1 Introduction

1.1 Research Background

Since ancient times, trade between countries has been an important part of the national economy. As early as before the Qin and Han dynasties, China had trade relations with coastal countries. Merchant ships in the Han Dynasty had reached the southeastern coast of India and established direct maritime trade relations with some countries and regions such as the Indochina Peninsula, the Malay Peninsula, and the Malay Archipelago. Countries will trade their own commodities with comparative advantages. Through trade, a country may produce a production possibility curve that exceeds its own. Trade is an integral part of an economy no matter what age it is. With the rapid development of China in the 20th century, China has become the "world's factory" with cheap labor and huge natural resources. According to statistics, from 2012 to 2020, China's industrial added value has increased from 20.9 trillion yuan to 31.3 trillion yuan, of which the manufacturing industry's added value has increased from 16.98 trillion yuan to 26.6 trillion yuan, accounting for 22.5% of the world's total to nearly 30%. "Made in China" has also entered every household in the world. China's manufacturing capabilities have two major advantages. First, the products span low, medium, and high-end. From screws to photovoltaics, new energy vehicles, and smartphones are all made in China. The world's major companies are also going to China to set up manufacturers or find foundries in China. For example, Tesla’s Shanghai Gigafactory in Shanghai, China, has an annual output of 450,000, which is an astonishing figure, which means that it takes less than a minute to produce a car in the Shanghai Gigafactory. Apple is also a typical example. Apple's largest foundry is Foxconn from Taiwan. Second, the industrial supporting advantages are obvious, the manufacturing capacity is continuously upgraded, and more and more parts and components are produced locally in China. In the early days of the epidemic, a large number of auto companies switched to producing masks, and in just a few days, a mask factory was built to introduce mature mask manufacturing processes. Apparel companies are also transforming to produce protective clothing and other protective equipment in a short period of time. The rapid transformation of these factories can reflect China's industrial supporting advantages. It is also because of these advantages that China can get out of the dilemma of resource shortage in a short time. As a result, exports from mainland China are also rising steadily, hitting new highs every year. China's export market share once reached 15%, and its total exports accounted for more than 30% of China's GDP, making it the world's largest exporter.

With the outbreak of the epidemic in 2020, many places in China have suspended work, schools, and work. After a few months, the "factory of the world" ceased operations. This poses a huge threat to global trade and commodity supply. Over the next few months, COVID-19 swept the world. It brings huge difficulties to logistics, shipping and country-to-country transportation[1]. This poses a huge impact and challenge to China's economic resilience. According to the NBSC(National Bureau of Statistics of China) there are more than 2 million private import and export enterprises in China, and these enterprises have suffered more or less from the business. The rapid development of the global epidemic has also had a huge impact on the domestic industrial chain. From a macro perspective, the epidemic has affected both the supply chain and the demand chain. For example, in 2021 due to the surge in Covid-19 cases within Malaysia. The Malaysian government has taken measures to block the country, and Malaysia is responsible for the packaging of chips. With factories locked down. This has led to a global crisis of lack of chips. A large number of automakers are unable to deliver vehicles on time due to insufficient chips. The output of mobile phone manufacturers is also limited by the lack of chips. In some places, the chip of the washing machine has even been disassembled and used in the car. Under the influence of the new crown epidemic and major changes in the global landscape, comprehensively ensuring the development and survival of small and medium-sized enterprises is conducive to stabilizing economic fundamentals. Before the epidemic, most trading companies sought customers through the Canton Fair or the World Trade Fair. After the outbreak of the new crown epidemic, foreign tourists were banned from entering, and various Canton Fairs and World Trade Fairs were cancelled. Domestic manufacturers have no way to attend the meeting. This also makes it difficult for domestic trading companies to find new customers and develop. This poses a huge threat to Chinese trading companies. Trading companies have to find other ways to find customers[2]. In the third wave of the epidemic from late 2021 to mid-2022, large cities such as Beijing and Shanghai have been closed down one after another, and work has been suspended. As a result, a large number of factories cannot be manufactured and finished goods cannot be sent out. Shanghai's nearly six-month lockdown has caused a large number of overseas customers to question the security of China's trade system. Many customers ruin their orders. Instead, hand the order to Made in Vietnam. In recent years, Vietnam has performed prominently in the world trade market with this low-cost labor force, and its export volume has reached a record high every year. This poses a huge threat to China's trade. Vietnam's trade volume surpassed Shenzhen's in April 2022 and is expected to reach US$180 billion in 2022. Before all kinds of difficulties and threats, finding new trade channels has become the biggest problem for trading companies.

1.2 Research Significance

Digital marketing will be a helpful way for companies that are in difficulty. Trading companies can publish product information by posting their own advertisements on the Internet. It is impossible to talk face-to-face with foreign customers because of the epidemic. The Internet can also break through the current barriers between countries. Create a new development platform and development space for trading companies. Digital trade will become a new trend in future trade development[3]. In many companies, the proportion of digital advertising expenditures has gradually become the bulk of advertising expenditures. With the advent of the Internet, the transmission of information has become more convenient and faster. Through the Internet people no longer need to be limited to the difficult problem of not being able to meet. Merchants can also meet more and wider customer groups than those encountered through offline exhibitions such as exhibitions in the past[4]. At present, there are several mainstream electronic trade methods, including online shopping platforms, which are electronic trade platforms for retailers to customers. On this platform, customers generally buy less quantity of goods and the total price is lower. There are mainstream platforms like: Amazon, Ebay, and StockX. There is also a B2B trading platform. Domestic trading companies release products through the platform, while foreign trading companies can directly purchase the goods they need in bulk through the platform. Such a platform can provide guarantees for buyers and sellers, buyers do not need to worry about the delay of goods, and sellers do not have to worry about delays in payment by buyers. At present, the main platforms are Alibaba International Station, Global Sources and Made-in-china. Another is that businesses publish their own advertisements through search engines and social media. Businesses can set their own keywords when people type relevant terms on search engines. The merchant's website will be displayed. This kind of platform can effectively increase the exposure of the merchant's website. Through a lot of exposure, as more people learn about the business, the business's customers will also increase. The same goes for social media, where merchants can post photos and profiles of their products. Posting on social media makes the business known to those interested in such products to increase the number of customers of the business. The current mainstream platforms are Google, Instagram, and Facebook. At present, a large number of manufacturers in China are not aware of electronic trade or do not use electronic trade as the main channel. This is also because the impact of the epidemic on these manufacturers has become unusually large. Many manufacturers are faced with the status quo of no orders, and the workshops that used to be full of goods every day have become empty. Therefore, this paper wants to summarize the current research results and compare and analyze the research status of E-trade. And provide an efficient approach for companies that are in trouble during the COVID-19 pandemic.

1.3 Research Contents

This article will list the reasons why trading companies in China are currently struggling. Provide solutions for these companies by comparing existing technologies. Demonstrate the feasibility and reliability of our proposed method by using real examples from QW Company.

2 Analysis on the Status Quo of Digital Development of Small and Medium-sized Enterprises

2.1 The Overall Development of SMEs in Digital Economics

The digital economy has been discussed a lot. Early enterprises' cognition of digital transformation is mainly the digitization and automation of hardware equipment[5]. Improve output and production efficiency by introducing automated machinery. However, this approach does not have a great effect on the core competitiveness of enterprise products, because this digital transformation does not greatly help product prices and brand awareness. Many small and medium-sized enterprises in China are still at this stage. Also because of the core competitiveness of products, many companies are currently facing the problem of overcapacity and the output is greater than the sales volume. To solve this problem digital marketing will be very important.

China's small and medium-sized trading enterprises did not regard digital marketing as the center or direction of enterprise development in the early days. This is also what has caused businesses to be hampered by the COVID-19 pandemic. Take Alibaba.com, the world's largest trade B2B platform, as an example. According to the National Bureau of Statistics of China, there are more than 6.2 million enterprises engaged in commerce and trade in China, while less than 200,000 businesses are registered on Alibaba.com. In the early days, some small and medium-sized trading enterprises in China mainly expanded their business through offline methods. Amid the COVID-19 pandemic, a large number of businesses have not turned to online for business expansion. China's foreign trade growth has shown signs of slowing as the outbreak hits China, removing masks, protective clothing, and ventilators from companies whose exports have soared due to COVID-19. Due to the current instability of the global economy, the loss of a large number of markets also has an impact on Chinese small and medium-sized trading enterprises. Under this circumstance, the development prospect of Chinese small and medium-sized trade enterprises is worrying.

2.2 Case Analysis

Company Analysis

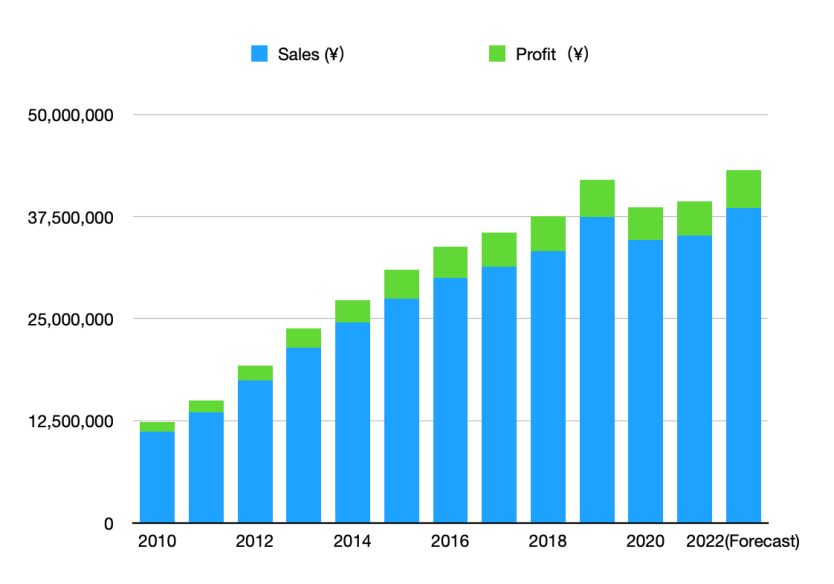

QW Company was founded in 2006. The company has 16 years of experience in the import and export of hardware products. The company has more than 1,000 products. Customers are located in South America, the Middle East, Southeast Asia and other regions. Before 2020, the company's sales and net profit achieved continuous growth. 2020-2021 saw a brief recession for the company as COVID-19 hit the company(Figure1).

Fig. 1. Changes in sales and profit from 2010 to 2022

As a typical small and medium-sized trading enterprise in China, QW company needs to set up a sustainable development plan in the context of global digitalization and flexibly respond to difficulties due to the impact of the COVID-19 pandemic, turning its main publicity and development platform to online development. The company must quickly seize market share in order to continuously expand operations, accumulate assets and proceed to the next step of development. QW Company has successively entered the B2B platform Alibaba.com and published its own advertisements through Google. Different from many big companies, QW company did not choose to increase the number of website or online store clicks through a lot of capital in digital advertising and operation. Instead, QW company chose to use precise keywords to get precise traffic at a lower cost. At present, this method is also more suitable for small and medium-sized enterprises with small accumulation of funds to carry out digital transformation. Through QW company, we can see the importance of capital investment and talent introduction.

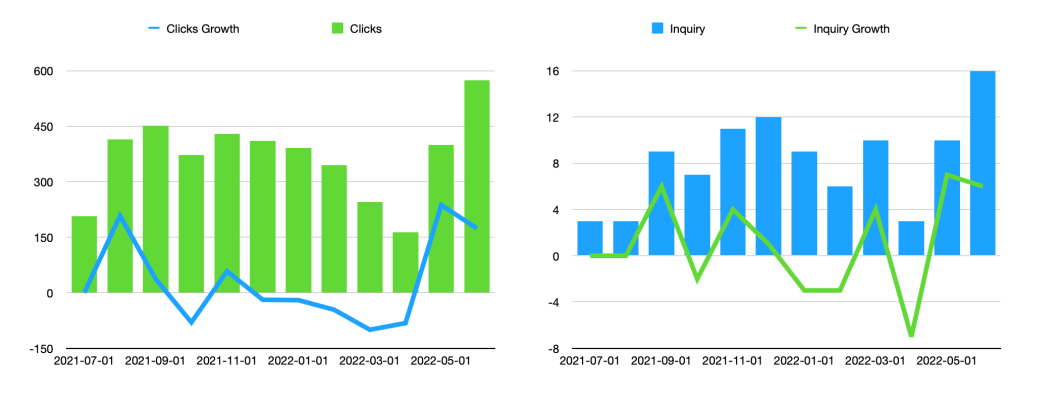

Fig. 2. Clicks and inquiry trends

From the Alibaba.com background data (Figure 2), it can be seen that the click-through rate of the store began to rise sharply after the advertisements were placed on the platform in 2021-08-01. After the adjustment from August to September, the number of company enquiries also began to increase significantly rise. However, between 2021-09-01 and 2022-04-01, the company did not introduce talents and did not have professional operators responsible for the online sales platform. The company's store data also began to decline. After the introduction of professional operation personnel on 2022-04-01, the number of visits and inquiries of the company's stores has also increased very well and reached a new high. In terms of data, it has exceeded 80% of its peers.

Digital Features

Qiwin's digital construction is mainly reflected in three aspects: the company's comprehensive digital order management platform, the construction of online stores, and the placement of online advertisements. The company's current digital order management platform is purchased by a third-party software company and maintained and operated by a third-party company. Online Alibaba stores are registered on Alibaba.com and are operated by internal personnel of the company through certification, and receive inquiry through the release of products on the Alibaba.com platform. The company's online advertising is mainly to publish search ads on the Google platform. Google platform ads are served on Google ads. Run by company insiders.

The company's current digital construction level is still in the development stage, and the investment capital is also in the stage of a small amount. The company will spend about $30,000 on digital transformation from 2021 to 2022. Advertising on Google platforms is still in beta.

3 Challenges Encountered by SMEs in Digital Transformation

3.1 Financial Issues

Due to the fixed business scope of China's small and medium-sized enterprises, the commodities are relatively single and have a very strong sense of competition. In the early stage of competition, a large number of companies adopted the method of low-price grabbing customers. Disrupting the market equilibrium leads to a fall in the market equilibrium price and a decline in corporate profits. The transformation of electronic marketing requires companies to have a solid capital base to support a large number of advertising expenses and operating expenses. Enterprises not only need to buy advertisements on the platform, but also need to recruit professional management and operation personnel. On some B2B platforms, companies also need to pay high admission fees and platform publicity fees[6]. In some special scenarios, companies also need venues to shoot live broadcasts or promotional videos. The accumulation of these costs is not a small expense for any business. Even these expenses can bring greater benefits to the business. However, a large amount of up-front investment and long-term investment returns may increase the financial burden of enterprises and lead to the failure of enterprise transformation and even bankruptcy.

3.2 Talent Issues

In the process of transformation, enterprises also face the problem of lack of talents. Because electronic marketing is something that most Chinese companies are less exposed to. Therefore, enterprises need to introduce personnel to operate online sales platforms[7]. Some enterprises will also look for outsourcing companies to contract the electronic market business of enterprises. However, the current fees of outsourcing companies are still too high for most enterprises.

3.3 Cognitive Problems

When most enterprises carry out construction, there is no unified methodology, which leads to cognitive differences among participants, which in turn causes technicians to be entangled in various complicated technical details, ignoring the unity and orderliness of intelligent application construction. The level of leadership leading digital transformation is not high enough. Digital transformation has entered the 3.0 stage and must be directly promoted by the CEO. Otherwise, the various obstacles encountered in the transformation process need to be communicated for too long, and the operation of the enterprise will be in trouble.

3.4 The problem of future unpredictability

When companies invest a lot of manpower and material resources in digital transformation, if the market environment changes, the company's original plans and expected results may be broken, and the safe zone no longer exists. This will leave businesses in trouble. Enterprises often choose between flexibility and precipitation. Flexible companies can quickly respond to market changes to solve crises. But flexible companies often lack experience. Therefore, enterprises need to formulate a long-term development plan that includes a variety of uncertainties and response plans

4 Suggestion

First, companies need to optimize the structure of digital service trade[8]. Digital service trade has become a new driving force for global trade growth. China's digital construction has a relatively low starting point and has a large room for development[9]. Enterprises should actively participate in the process of digital construction. Integrate digital technology and trade in services to ease the current predicament of global trade.

Second, the government should expand the opening of digital trade, and individuals should actively participate in the formulation of relevant policies. Digital trade has provided trading companies with a new platform for development in the past two difficult years. Even though China is the world's largest trading country, it is in a state of trade deficit all the year round. Fully opening up digital trade can significantly increase a country's exports. The development of service trade in the United Kingdom will be a good example. The United Kingdom is a big country in service trade and has a trade surplus all the year round. As digital trade has become a new driving force for the development of global trade, the UK attaches great importance to the development of digital trade and lays out the digital service industry[10]. China's comprehensive opening up and layout of the digital trade market will be of great help in reversing the trade deficit.

Third, enterprises need to improve the core competitiveness of their products. Only by continuously developing new products and quickly grabbing new market shares can an enterprise effectively improve the core competitiveness of its products[11]. Blindly cutting prices will only lead to a decline in corporate profits and break the market balance. Enterprises need to identify the consumption structure and market preferences of consumers through a large number of market analysis to propose efficient marketing plans and improve the market launch of products[12].

Fourth, the government needs to continuously introduce new policies to ensure the stability of the supply chain in the process of digital transformation and to make up for the shortcomings of the current industrial chain[13]. The stability of the supply chain is very important for enterprises to maintain customers. If the supply chain is broken, it will lead to delayed delivery of enterprise orders. This may cause customers to ruin orders. At the same time, the majority of small, medium and micro enterprises should also rise to the challenge and expand customers on different platforms. On the basis of keeping old customers, the company need to constantly looking for new customers and new business opportunities[14].

5 Conclusion

To sum up, this paper puts forward the problems that arise in the process of digital trade transformation of domestic small and medium-sized enterprises and suggestions for enterprises and governments through case analysis for small and medium-sized enterprises with insufficient funds. Now a large number of domestic manufacturers are facing trade difficulties. Digital transformation is the general trend and a rigid need to solve the current predicament. The current global financial crisis has brought a very big impact on the real economy, and the demand of foreign importers is also declining in the state of economic weakness. Through digital transformation, enterprises can effectively shorten the production and sales model to factories trading companies, i.e., customers. Such a production and sales chain can effectively reduce the operating costs of enterprises, help small, medium and micro enterprises to overcome difficulties and usher in new development. The research in this paper also has certain limitations and shortcomings, and the digital transformation of different industries is different. This article only describes the digital transformation of small and medium-sized trading companies. SMEs should develop a digital transformation plan that is in line with the company’s funding and development status. Future research directions will focus on innovative digital transformation and the direction of the next digital transformation. Times are always changing, and in order to cope with the turbulent global situation and market changes, companies need to be flexible to respond to market changes. Provide a development basis and a financial basis for a variety of future possibilities. Only by achieving a balance between flexibility and precipitation can an enterprise achieve better development.