Volume 243

Published on November 2025Volume title: Proceedings of CONF-BPS 2026 Symposium: Innovation, Finance, and Governance for Sustainable Global Growth

In recent years, competition in mainstream business sectors such as transportation, accommodation, and office work in China's sharing economy has continued to intensify. The markets in first- and second-tier cities have gradually reached saturation, and enterprises' profit margins have been continuously compressed. Seeking new growth engines has become the core demand for industry development. At the same time, the lower-tier market centered around counties, towns, and rural areas, covering approximately 200 prefecture-level cities, 3,000 county-level cities, and 40,000 towns, accounts for about 70% of the country's population (approximately 1 billion people). Its consumption capacity is steadily increasing and its consumption concepts are highly consistent with the core logic of sharing economy. The lower-tier market not only provides a broad demand space for sharing economy but also, with its low-cost operation advantages and policy support benefits, becomes a key battleground for promoting the continuous growth of sharing economy. Based on the unique attributes of the lower-tier market, this article systematically analyzes the development potential and practical challenges of sharing economy in this market, and then proposes targeted development strategies to provide theoretical and practical support for the high-quality development of the industry.

View pdf

View pdf

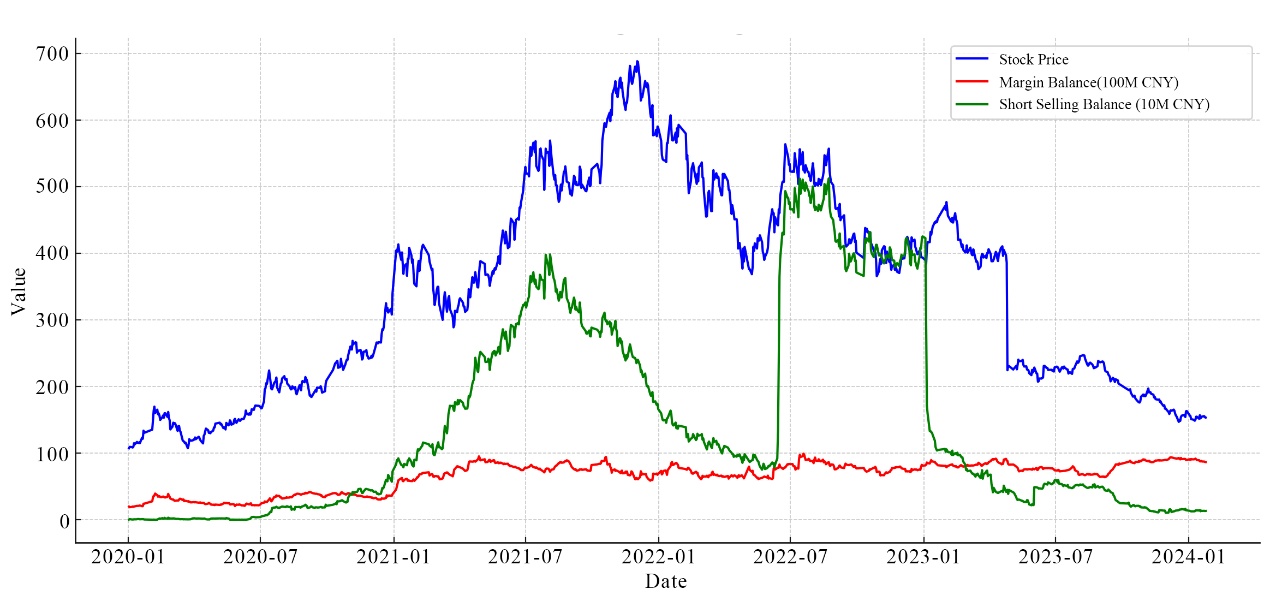

Disposal effect is one of the classic behavioural biases in behavioural finance. The research system on this phenomenon is already quite complete, but few articles focus on the impact of investors' own experiences and the overall market environment on the disposal effect. This paper will fill this gap and take the stock of Contemporary Amperex Technology Co., Limited (CATL) as a case study. CATL is divided into three major stages: 2020-2021, the period of soaring stock price; 2021-2022, the period of stock price fluctuation; 2022-2024, the period of continuous decline in stock price. Three research methods are adopted respectively to collect the emotional feedback of investors in the stock forum, analyse the stock trading data, and infer the intensity of the disposal effect of investors in different periods by calculating the difference between realized profit ratio (PGR) and realized loss ratio (PLR) and the change of margin trading balance with the stock price. It also supplements the explanation of the impact of investment experience and market environment on the disposal effect, and studies the underlying mechanism. Finally, it is found that there is a non-linear correlation between the two, and the mechanism of the disposal effect mainly lies in the overconfidence and risk aversion in investors' psychology.

View pdf

View pdf

Overconfidence, as a key concept in the field of behavioral finance, plays an indispensable role in optimizing individual decision-making efficiency and elucidating market anomalies. Currently, numerous scholars both domestically and internationally have conducted extensive and in-depth research on the influencing factors of overconfidence. However, there is very little literature that summarizes the influencing factors from both individual and external dimensions. This article organizes and summarizes the influencing factors of overconfidence from both personal and external dimensions, pointing out that individual factors such as age, gender, experience, and past successful experiences will have an impact on overconfidence; external factors such as market cycles and information sources will also have an impact on overconfidence. At the same time, this article points out the direction for subsequent related research. This article aims to provide inspiration for subsequent scholars' related research and help non-financial scholars who want to conduct interdisciplinary research to quickly and comprehensively understand the knowledge of overconfidence.

View pdf

View pdf

You know, the global financial markets have really taken some hard hits over the years — from the 2008 financial crisis to the wild swings caused by COVID-19 in 2020, it’s just been one shock after another. Every time something big like that happens, asset prices go crazy, and investors end up with some pretty deep psychological scars. Those “crisis memories,” as we call them, have actually become a super important concept in behavioral finance lately — people in both academia and the financial world are paying more and more attention to them.So, in this study, we take a behavioral finance perspective and try to figure out how these crisis memories mess with people’s investment decisions. Basically, we look back at past financial crises, pull in theories like risk preference, loss aversion, and herd behavior, and analyze how crisis memories create psychological biases. Those biases then lead people to do things like panic selling, being overly cautious, or just blindly following the crowd — all of which make market volatility worse.Our results show that the impact of crisis memories is long-term and pretty complicated. The way they play out depends on stuff like how transparent the market is and what kind of investors you’re talking about. In the end, we also throw out some practical suggestions to help investors make better decisions, help financial institutions manage risk more effectively, and give regulators a few ideas for keeping markets more stable.

View pdf

View pdf

This study probes into the design and influence of the Hulk's visual appearance within the Marvel Cinematic Universe through a combined-methods approach with three main aims: clarifying how the fundamental visual aspects of the Hulk correspond to the tenets of Brand Visual Identity, examining the way in which the equilibrium between visual consistency and creative variation shapes audience perception, and exploring what makes a superhero look instantly recognizable and unique—and how does that affect whether fans connect with them and buy related products? This research set out to explore exactly that, comparing how different major studios handle the visual identity of their superhero IP. This paper dove deep into 12 MCU films, 30 official merchandise items, and 50 promotional posters, and spoke one-on-one with 15 industry experts. It became clear that the Hulk’s “green skin and purple clothing” are at the heart of his look. While these core elements stay consistent across movies and merch, they don’t leave much room for creative variety in spin-off designs. In the end, this study doesn’t just point out trends—it offers a clear framework and actionable ideas for managing superhero visuals, with useful applications across the wider entertainment industry.

View pdf

View pdf

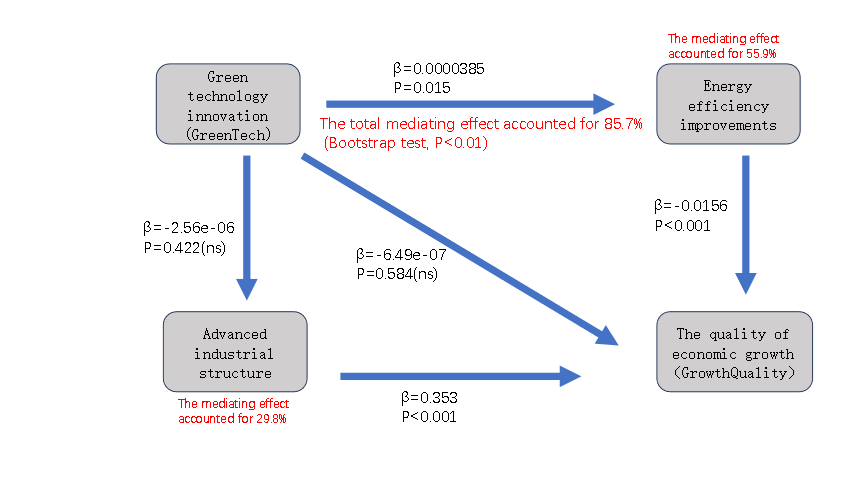

In the context of global shift towards green and low-carbon development, the role and path of green technological innovation in improving the quality of economic growth remain to be fully elucidated. Using panel data from 30 Chinese provinces spanning 2011 to 2023, this study establishes a three-dimensional index framework including green total factor productivity, industrial structure upgrading index, and carbon intensity, and uses fixed effect and mediating effect models for empirical analysis. The empirical findings indicate that green technology innovation mainly drives the quality of economic growth through the synergy between industrial structure upgrading (29.8% of the mediating effect) and energy efficiency improvement (55.9% of the mediating effect), and the synergistic effect between green technology and digital infrastructure is significantly stronger in eastern China than that in the central and western regions (the central effect is not significant, and the western region is only marginally significant at the 10% level). The results of this study provide an empirical basis for solving the "last mile" problem of green technology transformation and formulating differentiated regional green innovation policies.

View pdf

View pdf

This paper focuses on the issues related to price discrimination under the background of big data, based on the actual situation and problem of Chinese Internet users' consumption data, through the methods of literature research and case analysis, and theoretically expounds its economic essence, so as to find the existing economic problems under the background of big data. The research background and significance of this paper point out that modern enterprises use big data to collect massive users' Internet browsing history and other actual situations to achieve precise marketing plan of enterprises, which makes the hot topic of "big data killing" cause a lot of disputes among users. It can be seen that discussing this issue is of great significance to promote the legal use of personal information records by enterprises, and protect the rights and interests of consumers. Then it analyzes the impact of big data on price discrimination, including the specific implementation path of "data-algorithm" and further makes a specific comparison with the traditional sense of price discrimination. This study also points out the damage of price discrimination to consumer experience and consumption fairness caused by the current situation, and there is no corresponding sound system, and some Internet industries still hide the defects of black box algorithm, and other specific situations, which urgently need to put forward solutions. In view of the shortcomings of regulation and algorithm transparency, this paper describes the specific content and implementation methods of China's digital economy in the future.

View pdf

View pdf

In recent years, with the rise of global trendy toy culture and the accelerated internationalization of China's cultural and creative industries, the 'Guzi’ economy, represented by trendy toys, is becoming a significant force driving consumption upgrading and industrial integration. This paper takes Pop Mart's development in the Southeast Asian market as a case study to explore how trendy toy culture influences consumer behavior transformation and the restructuring of industrial value chains in the region. Through the ways of 'emotional consumption’ and 'symbolic consumption’, Pop Mart stimulated the collection and social needs of Generation Z users in Southeast Asia and achieved great success in the market of trendy toys. There are still some problems to be solved. This paper discovers the problems of big cultural differences, difficulty in local sales, and increasing market competition. Then, the paper also explores the reasons for these problems. Finally, the paper puts forward the strategies for overseas sales of trendy toy brands. They should pay attention to the balance between 'global brand unification’ and 'local market differentiation’ to ensure the continuous source of vitality. This not only expands the application of the research on trendy toy economy and international business in overseas emerging market, but also provides solutions and suggestions for the Chinese cultural and creative enterprises to go global, which promotes the upgrading of consumption and industrial integration based on the culture of trendy toy.

View pdf

View pdf