Volume 242

Published on November 2025Volume title: Proceedings of CONF-BPS 2026 Symposium: Sustainability Transitions and Regional Economic Restructuring in New Contexts

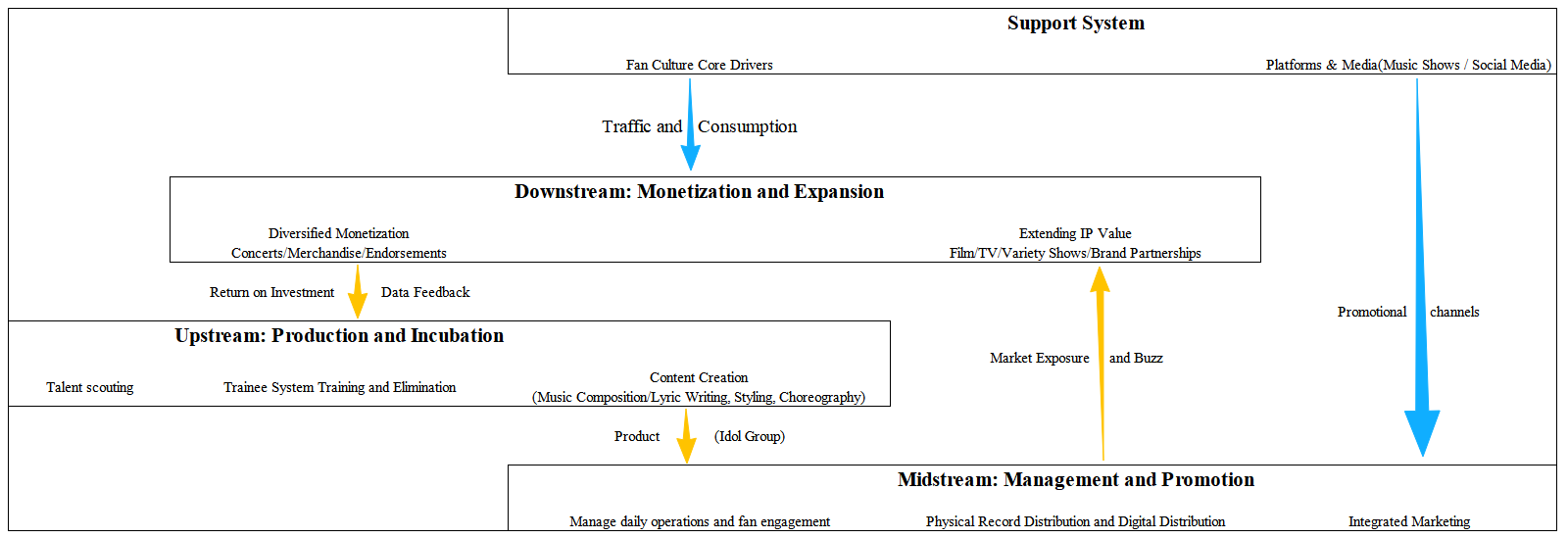

From “Korean Wave” to a worldwide wave, the cultural industry has gradually become the most important soft power and economic engine in the Republic of Korea. In the cultural industry, music industry is the most important industry that exports Korean culture to other countries. By analyzing Korea’s music industry chain and exporting model—industrialized and systematized export model, and analyzing the reasons why Korean music industry can be successfully exported to all over the world, it has important research value and reference value for exporting China’s music industry and internationalization. It is worthy of the deep research and discussion. This paper will analyze the export model of Korea’s music industry chain by its own experience. Try to summarize the experience of Korea’s successful experience in exporting its music industry to all over the world. Based on the current situation of China’s music industry, combining with the situation of the implementation, this paper puts forward several feasible and constructive suggestions for the own export model. It is hoped that this paper can provide some references for the export of China’s music industry and professionals to promote the internationalization of Chinese music.

View pdf

View pdf

Under the backdrop of "dual carbon" goals and the intelligentization of automobiles, the capital demands and valuation fluctuations of new energy vehicle enterprises have been simultaneously magnified. Taking NIO as a core case, and combining its key financing nodes from 2015 to 2025 with the phased changes in market value/PS multiples, this paper establishes an analytical framework of "financing ratio - transmission path - valuation result": Path one is equity dilution and repair speed; path two is the use of funds and conversion efficiency; path three is the stability of investor structure and valuation anchor. The research finds that what determines the intensity of valuation impact is not the ratio value itself, but the functional fit between investor composition and the enterprise's phased demands - state-owned capital brings "quick repair but limited sustainability" during the crisis period, while foreign capital strengthens "channel expansion and long-term space" during the expansion period. The NIO case shows that the impact of financing events on valuation presents phased and structural characteristics, and the efficiency of fund use and the stability of investor structure jointly determine the speed and sustainability of valuation repair. Based on this, this paper puts forward capital operation and governance suggestions for NIO at different development stages.

View pdf

View pdf

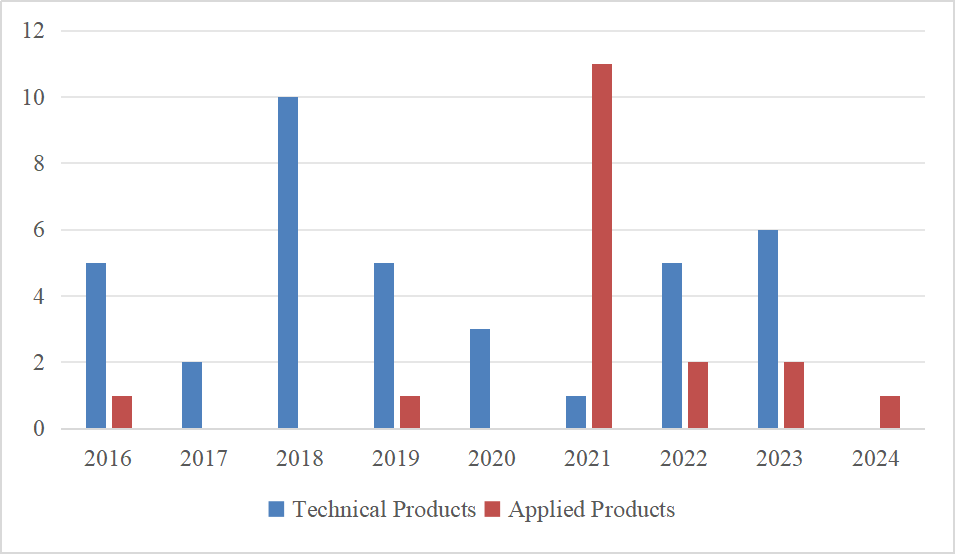

The scale of China's health consumption market is accelerating. The Artificial Intelligence(AI) healthcare industry is rapidly emerging, driving the continuous development of the industry. As a high-tech and highly uncertain emerging industry, the AI healthcare industry requires a large amount of external funding support in the early stages, so private equity needs to be introduced to help the growth of enterprises. This article studied the impact of the introduction of private equity on the strategic decision-making of companies in the AI healthcare sector. The study adopted a longitudinal single case study method and selected Koya Medical Company as the research object. By comparing the changes in strategic focus, product development direction, recruitment of personnel, and Initial Public Offering (IPO) process before and after introducing private equity, it was found that after introducing private equity, the company's strategic focus will shift from technology research and development to commercialization, with an increase in applied product research and development, large-scale construction of commercial teams, and significantly accelerated IPO process.

View pdf

View pdf

With the intensification of global aging, the proportion of the population aged 0-14 has declined, while the proportion of the population aged 65 and above has risen to 10%. Coupled with the job replacement effect of artificial intelligence, the realization of the value of elderly workers has become a key issue. This study takes the "Silver Hair Talent Resource Center" in Japan and the "Generación Savia Project" in Spain as the research subjects. Research has found that the Japanese project targets people aged 65 and above, filling the labor gap with localized short-term low-intensity positions and improving the health of the elderly, which has driven the employment rate of this group to 25.2%. However, there is a problem of waste of high-tech talents. The Spanish project focuses on the unemployed risk group over 50 years old and builds a full-chain support system of "diagnosis - training - entrepreneurship". However, due to the reliance on external funds, the sustainability is insufficient. The root causes of these two types of problems lie in the single service model and the excessive concentration of operational forces. This study points out that policies for elderly employment should follow the logic of "localized positioning + stratified and classified design + government-enterprise collaborative operation", and be implemented based on the aging stage and group needs, balancing public welfare attributes and sustainability.

View pdf

View pdf

As the world's financial system matures, investors are finding it increasingly difficult to find among the wide range of stocks that offer lasting growth at a significant price. To solve this problem, an in-depth analysis of T-mobile (TMUS), AT&T (T) and Verizon (VZ) is conducted in this article. Based on fundamental analysis and data from the Altman Z-score model, the investment value of these three companies is evaluated using the Growth at a Reasonable Price (GARP) investment strategy model. This analysis conducts a comprehensive assessment of the company's financial status through three key aspects: growth, valuation, and stability. Further analysis of the Z-score results and five-year return forecasts provides multi-level comparisons for investment performance. The research results show that the three companies have certain differences in terms of financial structure and growth consistency. TMUS has demonstrated a good balance between profitability and leverage ratio. This effectively reflects its market value with long-term profit potential. In contrast, T demonstrated stronger profit performance, but its reinvestment flexibility was limited. However, VZ's revenue expansion was relatively slow and it was under greater financial pressure, performing the worst. Overall, this study provides the practical application value of GARP for investors who pursue data-driven decision-making. In addition, this study further extends the empirical application of the GARP strategy to the wireless communication industry, providing reference ideas for identifying companies that combine growth potential with financial stability in the market based on industry characteristics.

View pdf

View pdf

China's "dual carbon" strategy and the global energy transition have intensified competition in the new energy vehicle market. Exploring the core competitiveness of enterprises holds significant industry value. This article takes Tesla and NIO as the research objects and uses the case comparison method to analyze their competitive strategies. The research finds that Tesla, with technology-driven and globalized efficient Model at its core, relies on the coordinated development of its main automotive business (Model 3/Y as the main force) and secondary industries such as energy storage and solar energy. Although it faces political risks and cash flow pressure, its technology monetization and cost advantages still have potential. Nio, on the other hand, focuses on building a localized ecosystem. It builds its advantages through multi-brand layout, battery swapping services and technology output. However, its profits are fragile and it faces fierce market competition. The conclusion indicates that there is no single successful model in the new energy vehicle market. Enterprises need to disrupt the traditional business model to build an ecosystem of "products + energy + software + services", achieve diversified profits to enhance their risk resistance capabilities, and provide references for differentiated competition in the industry.

View pdf

View pdf

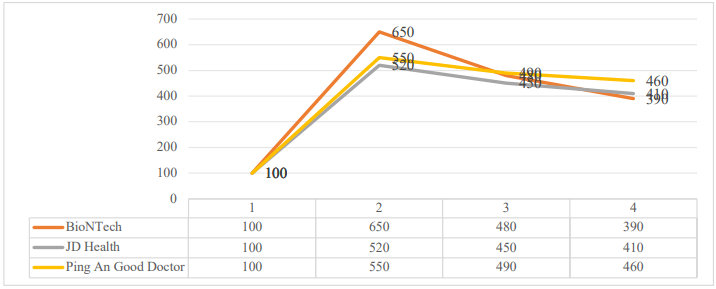

Under the background of increase global economic volatility, the special event that cause by technological breakthrough and external shock has been become the key force to influence the valuation of capital market. However, the existing research is mainly located in public markets, and there is little involvement in the valuation influence mechanism of the private market. This essay mainly explores three core issues, that is how do special event affect private equity valuations, what is the path of special event impact and what is the difference between technological breakthrough and external shock in their influence effect. In order to investigate these three core issues, this study adopts two research methods that is Multi-case comparative analysis and events study methods, and select the technological breakthrough of 'ChatGPT’, 'COVID-19’ these two specific events as the major events, and use six companies that directly benefited from the incident were used as sample like OpenAI and BioNTech to analyze the valuations changes during the event window. The study reveals that the events can significantly boost valuation by changing industry expectations and capital flows, but the persistence of this impact is strongly moderated by a company’s technological barriers and the sustainability of its business model. This study not only fills the gaps in the valuation theory of the private market under the impact of special events, but also provides a framework for investors to use in identify opportunities and manage the risk.

View pdf

View pdf

Currently, the Chinese economy is undergoing significant cyclical fluctuations, and the market environment is complex and ever-changing. In this context, non listed companies are facing many development difficulties, particularly in terms of financing difficulties and high financing costs. At the same time, information disclosure is opaque and difficult to obtain, which seriously restricts their further development. In the current critical period of economic development, scientific valuation of non listed companies has become an important issue that urgently needs to be addressed, and it is urgent to establish a comprehensive company value evaluation system. This article uses market analysis methods and carefully selects data from listed companies in 2023 to explore in depth the financing scale and structural characteristics during their initial public offering (IPO) period. And with the help of the Stata regression model, will carefully study the impact of the shareholding ratio of private equity institutions among non listed company shareholders on IPO valuation, striving to accurately evaluate the growth potential of enterprises and provide more targeted and practical decision-making recommendations for private equity investment institutions.

View pdf

View pdf