Article 17 of the Anti-Monopoly Law concerning “differential treatment,” often overlooking the potential for a coordinated regulatory framework involving Article 8 (Right to Information) and Article 10 (Right to Fair Trade) of the Consumer Rights Protection Law, along with Article 18 of the E-Commerce Law addressing constraints on algorithmic recommendations. By adopting an interdisciplinary approach, this study reveals the dual failures underlying the “big data price discrimination” phenomenon—market failure and regulatory failure—and proposes pathways for institutional innovation. In doing so, it aims to provide an integrated solution for competition policy and consumer protection in the digital economy era.

2. The economic foundations and legal controversies of big data price discrimination

2.1. Price discrimination in platform economies

Algorithmic pricing behavior in platform economies exists in a field of tension between the economic principle of efficiency and the legal value of fairness. Proponents interpret “big data-enabled price discrimination” as a higher-order manifestation of market rationality, arguing that it achieves Pareto improvements through the precise allocation of data elements. Opponents, however, expose its essence as a new form of rights deprivation under technological alienation, ultimately leading to the systemic disruption of market order. The root of this divergence lies in differing conceptualizations of algorithmic power. The motivation for enterprises to engage in price discrimination is rooted in the value appreciation chain of data capitalization. User behavior data, once processed through algorithms, is transformed into "digital capital," whose value realization follows a three-stage progression: data assetization → data commodification → data empowerment.

Research on big data-enabled price discrimination is grounded in three core characteristics of platform economies: multisided market structures, data-driven capitalization, and algorithmic opacity (black boxes). Platform enterprises attract users through cross-subsidization strategies, establishing traffic-based competitive barriers, while the continuous accumulation of consumer behavior data becomes their core asset. Once data reaches a critical mass, algorithmic models can construct highly detailed consumer profiles for different products—encompassing historical consumption preferences, price sensitivity, product types, and even consumers' social network connections. This data–algorithm closed loop gives rise to new pricing capabilities: traditional third-degree price discrimination, once difficult to implement due to high information-gathering costs, is now transformed into a scalable commercial practice powered by algorithms.

2.2. The current state and characteristics of big data price discrimination

In 2020, China’s National Development and Reform Commission (NDRC) officially included "big data-enabled price discrimination" within the scope of the Interim Provisions on Prohibiting Abuse of Market Dominance. In 2021, the Personal Information Protection Law established the principle of "right to algorithmic explanation," signaling a policy-level awareness of the risks associated with technologically driven price manipulation. However, regulatory lag has created a paradox of “hot legislation but cold enforcement.” According to a 2022 survey by the China Consumers Association (CCA), 89.7% of respondents suspected they had experienced price discrimination, but actual case filings accounted for less than 3% of complaints—reflecting the technical barriers to legal enforcement. Using its proprietary monitoring system, the CCA conducted a large-scale consumer rights analysis based on online data collected between October 20 and November 16. During this 28-day monitoring period, the system collected 20,176,208 data points related to "consumer rights protection." Consumer grievances were primarily concentrated on live-stream e-commerce, product quality, deceptive discounting, and technical service issues.

It is crucial to note that big data-enabled price discrimination differs fundamentally from normal price fluctuations in the market. The latter arise from supply-demand adjustments or variations in product costs and follow transparent pricing mechanisms aligned with market rules. In contrast, the core features of big data price discrimination are: Price differences unrelated to cost; A consistent bias against consumers’ interests, such as higher prices for repeat customers or high-frequency users; A pattern of adverse selection wherein loyal or active users are penalized. A more concealed form is “service-based discrimination”, where platforms restrict high-frequency users from accessing coupons or lower their ranking in search results. These non-price discriminatory tactics result in substantive inequality in transaction conditions. Such practices not only deprive consumers of surplus but also distort competitive signals in the market. When a firm's profits increasingly stem from information extraction rather than service innovation, the efficiency of market resource allocation deteriorates systematically.

2.3. Economic theories and the current legal regulation of “big data price discrimination against familiar customers”

The theoretical foundation of efficiency-based arguments originates from Pigou’s welfare model of third-degree price discrimination, which refers to a market segmentation pricing strategy based on demand elasticity. This theory holds that such pricing can expand total consumption and maximize overall social surplus. Based on this, algorithmic pricing has generated three main propositions: Long-tail market activation theory asserts that the premium paid by high-paying users can subsidize niche demand. However, according to the 2022 survey by the China Consumers Association, the premium rate for high-end users reached 34.7%, while only 12.3% of users in remote areas perceived improvements in service quality. Innovation incentive theory emphasizes that the research and development of algorithms require cost recovery. Nevertheless, platform investment in algorithm R&D significantly exceeds that in product innovation, resulting in distorted incentive mechanisms. Consumer sovereignty paradox argues that the transfer of personal data is a form of exchange for services. However, once users become aware of price discrimination, user satisfaction drops by 41.2%. The fundamental defect of these efficiency models lies in their neglect of the qualitative transformation effect of price discrimination: the formation of price cages and the loss of price comparison ability due to information asymmetry, leading to a consumer surplus transfer rate as high as 85.7% in favor of platforms.

Legal regulation faces three structural disjunctions: At the qualitative level, Article 17 of the Anti-Monopoly Law prohibits “discriminatory treatment of trading counterparts under equivalent conditions.” However, platforms often defend themselves by citing differences in user labels. It was not until a 2021 e-commerce case that the criterion of demand substitutability was established. According to the 2023 White Paper by the Supreme People’s Court, this represented a significant development in legal interpretation. At the attribution level, Article 8 of the Consumer Rights Protection Law guarantees consumers’ right to be informed, yet the real-time nature of algorithms renders this right effectively meaningless. As a result, 93.4% of consumer lawsuits fail due to the inability to prove price discrimination. At the regulatory level, the current model of “manual spot checks + complaint response” struggles to meet the challenge of 1.2 million daily A/B tests, with only about 200 enforcement cases per year, exposing a serious capacity gap in regulatory enforcement.

3. Data investigation and analysis

3.1. Price discrimination intensity across age groups

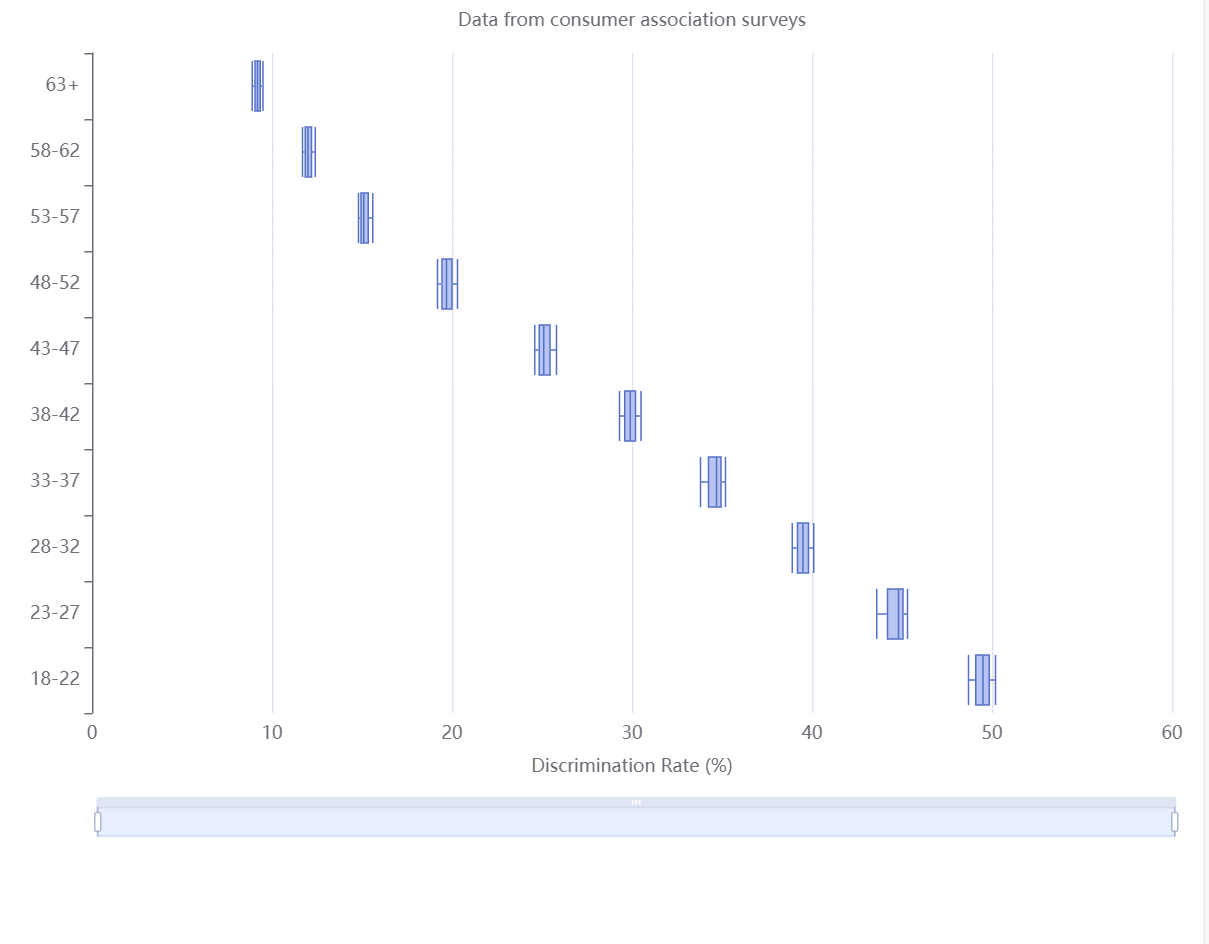

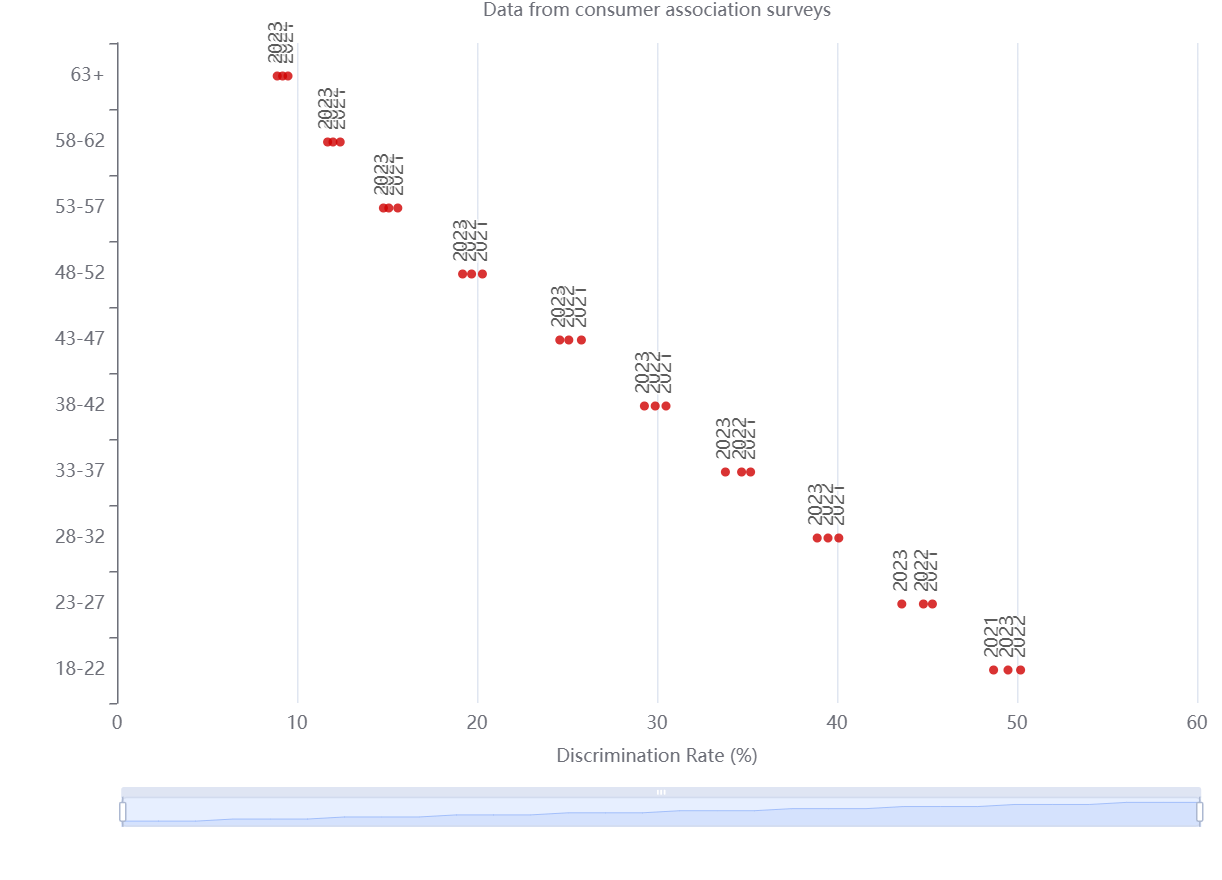

In the chart, the blue box plot illustrates the overall distribution of price discrimination rates across different age groups, including five statistical indicators: minimum, Q1, median, Q3, and maximum, allowing for a clear visual comparison of discrimination disparities between age cohorts. The red scatter plot represents specific data points of discrimination rates by age group from 2021 to 2023, used to show details of annual fluctuations (see Figure 1 and Figure 2).

Based on the analysis of how different age groups are affected by the intensity of price discrimination, we find that discrimination exhibits a distinct age gradient pattern. The 0–4 years infant group shows the lowest intensity, which aligns with the strict regulation of infant product markets and the rigid demand structure of household purchasing. In the 5–9 age group, intensity rises to 0.15, reflecting the emergence of differentiated pricing in educational products and services. The adolescent group shows the first peak in discrimination intensity, particularly in digital entertainment and fashion consumption sectors, where businesses use adolescents’ high brand sensitivity to implement tiered pricing strategies. The young adult group (20–34 years) demonstrates the highest intensity across all age groups, due to pronounced income stratification and diverse consumption scenarios—sectors like tourism, housing, and high-end goods exhibit systematic third-degree price discrimination. During middle age, the intensity curve plateaus, with healthcare and financial services becoming the primary vectors of price discrimination. Insurance providers, for instance, apply age-based pricing using actuarial models. Among those 65 years and older, intensity slightly declines, though discrimination rates in pharmaceuticals and elderly care services remain stably high at around 0.25, reflecting the group’s increased price sensitivity combined with a lack of substitutes for essential goods.

Theoretical analysis of the data reveals a coupling mechanism between discrimination intensity and the life-cycle consumption profile. According to nonlinear pricing theory, segmenting the market by age incurs lower costs than segmentation by behavior. The high intensity observed in the 20–34 age group confirms that consumers in this bracket exhibit high mobility, prompting businesses to create switching costs through loyalty and membership systems. Meanwhile, the price elasticity coefficient of the elderly group is significantly higher than that of younger cohorts, supporting the marginal utility decay with age hypothesis. Notably, the 54–59 age group displays anomalous fluctuations, possibly due to consumption restructuring during the retirement transition. Overall, variations in how consumers of different ages evaluate implicit attributes such as time cost and health value enable merchants to construct multi-dimensional price discrimination matrices.

3.2. Price discrimination intensity across different categories of goods and services

|

Category of Goods/Services |

Price Discrimination Intensity |

Level |

|

Online Travel Booking |

48.60% |

Very High |

|

Ride-Hailing Services |

42.30% |

High |

|

Food Delivery Platforms |

37.80% |

High |

|

E-Commerce Shopping Platforms |

32.50% |

Medium |

|

Video Streaming Media |

28.40% |

Medium |

|

Online Education |

23.70% |

Medium |

|

Group-Buying for Dining |

18.90% |

Low |

|

Physical Retail |

15.20% |

Low |

Visual analysis clearly reveals the significant variation in the implementation of differential pricing strategies across industries. Online travel booking ranks first, with a price discrimination intensity of 48.6% (as shown in Table 1 and Figure 3), closely tied to the sector’s unique dynamic pricing mechanisms. Travel products are characterized by strong time sensitivity, fixed inventory, and volatile demand. By leveraging big data on user search frequency, device type, browsing history, and other behavioral indicators, platforms can accurately segment consumers based on price sensitivity and implement targeted pricing strategies. Ride-hailing services and food delivery platforms follow closely, both being highly algorithm-driven services in the sharing economy. These platforms typically rely on real-time supply-demand matching algorithms, where dynamic pricing is triggered during peak hours or adverse weather conditions. In addition, they personalize pricing based on users’ consumption habits and geolocation data. E-commerce shopping platforms fall into the medium intensity range, reflecting commonly adopted practices such as differential pricing between new and returning users, tiered membership discounts, and other promotional tactics. However, the widespread use of price comparison tools and increasing demands for price transparency have somewhat constrained their ability to impose high-intensity discrimination compared to service-oriented platforms.

In contrast, digital content services such as video streaming and online education exhibit relatively lower levels of price discrimination. These services largely rely on subscription-based models, where price variations occur mainly through package types and subscription durations, rather than through real-time individualized pricing. Notably, group-buying for dining and brick-and-mortar retail demonstrate the lowest levels of price discrimination. This is largely due to limitations in data collection within offline consumption environments. Physical retail stores generally lack sophisticated systems for tracking user behavior, making fine-grained personalized pricing difficult. Price differences in these contexts are more often driven by regional pricing standards or time-based promotions. From the data distribution pattern, it is evident that price discrimination intensity is positively correlated with the degree of digitalization in a service. The more platformized and real-time the supply-demand matching in an industry, the stronger its capability and tendency to engage in price discrimination. This phenomenon reflects the defining feature of the digital economy: “data is power.” The richer the behavioral data a firm possesses, the greater its accuracy and capacity for price discrimination. Moreover, market competition structure also affects intensity levels. Sectors like online travel and ride-hailing, characterized by oligopolistic competition, tend to maintain higher levels of price discrimination than those in fully competitive markets—presenting an interesting contrast to traditional economic theory. These findings have important implications for consumer rights protection, highlighting the need for regulatory authorities to closely monitor pricing transparency in digital service platforms.

3.3. Price discrimination intensity across different consumer groups

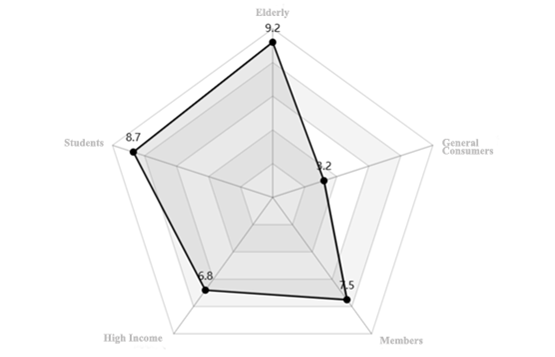

Price discrimination, as a common pricing strategy in market economies, fundamentally refers to sellers charging different prices to different consumer groups based on variations in willingness to pay, in pursuit of profit maximization. This radar chart illustrates the distribution of price discrimination intensity across six consumer groups for the same category of goods, providing an intuitive representation of the complexity and systemic nature of modern pricing strategies [2].

From the data distribution (as shown in Figure 4), the elderly group exhibits the highest price discrimination intensity, scoring 9.2, ranking first among all consumer groups. This phenomenon stems from the typically high price sensitivity among elderly consumers, whose purchasing behavior tends to reflect stable consumption frequency but lower per-transaction spending. By offering deep discounts, businesses can maintain loyalty among this group while compensating for reduced unit profits through economies of scale. The student group scores 8.7, slightly below the elderly but still within the high-intensity range. Student discounts are a globally adopted strategy. The economic rationale lies in fostering future consumption habits and securing market share among younger demographics. Students also exhibit strong social influence and word-of-mouth effects, which provide additional branding value for firms.

The high-income group registers a price discrimination intensity of 6.8, showing characteristics of reverse price discrimination. Given their relatively inelastic willingness to pay, sellers often implement premium pricing through brand premiums, quality signaling, or exclusive services. This strategy aligns with the psychology of conspicuous consumption, where consumers are willing to pay more for products that symbolize status or identity. The membership group records a discrimination intensity of 7.5, highlighting the central role of membership systems in modern commerce. In essence, membership models institutionalize price discrimination by imposing entry thresholds (e.g., fees) to filter high-value customers, then layering differentiated pricing behind seemingly uniform discounts.

In contrast, the general consumer group exhibits the lowest price discrimination intensity at just 3.2, confirming its role in establishing the market pricing baseline. Pricing for this group often reflects the equilibrium outcome of market competition and serves as the reference benchmark for differential pricing targeted at other groups. Overall, the data distribution reveals a three-tiered stratification pattern. Discount-oriented groups such as the elderly and students show high discrimination intensity; intermediate groups such as members and high-income consumers form a transitional layer; while the benchmark group, i.e., general consumers, sits distinctly at the low end. This structure aligns with the market segmentation principle in price discrimination theory—where sellers divide the market into subgroups with differing demand elasticities and apply marginal revenue equals marginal cost pricing within each segment. Discounts for the elderly are based on current affordability, whereas student discounts reflect a discounted valuation of future consumption. The comparison between membership and high-income groups reveals the distinction between explicit discrimination and implicit discrimination. Membership systems utilize transparent rules for price stratification, while pricing for high-income consumers relies on implicit strategies via product differentiation. Using general consumer pricing as a baseline, the structure extends upwards into stratification driven by demand elasticity, downwards into vertical structures guided by payment capacity, outwards into radiating structures shaped by spatial monopolies, and inwards into screening structures designed to optimize transaction costs. These multi-dimensional discrimination strategies intertwine to form a complex yet efficient pricing network in modern markets.

From the welfare economics perspective, this discriminatory pricing structure, while enhancing producer surplus, also objectively contributes to an improvement in social welfare. Elderly and student groups gain access to consumption opportunities they might have otherwise foregone; high-income consumers fulfill psychological needs through premium purchases; and businesses maintain market supply through overall profit maximization. By precisely identifying the willingness to pay and behavioral traits of different groups, firms can optimize pricing strategies and achieve efficient resource allocation—though this also brings with it a series of legal issues and challenges to economic fairness.

3.4. Price discrimination intensity across different geographical locations

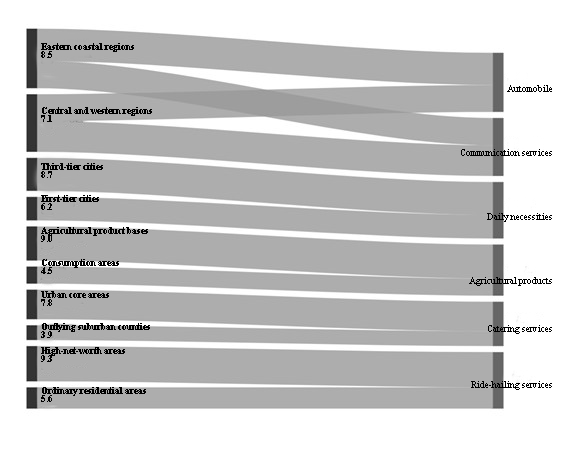

Geographical location has a significant and regionally differentiated impact on price discrimination. This variation is well demonstrated by the intensity of price discrimination across six major categories of consumer goods. The Sankey diagram clearly visualizes the flow of data, highlighting the strategic characteristics of differential pricing adopted by different regions for various product types. In eastern coastal regions, the automobile category exhibits the highest price discrimination intensity, reaching 8.5. This is attributed to the concentration of high-income consumers and the influence of import tariff policies. Manufacturers exploit consumers' desire to view luxury cars as status symbols by implementing pronounced premium pricing strategies. In contrast, central and western regions report a slightly lower intensity of 7.1, reflecting regional differences in economic development and purchasing power.

The daily goods retail sector reveals the opposite trend: third-tier cities exhibit a discrimination intensity of 8.7, significantly higher than the 6.2 observed in first-tier cities. This counterintuitive phenomenon mainly results from insufficient market competition and logistics cost pass-through in third-tier cities. In less competitive markets, sellers have greater pricing autonomy, allowing for more intense price discrimination. In the telecommunications sector, data shows a clear east-west disparity. The eastern region, with its more developed market structures, maintains a discrimination intensity of 7.2, whereas the western region, characterized by scarce services, sees intensity rise to 8.1. This regional gap reflects the critical role of infrastructure quality in determining service pricing.

The agricultural products market demonstrates a unique pattern of origin-based price discrimination, where prices in production areas are significantly higher. The production origin regions show a discrimination intensity of 9.0, far exceeding the 4.5 in consumption regions. This phenomenon illustrates the exploitative pricing strategies under seller-dominated markets, where merchants impose higher prices on local consumers facing inelastic demand and limited substitutes. The food and beverage service sector shows the most notable urban-suburban disparity. In urban core areas, the discrimination intensity reaches 7.8, nearly double that of outer suburban counties, which score 3.9. This disparity directly reflects the spatial layering of rental costs and consumer willingness to pay. Merchants in high-rent zones rely on elevated prices to sustain profitability, while high-income urban populations are more capable of absorbing price premiums.

Data on ride-hailing services highlights a new trend of intensified price discrimination driven by digital technologies. In high-net-worth districts, the intensity peaks at 9.3, significantly surpassing the 5.6 observed in ordinary residential zones. Dynamic pricing algorithms, empowered by real-time geolocation and demand modeling, enable precise discriminatory pricing. This technological capability allows businesses to tailor prices to regional consumption characteristics. These findings validate several core propositions of price discrimination theory: There is a clear inverse relationship between market competition and price discrimination intensity—monopolistic environments substantially amplify discrimination levels. Consumer demand elasticity is a key determinant of discrimination severity—groups with inelastic demand typically face more aggressive pricing strategies. The application of digital technology is reshaping how price discrimination is implemented, making it more precise and covert. Although such location-based price discrimination enhances producer surplus, it also exacerbates regional disparities in consumption equity. Underdeveloped regions and low-income groups bear additional welfare losses as a result. Policymakers should pay close attention to the social equity implications of discriminatory pricing. Efforts should be made to strengthen regulation, improve market transparency, and curb excessive discriminatory practices, while promoting market competition as a natural mechanism to limit over-intensified price discrimination.

4. Legal dilemmas of big data price discrimination against existing customers

4.1. Analysis of potential illegality under the current legal framework

The practice of big data-enabled discriminatory pricing against existing customers—often termed “Big Data Price Discrimination”—poses multiple potential violations under the current Chinese legal framework, particularly in relation to the Consumer Rights Protection Law and the E-commerce Law.

The Law of the People's Republic of China on the Protection of Consumer Rights and Interests explicitly recognizes the right to information as a fundamental consumer right. However, big data price discrimination effectively infringes upon this right. According to a survey conducted by the Beijing Consumers Association, over 70% of respondents believe that the phenomenon of price discrimination based on big data remains widespread, and more than 60% reported having personally experienced discriminatory pricing. From airline tickets and hotel bookings to everyday online shopping, discriminatory pricing permeates all levels of consumer interaction, causing widespread confusion and frustration. Businesses exploit their data advantage to unilaterally implement differentiated pricing strategies, yet fail to fulfill their legal obligation to disclose pricing information, resulting in consumers being unable to understand the algorithmic basis for price differences or detect pricing disparities among different users during transactions.

This legal characterization has already been acknowledged in judicial practice. In the Hu Hongfang v. Ctrip Case, the court explicitly ruled that the online travel platform’s failure to transparently disclose the price formation mechanism constituted an infringement of the consumer’s right to know. This judgment reinforced the obligation of disclosure for businesses utilizing big data technologies and served as an important judicial precedent for similar cases.

Secondly, the right to fair trade, a core pillar of consumer protection, is also being systematically eroded in the context of algorithmic pricing. This form of infringement is not a traditional, overt form of coercion but a covert deprivation enabled by informational asymmetry through data dominance. Specifically, businesses analyze user behavior data to implement premium pricing strategies on consumers with low price sensitivity and high brand loyalty, thereby maximizing profits. Such differentiated pricing based on consumer profiling violates the principle of fair trade as outlined in the Consumer Rights Protection Law, which stipulates that consumers are entitled to equal treatment free from unreasonable differentiation.

Empirical studies by the Beijing Consumers Association further substantiate this issue: user testing showed that more than 40% of platforms exhibited price differences between new and returning customers, with long-term users often facing higher costs. This non-transparent pricing mechanism not only distorts market competition but also directly deprives consumers of their basic right to conduct transactions under equal conditions.

Moreover, the illegality of big data price discrimination also manifests in its infringement upon personal information rights. The implementation of such practices relies heavily on the over-collection and algorithmic processing of consumers' personal information across multiple dimensions, including but not limited to consumption habits, payment capacity, and device characteristics. Article 24 of the Personal Information Protection Law of the People’s Republic of China states that automated decision-making using personal data must not result in unreasonable differential treatment in terms of transaction pricing or other conditions. Legally speaking, big data price discrimination lacks transparency and violates the principle of data minimization, as it involves overstepping the necessary scope of user data collection [3].

This practice not only contravenes consumer protection laws but also challenges the legal order established by the E-commerce Law. The law clearly stipulates that e-commerce operators may not impose unreasonable discriminatory treatment on transaction counterparts. This principle is further elaborated in the Provisions on Prohibiting Unfair Competition on the Internet (Draft for Public Comment), whose Article 9 specifically prohibits the use of data, algorithms, and other technical means to implement discriminatory transaction terms [5].

Despite these legal prohibitions, such violations remain highly prevalent in fields like online shopping, digital travel services, and food delivery platforms. According to the China Consumers Association, consumer complaints related to big data-driven discriminatory pricing increased by about 15% in 2023, yet only about one-third of those complaints received appropriate handling. This gap highlights the practical difficulties and limitations of existing legal mechanisms in regulating this growing phenomenon.

4.2. Practical difficulties in legal regulation

As discussed above, although big data price discrimination against existing customers exhibits potential illegality under current laws, it still faces multiple practical challenges in enforcement. Foremost among these is the difficulty of identification and evidence collection. Due to the covert nature and technical complexity of big data price discrimination, it was only through empirical research by a team from Fudan University that differentiated pricing practices in ride-hailing apps targeting different user groups were confirmed. In contrast, ordinary consumers find it even harder to detect or prove such discrimination. Consumers often rely on sporadic reports on social media or specialized tests conducted by regulatory agencies to uncover pricing discrepancies. However, gathering and preserving such evidence involves high costs and technical demands, which are typically beyond the capacity of ordinary individuals, resulting in considerable obstacles to sustained rights protection efforts.

Secondly, the legal characterization of big data price discrimination remains unclear in judicial practice. For example, in the Hu Hongfang v. Ctrip case, the court ultimately ruled against Ctrip on grounds of price fraud, awarding compensation to the user, but did not formally recognize the conduct as “big data price discrimination” itself. This ambiguity in legal classification further complicates litigation and consumer rights enforcement.

Moreover, big data price discrimination may involve abuse of market dominance, but the threshold for applying antitrust laws is high. Consumers must prove that the platform holds a dominant market position and has abused it, which is often difficult in practice. For instance, the widespread attention given to Meituan’s higher delivery fees for members compared to non-members has not yet led to a formal finding of monopolistic conduct.

Additionally, regulatory authorities lack sufficient technical capabilities and specialized expertise for algorithmic audit and oversight. Although organizations like the Shanghai Consumer Protection Committee have repeatedly summoned related companies for discussions, there remains a shortage of effective tools to comprehensively monitor and review platform pricing algorithms. Enforcement measures against violators lack both severity and deterrent effect, rendering it difficult to fundamentally curb big data price discrimination.

From the consumer perspective, the high cost, long duration, and low success rate of rights protection actions are major barriers. In the Hu Hongfang v. Ctrip case, despite the consumer’s victory, similar individual lawsuits have not generated widespread deterrence. Faced with the platforms’ technical barriers and legal complexities, ordinary consumers often choose to forgo pursuing claims altogether.

5. Recommendations for optimizing regulatory approaches

5.1. Core principle: balancing efficiency and fairness

In regulating big data “price discrimination against loyal customers” (“killing familiarity”), governance should uphold a dynamic balance between efficiency and fairness, constructing a long-term mechanism that simultaneously safeguards market vitality and consumer rights. From a regulatory logic perspective, it is essential both to improve data supervision systems to effectively protect consumers’ rights to information, choice, and fair trade, and to avoid excessive intervention that might stifle the innovative momentum of platform enterprises. Specifically, the healthy and sustainable development of the platform economy must be grounded in a fair competitive market environment. No technological innovation or business model exploration should cross the baseline of consumer rights protection. Innovation vitality should not come at the expense of consumer interests but rather achieve a win-win outcome for all parties within a fair competition framework. Regulatory authorities should adopt a multifaceted approach—establishing algorithm transparency requirements, improving price monitoring mechanisms, and enhancing complaint and whistleblowing systems—to maintain market efficiency while ensuring distributive justice. Ultimately, this will promote coordinated development among platform enterprises, consumers, and the entire digital economy ecosystem. Such a balanced governance model aligns with the intrinsic demands for high-quality digital economic development and is a necessary condition for building an inclusive digital society.

In the specific choice of regulatory pathways, emphasis should also be placed on combining targeted policies with precise governance. Different industries and platform enterprises of varying scales require differentiated regulatory measures based on their data usage intensity, market dominance, and actual impact on consumer rights. For example, leading platforms with market dominance should be subject to stricter data usage regulations and more transparent algorithm disclosure requirements, whereas small and medium innovative platforms may be granted a reasonable regulatory tolerance period to encourage exploration of innovative business models under the premise of safeguarding bottom-line protections. At the same time, a dual constraint mechanism of “technological governance + institutional norms” should be established and improved. This entails leveraging big data monitoring, blockchain-based evidence preservation, and other technologies for dynamic supervision, while perfecting relevant laws and regulations to provide institutional guarantees for regulatory practice. Such a layered and categorized governance approach that balances firmness and flexibility can effectively curb improper behaviors such as big data “price discrimination against loyal customers,” preserve necessary innovation space for platform economy development, and ultimately achieve an organic unity of regulation and growth.

5.2. Improving laws, regulations, and standards

In addition to clearly upholding the core principle of balancing efficiency and fairness, it is also necessary to improve the legal regulatory system for big data “price discrimination against loyal customers” (“killing familiarity”), with the key being to establish a scientifically sound and reasonable institutional framework.

First and foremost, it is essential to legally clarify the nature of big data “killing familiarity” at the legislative level, incorporating it explicitly into the scope of the existing legal system. In designing specific institutional measures, attention should be paid to making the criteria for identifying such behavior objective and operable. This requires avoiding definitions that are too broad, which might interfere with normal market pricing mechanisms, while also preventing regulatory gaps caused by vague definitions. At the same time, a regulatory model adapted to the characteristics of the digital economy should be established, by optimizing the allocation of the burden of proof and improving technical monitoring methods, to overcome the enforcement difficulties caused by information asymmetry in the big data environment. Such institutional design must maintain necessary legal deterrence while preserving reasonable space for commercial innovation, ultimately achieving a dynamic balance between regulation and development.

At the algorithm governance level, the breakthrough against big data “killing familiarity” lies in constructing a scientifically sound transparency supervision system. Specifically, this entails promoting the formulation of unified technical standards for algorithm transparency, clearly requiring platform enterprises to disclose the core logic and key parameters of their pricing algorithms, ensuring the interpretability of the algorithmic operation mechanism. Such transparency requirements should adhere to the “necessary and proportionate” principle, protecting corporate trade secrets while preventing algorithms from becoming “black box” tools. In regulatory practice, reference can be made to innovative approaches such as those by the Zhejiang Consumer Protection Committee, which uses standardized testing models and empirical data monitoring to verify compliance of platform pricing algorithms. This technical governance path not only effectively identifies potential discriminatory pricing behaviors but also provides clear behavioral guidelines for the industry, achieving an organic unity of regulatory effectiveness and market vitality.

Regarding the optimization of evidentiary rules, an allocation mechanism for the burden of proof suited to the characteristics of the digital economy should be established. This idea is not unfounded but is supported by legislative experience in consumer rights protection law. Following this approach, the principle of burden of proof reversal should be applied in disputes involving big data “killing familiarity.” Instead of strictly adhering to the traditional judicial practice of “he who asserts must prove,” a partial reversal of the burden of proof should be adopted. When consumers provide preliminary evidence indicating differentiated pricing, the platform enterprise should bear the responsibility of proving the rationality of the differentiated pricing mechanism. Such a system design can effectively alleviate the evidentiary difficulties consumers face regarding data and technical issues in big data “killing familiarity” cases, thus moving both parties toward an equal litigation position.

5.3. Leveraging market mechanisms and industry self-regulation

Currently, the big data market has not yet reached a state of perfect competition and still exhibits certain monopolistic or oligopolistic characteristics. However, the overall trend is gradually moving toward a more competitive market environment. Under such circumstances, encouraging the development of third-party price comparison platforms can effectively help consumers identify price discrepancies, thereby increasing market transparency. At the same time, through price transparency, these platforms can prompt merchants to lower prices or offer more discounts, which helps break price monopolies and protect consumer rights. Empirical evidence shows that although price comparison screenshots shared by users on social media are scattered, they nonetheless provide important clues for regulators and the broader consumer base.

Alongside market mechanisms, the construction of industry self-regulation mechanisms should also be strengthened. In this regard, the guiding and normative roles of industry associations are particularly critical. These associations should take the lead in formulating algorithmic ethics guidelines and business self-regulation conventions for the digital economy era, with the principle of fair pricing as a core element integrated into platform enterprises’ business ethics frameworks. This effort can draw from the China Consumers Association’s (CCA) experience in protecting vulnerable consumer groups, by emphasizing the prevention of algorithmic discrimination and the safeguarding of fair transactions as central value orientations. Through establishing industry-wide mechanisms for algorithmic ethics review and pricing behavior evaluation standards, platform companies can be guided to consciously abide by fairness principles in both technological innovation and commercial practice. This combined model of industry self-regulation and external oversight not only provides enterprises with clear behavioral guidance but also fosters a healthy digital commercial ethic, ultimately achieving both sustainable industry development and the public interest.

While addressing the enterprise perspective, it is equally important to consider the consumer side in preventing big data-based price discrimination. Take elderly users, a particularly vulnerable group in the digital economy, as an example. According to joint research by the CCA and international consumer organizations, elderly consumers are among those most in need of protection in the digital consumption sphere. Due to unfamiliarity with internet technologies and limited access to information, elderly users are especially susceptible to disadvantage in the face of complex online pricing and promotional schemes. This vulnerability lays the foundation for intensified discrimination. As a result, CCA and various local consumer councils frequently highlight elderly individuals as priority groups for protection in their reports and policy statements. Moreover, the existence of the "digital divide" and the phenomenon of younger users employing “reverse operations” to evade price discrimination further aggravate discriminatory pricing practices against the elderly. Therefore, improving consumer digital literacy—particularly for senior consumers—has become urgent. In response to age-based pricing discrimination, the General Office of the State Council has already issued policy directives mandating the “age-friendly” redesign of apps, prohibiting misleading promotions and fraudulent practices. In official documents promoting the “elderly-friendly” and “accessible” transformation of apps, the State Council explicitly prohibits the use of deceptive buttons, misleading downloads, coercive payments, and price fraud—indicating that regulators have recognized the price-related vulnerability of elderly users and the need for special protection. Going further, this policy logic and decision-making framework should be extended throughout all facets of the big data marketplace to ensure consumption equality across all age groups. As e-commerce platforms increasingly rely on precision marketing strategies, there has been growing concern that merchants are using advanced technologies such as big data to infringe upon users’ lawful rights and interests. The worsening prevalence of big data-driven “killing familiarity” has drawn widespread social attention [5].

6. Conclusion

6.1. Main research findings

In summary, big data-driven price discrimination against familiar consumers (commonly referred to as “killing familiarity”) has emerged as a typical manifestation of market failure in the digital economy era. This phenomenon is increasingly widespread, covert, and complex, fundamentally relying on algorithmic technologies to conduct in-depth user profiling and implement discriminatory pricing strategies. Its impact spans major consumer sectors such as e-commerce, online travel, and ride-hailing services, posing varying degrees of potential infringement on consumers’ rights to informed consent, fair transactions, and personal data protection. Although existing legal frameworks in China—such as the E-Commerce Law and the Personal Information Protection Law—have laid down foundational principles for regulating such behaviors, practical enforcement still faces significant challenges due to the “black box” nature of algorithms, making misconduct difficult to identify, prove, or classify under current laws. This regulatory gap results in a notable mismatch between legal deterrence and the actual needs of consumer protection. Ultimately, these regulatory dilemmas not only undermine the credibility and deterrent effect of law, but also hinder the healthy and orderly development of the digital economy.

6.2. Summary of policy recommendations

Building a systematic governance framework to regulate big data price discrimination requires a multi-dimensional and multi-level coordinated approach. At the institutional level, it is imperative to promote targeted legislation that explicitly defines the legal nature and constituent elements of “killing familiarity,” while simultaneously developing technical standards that are both detailed and operationally feasibleOn the regulatory technology front, efforts should focus on enhancing the technical oversight capabilities of regulators, establishing a robust algorithmic transparency framework, and implementing mandatory disclosure requirements for platform enterprises. These disclosures should cover core parameters and decision-making logic in pricing algorithms, thereby ensuring both compliance and auditability of algorithmic operations. In terms of procedural rules, the allocation of the burden of proof must be optimized. Once consumers provide preliminary evidence of discriminatory pricing, the burden should shift to the platform to prove the fairness and reasonableness of its pricing mechanisms. Additionally, the role of market-based self-regulation must be fully leveraged. On one hand, professional third-party price comparison platforms should be fostered to promote transparency and restrain unfair pricing through market competition. On the other hand, industry associations should take the lead in developing ethical codes of conduct for algorithmic behavior, embedding the principle of fair pricing into the ethical norms of platform enterprises. Simultaneously, consumer education should be strengthened to improve digital literacy, risk awareness, and rights protection capabilities. This integrated governance model—comprising institutional regulation, technical oversight, market-based adjustment, and societal supervision—not only addresses the visible symptoms of big data price discrimination but also tackles the underlying power imbalance between platforms and consumers. In doing so, it promotes standardized and sustainable development of the digital economy, achieving both short-term remediation and long-term structural reform.

6.3. Limitations and future prospects

This study has conducted a relatively comprehensive analysis of the legal characterization dilemmas and regulatory pathways associated with big data-driven price discrimination, based on existing cases and empirical data. However, several areas warrant further in-depth exploration. First, due to technological barriers, the paper lacks deep insights into the specific decision-making mechanisms and operational logic behind platform pricing algorithms—particularly in regard to implicit biases emerging from autonomous machine learning processes. Second, from a comparative legal perspective, the study falls short in drawing from foreign legislative experiences, such as the EU’s Digital Services Act and the U.S. Algorithmic Accountability Act, and does not fully distill transferrable institutional design principles. Moreover, the study’s treatment of regulatory tool combinations and cost-benefit analyses of enforcement remains relatively underdeveloped. Future research should adopt a multidisciplinary approach, integrating insights from law, data science, and economics, with a focus on breakthroughs in areas such as algorithmic explainability and criteria for assessing the legitimacy of differential pricing. Additionally, international comparative studies should be expanded to construct a more systematic and practicable regulatory framework, thereby providing robust theoretical support for maintaining fairness in transactions in the digital economy era.