1. Introduction

With the rapid development of the global economy and the continuous advancement of information technology, the application of fintech in the banking industry has become increasingly widespread, prompting the banking industry to face a more complex market environment and increasingly stringent regulatory requirements. The rapid development of FinTech has driven the digital transformation of banks, which is not just about improving operational efficiency, but also a key means of addressing systemic financial risks. By introducing digital technologies such as big data, artificial intelligence and blockchain, banks are able to process and analyse massive amounts of information more efficiently and improve their risk prediction and management capabilities, thereby optimising the prevention and control of systemic financial risks.

In this context, the relationship between banks‘ digital transformation and systemic financial risk has become particularly important, especially credit risk management as a core area that directly affects banks’ overall risk level. The non-performing loan ratio (NPL), as an important indicator of banks' credit risk, is directly related to their asset quality and the robustness of systemic risk. Therefore, an in-depth discussion of how FinTech development affects banks‘ systemic financial risk, especially the change of NPL ratio, by promoting banks’ digital transformation is not only of great theoretical significance, but also provides practical guidance for the banking industry to formulate risk control strategies in the new economic environment.

In past studies, scholars have mainly focused on the impact of digital transformation on banks' business models, operational efficiency, and customer service. For example, it has been shown that banks can not only reduce operational costs, but also improve service efficiency and customer satisfaction through the automation and intelligence of business processes. However, relatively few studies have been conducted on the specific impact of digital transformation on banks' credit risk, especially the non-performing loan ratio. Some studies suggest that digital technology can reduce credit risk by improving information processing and risk management processes; however, in-depth analyses of the mechanisms and pathways of this process are still not systematic enough. In addition, differences in the strategies and effects of digital transformation across banks, and the impact of these differences on NPL ratios, have not been fully explored.

This paper aims to fill the above research gaps by systematically analysing the mechanism of the impact of banks' digital transformation on NPL rates. By combining the digital transformation paths in the three dimensions of strategy, business and management, this paper will delve into the specific application of digital technology in banks' credit risk management and its impact on NPL rates. To this end, this paper will first review the relevant literature and sort out the existing research results and shortcomings, then construct a theoretical analysis framework, put forward hypotheses and conduct empirical tests. Finally, this paper will summarise the research results and provide policy recommendations and practical guidance for the credit risk management of the banking industry in digital transformation.

2. Related Work

Bank credit risk is a core indicator of a bank's asset quality and risk level, of which the non-performing loan ratio (NPL) is a key measure. With the continuous development of digital technology, digital transformation in the banking industry has become an important means to improve operational efficiency, optimise risk management and reduce credit risk. Globally, the impact of financial technology (FinTech) and digital transformation on the banking industry has become increasingly significant, especially in reducing credit risk and improving asset quality [1][2]. Therefore, it is of great theoretical and practical significance to explore the impact of banks' digital transformation on credit risk, especially non-performing loan ratio [3][4].

Digital transformation of banks usually involves three main dimensions: strategic digitalisation, operational digitalisation and management digitalisation. Strategic digitisation involves the bank's overall technology layout and long-term planning investment. A study by Qingjun Zhang and Yiding Ou points out that strategic digitalisation effectively reduces the non-performing loan ratio by optimising the technological infrastructure and risk management system [5]. Vives, on the other hand, points out that strategically investing in digital technology can improve banks' risk identification and management capabilities, thereby reducing credit risk [2]. Operational digitalisation focuses on banking services and product innovation, whereby big data analytics and artificial intelligence technologies enable banks to identify and manage high-risk customers, thereby optimising credit decisions [3]. Management digitalisation, on the other hand, focuses on improving risk control within banks through automated and data-driven risk management processes [6-7].

The path of digital transformation to credit risk is multidimensional. First, the application of big data and artificial intelligence enables banks to integrate and analyse a large amount of customer information to improve the accuracy of credit decisions. Xiang Houjun pointed out that banks can identify high-risk customers more effectively through intelligent analytics and take preventive measures in credit approvals, thus reducing the rate of non-performing loans [7].Gai et al. further confirmed the role of intelligent algorithms and big data in optimising credit management through research [8]. Secondly, digital transformation significantly improves the operational efficiency of banks and reduces human errors and delays, thereby reducing credit risk. Research by Jian Xiong shows that automated operational processes can quickly identify and respond to potential risks, thereby reducing the incidence of non-performing loans [9].

In addition, banks are able to monitor market dynamics in real time through digital transformation and quickly adjust their credit strategies in response to market changes, thereby reducing the impact of external economic fluctuations on credit quality [2].Vives states that real-time data monitoring and intelligent analytics systems enable banks to respond flexibly to macroeconomic changes and reduce non-performing loans due to market fluctuations [2]. Through customer relationship management (CRM) systems, banks can better manage customer behaviour, reduce default rates and further reduce the incidence of non-performing loans [5-6].

In the framework of theoretical analysis, digital transformation significantly reduces credit risk through information dominance theory, operational efficiency theory and risk management capability improvement theory. The information dominance theory indicates that digital transformation improves banks' ability to identify customer risks and reduces information asymmetry, which optimises credit decisions and reduces non-performing loan rates [6][10]. Operational efficiency theory states that through automated and intelligent operational processes, banks can significantly improve efficiency and reduce human intervention and delays in the credit process, thereby reducing non-performing loans [7-8]. The theory of risk management capability enhancement suggests that digital technology can help banks build an intelligent risk management system to predict future risks through historical data and market trends, thus taking preventive measures before risks occur [9].

In summary, the digital transformation of banks not only improves operational efficiency, but also significantly reduces credit risk, especially the rate of non-performing loans. The synergy of strategic, operational and managerial digitalisation provides banks with a more comprehensive risk prevention and control system, and provides a solid theoretical foundation and empirical support for the future digital development of banks.

3. Empirical analyses

3.1. Data sources

In the empirical analyses of this paper, key data from different sources are used. The bank-related data are mainly from the CSMAR database and include indicators such as the non-performing loan ratio (NPL), the bank's financial condition, and operational efficiency. The non-performing loan ratio (NPL) is a core measure of a bank's credit risk and represents the proportion of problem loans in a bank's loan portfolio to total loans. With the extensive data coverage of the CSMAR database, this paper is able to obtain detailed operational data of each bank over time for in-depth analysis.

The digitisation-related metrics are derived from the study ‘Digital Transformation of Chinese Commercial Banks: Measurement, Process, and Impact’ by Gloria Xie [11], which systematically measures the level of digitisation transformation of Chinese commercial banks and provides a detailed total digitisation index. The total digitalisation index reflects the bank's digitalisation process in the three dimensions of strategy, operations and management, and is an important indicator of the extent of the bank's digital transformation.

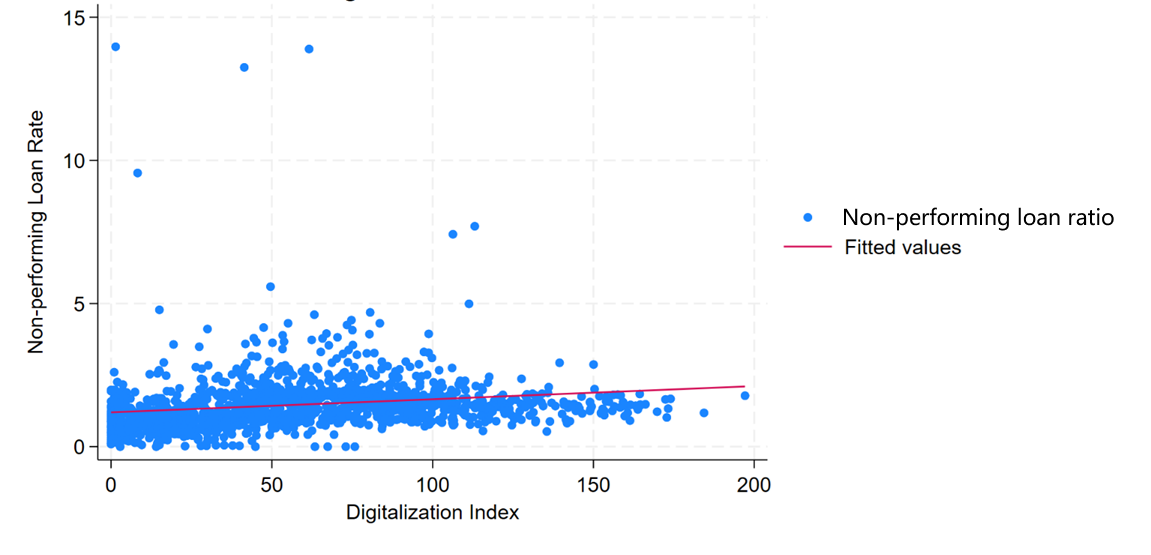

In order to visualise the relationship between these core variables, this paper plots a scatter plot of the NPL ratio against the total digitalisation index, as shown in Figure 1:

Figure 1: Scatterplot of NPL ratio versus total digitisation index

As can be seen in the figure, there is some dispersion in the level of digital transformation and NPL ratios across banks. Although the overall trend is relatively flat, the distribution of data in the figure suggests that a higher total digitalisation index may be associated with a lower NPL ratio. This observation hints at the potential impact of digital transformation on credit risk, but the exact causality still needs to be further explored through regression analysis.

3.2. Descriptive statistics

In order to better understand the characteristics of the data and ensure the validity of the analyses, the paper begins with descriptive statistical analyses of the key variables. Descriptive statistics provide an overview of the basic distributional characteristics of the variables and lay the foundation for subsequent regression analyses.

The specific descriptive statistics are presented in Table 1.

Table 1: Descriptive statistics table

VarName | Obs | Mean | SD | Min | Median | Max | |

NPL ratio | 1411 | 1.467 | 0.968 | 0.000 | 1.390 | 13.970 | |

Total digitalisation index | 1433 | 58.192 | 39.658 | 0.000 | 54.307 | 197.142 | |

Number of employees with bachelor's degree or above | 937 | 11380.698 | 37992.766 | 142.000 | 2271.000 | 3.47e+05 | |

Number of branches | 1131 | 33.949 | 88.524 | 1.000 | 9.000 | 495.000 | |

Total number of institutions | 1296 | 989.689 | 3900.477 | 3.000 | 118.500 | 39928.000 | |

Total profit | 1353 | 2.02e+10 | 6.99e+10 | -9.93e+07 | 1.98e+09 | 8.30e+11 | |

Equity to liability ratio | 1354 | 0.080 | 0.034 | 0.035 | 0.076 | 0.692 | |

Total liabilities | 1356 | 1.20e+12 | 3.74e+12 | 1.58e+09 | 1.50e+11 | 3.19e+13 | |

Loan growth rate | 1403 | 0.202 | 0.158 | -0.985 | 0.180 | 2.442 | |

Deposit growth rate | 1403 | 0.175 | 0.177 | -0.963 | 0.149 | 2.355 | |

Shareholding ratio of the largest shareholder | 1409 | 21.085 | 15.614 | 1.770 | 18.300 | 100.000 | |

Total number of employees on board | 1303 | 21633.645 | 73716.722 | 297.000 | 2966.000 | 4.92e+05 | |

Number of independent directors | 1358 | 3.638 | 1.477 | 1.000 | 3.000 | 8.000 | |

Financial assets held for trading | 1218 | 4.04e+10 | 1.37e+11 | 0.000 | 2.50e+09 | 2.61e+12 | |

From the table, it can be seen that the mean value of NPL ratio is 1.467 and standard deviation is 0.968 which shows the variation in credit risk among the banks in the sample. The mean value of the total digitalisation index is 58.192 with a standard deviation of 39.658, indicating that there are significant differences in the digital transformation process of the banks. Through descriptive statistics, this paper provides a solid data foundation for the subsequent regression analysis and ensures the accuracy and rigour of the study.

3.3. Core issues

In this study, the central issue is to explore how digital transformation in banks can reduce credit risk, particularly the impact on the NPL ratio, by improving information processing capabilities, optimising operational efficiency and enhancing risk management capabilities. To this end, this paper adopts a panel data model to analyse the specific impact of digital transformation on the NPL ratio by introducing the double fixed effects of time and bank. Specifically as shown in equation (1).

\( {NPL_{it}}=α+{β_{1}}×{Digitalization_{it}}+\sum _{j=2}^{n}{γ_{j}}×{Controls_{ijt}}+{μ_{i}}+{λ_{t}}+{ϵ_{it}}\ \ \ (1) \)

where \( {NPL_{it}} \) denotes the bank \( i \) 's NPL ratio at time \( t \) , \( {Digitalization_{it}} \) denotes the bank \( i \) 's total digitised index at time \( t \) , \( {Controls_{ijt}} \) denotes other control variables that may affect the NPL ratio (e.g. total profit, loan growth rate, etc.), \( {μ_{i}} \) is the bank's fixed effect to control for inter-bank heterogeneity, \( {λ_{t}} \) is a time-fixed effect to control for the effects of time change that are common to all banks (e.g. macro-economic factors and policy changes), \( {ϵ_{it}} \) is a random error term.

The rationality of the selected control variables is crucial in the research process. In this paper, the following control variables have been selected and analysed based on their respective importance:

1. Bank size and operations: Variables such as the number of employees with a bachelor's degree or higher, the number of branches and the total number of institutions are indicators that reflect the size and organisational structure of the bank. Larger banks usually have better risk management systems and more resources, which may affect the NPL ratio. Therefore, controlling for these variables helps isolate the independent effects of banks' digital transformation.

2. Financial health: Variables such as total profit, loan growth rate and deposit growth rate are used to measure a bank's financial performance and ability to expand its business. Banks with strong profitability and fast business growth are usually more resilient to risk, and therefore, these control variables can effectively explain changes in NPL ratios.

3. Capital structure and shareholder composition: The equity-to-debt ratio and the proportion of shares held by the largest shareholder reflect a bank's capital structure and shareholder composition. These factors may affect the bank's risk appetite and decision-making process and thus have an indirect impact on credit risk. Therefore, controlling for these variables can better dissect the direct impact of digital transformation on the NPL ratio.

The key difficulty in the study is how to accurately measure the level of digital transformation in a bank and to reasonably control for other factors in the model that may affect the NPL ratio. Digital transformation is a multidimensional and complex process that includes changes in all aspects of strategy, operations and management. Therefore, how to combine these dimensions to construct an effective total digitalisation index is a major challenge in the study.

By clearly presenting the data sources, conducting detailed descriptive statistics, and combining the discussion of core issues and key difficulties, this paper lays a solid foundation for the subsequent regression and heterogeneity analyses. These steps ensure the scientific nature of the research process and the reliability of the conclusions, and provide strong support for empirical research on banks' digital transformation strategies.

4. Results and Discussions

4.1. Analysis of main regression results

The main regression analysis in this paper aims to explore the overall impact of digital transformation on banks' NPL ratio. In the regression analysis, this paper sets up three models, namely model (1), model (2) and model (3), to gradually incorporate more control variables and consider fixed effects, so as to enhance the explanatory power and robustness of the regression results.

Model (1): this model is the base model, which only incorporates the total digitalisation index as the main independent variable, aiming to initially explore the direct impact of digital transformation on the NPL ratio. In this model, no other control variables are introduced and only year fixed effects are considered to control for the impact of changes in the macroeconomic environment on the NPL ratio between different years. The results show that the regression coefficient of the total digitalisation index is -0.001 and is significant at 10% level of significance. This indicates that there is a significant negative correlation between digital transformation of banks and NPL ratio, i.e. the higher the degree of digital transformation, the lower the NPL ratio.

Model (2): in this model, this paper further adds several control variables related to bank characteristics on the basis of model (1). These control variables include the number of employees with bachelor's degree and above, the number of branches, and the total number of institutions, etc., which are used to capture the potential impact of the bank's size and organisational structure on the NPL ratio. In addition, model (2) still incorporates year fixed effects and adds bank-level fixed effects (Id) to control for heterogeneity across banks. The results show that the coefficient of the total digitalisation index is -0.003 and significant at the 5% significance level, indicating that digital transformation still has a significant effect on reducing the NPL ratio even after controlling for factors such as bank size.

Model (3): in this model, the paper further extends model (2) to include more control variables related to banks' financial condition and governance structure. These variables include total profit, loan growth rate, deposit growth rate, equity to liabilities ratio, shareholding of the first largest shareholder, etc., which are designed to control for the impact of the bank's financial health and governance structure on the NPL ratio. The model goes on to consider vintage and bank level fixed effects to ensure the robustness of the model. The result shows that the coefficient of the digital aggregate index is -0.004 and significant at 1% level of significance. This suggests that the impact of digital transformation on reducing NPL ratio is more robust after fully controlling for bank size, financial health and governance structure.

The specific results are shown in Table 2.

Table 2: Main regression results

(1) | (2) | (3) | |

Non-performing loan ratio | Non-performing loan ratio | Non-performing loan ratio | |

Total digitalisation index | -0.001* | -0.003** | -0.004** |

(0.001) | (0.002) | (0.002) | |

Number of employees with bachelor's degree or above | -0.000 | -0.000 | |

(0.000) | (0.000) | ||

Number of branches | 0.003 | 0.005 | |

(0.003) | (0.003) | ||

Total number of institutions | -0.000 | -0.000 | |

(0.000) | (0.000) | ||

Total profit | -0.000*** | -0.000*** | |

(0.000) | (0.000) | ||

Loan growth rate | -0.736** | -0.978** | |

(0.313) | (0.392) | ||

Deposit growth rate | -0.553** | -0.504** | |

(0.240) | (0.250) | ||

Equity to liability ratio | 3.762* | ||

(2.209) | |||

Total liabilities | -0.000 | ||

(0.000) | |||

Shareholding ratio of the largest shareholder | 0.004 | ||

(0.006) | |||

Total number of employees on board | 0.000 | ||

(0.000) | |||

Number of independent directors | 0.041 | ||

(0.037) | |||

Financial assets held for trading | -0.000 | ||

(0.000) | |||

_cons | 1.007*** | 1.185*** | 0.738*** |

(0.067) | (0.136) | (0.250) | |

N | 1411 | 690 | 615 |

r2 | 0.518 | 0.528 | |

Year | Yes | Yes | Yes |

Id | Yes | Yes |

Standard errors in parentheses

* p < 0.10, ** p < 0.05, *** p < 0.01

Using these three models, the paper concludes that digital transformation of banks, especially after controlling for various influencing factors, significantly reduces the NPL ratio. This result indicates the important role of digital transformation in bank risk management.

4.2. Heterogeneity analysis results

To further explore the impact of different dimensions of digital transformation on the NPL ratio, the paper splits the total digitisation index to examine the impact of the three dimensions of strategic digitisation, operational digitisation and managerial digitisation separately.

1. Strategic digitisation: Involving the bank's overall strategic layout and investment in digital technology, the regression results show that strategic digitisation has the most significant effect on the NPL ratio, with a coefficient of -0.001 and significant at the 1% significance level. This suggests that strategic level digitalisation investment plays a key role in reducing credit risk.

2. business digitisation: it mainly reflects the banks' application of digitisation in products and services, such as business operations through digital channels. The regression results show that the impact of business digitisation on the NPL ratio is insignificant, suggesting that the digital transformation in this dimension may be more reflected in the improvement of operational efficiency and customer service quality, while the direct regulation of credit risk is limited.

3. Management digitisation: involves the digitisation of banks' internal management and risk control practices. The regression results also show that the impact of management digitisation on NPL ratio is not significant, probably because management digitisation is more on internal process optimisation and has less direct impact on external credit risk.

The specific results of the analysis are shown in Table 3.

Table 3: Heterogeneity test results

(1) | (2) | (3) | |

Non-performing loan ratio | Non-performing loan ratio | Non-performing loan ratio | |

Business Digitisation | -0.001 | ||

(0.001) | |||

Managing digitalisation | -0.001 | ||

(0.001) | |||

Strategic digitisation | -0.001*** | ||

(0.000) | |||

Number of employees with bachelor's degree or above | -0.000 | -0.000 | -0.000 |

(0.000) | (0.000) | (0.000) | |

Number of branches | 0.005 | 0.004 | 0.005 |

(0.003) | (0.003) | (0.003) | |

Total number of institutions | -0.000 | -0.000 | -0.000** |

(0.000) | (0.000) | (0.000) | |

Total profit | -0.000** | -0.000** | -0.000*** |

(0.000) | (0.000) | (0.000) | |

Equity to liability ratio | 3.605 | 3.453 | 3.121 |

(2.262) | (2.266) | (2.189) | |

Total liabilities | -0.000 | -0.000 | -0.000 |

(0.000) | (0.000) | (0.000) | |

Loan growth rate | -1.011** | -0.989** | -0.961** |

(0.402) | (0.395) | (0.376) | |

Deposit growth rate | -0.476* | -0.470* | -0.445* |

(0.250) | (0.250) | (0.243) | |

Shareholding ratio of the largest shareholder | 0.004 | 0.004 | 0.005 |

(0.006) | (0.006) | (0.006) | |

Total number of employees on board | 0.000 | 0.000 | 0.000 |

(0.000) | (0.000) | (0.000) | |

Number of independent directors | 0.036 | 0.040 | 0.039 |

(0.037) | (0.037) | (0.037) | |

Financial assets held for trading | -0.000 | -0.000 | -0.000 |

(0.000) | (0.000) | (0.000) | |

_cons | 0.717*** | 0.706*** | 0.714*** |

(0.251) | (0.251) | (0.248) | |

N | 615 | 615 | 615 |

r2 | 0.521 | 0.520 | 0.531 |

Year | Yes | Yes | Yes |

Id | Yes | Yes | Yes |

Standard errors in parentheses

* p < 0.10, ** p < 0.05, *** p < 0.01

In the above heterogeneity analysis, the paper explores in detail the three dimensions of strategic digitisation, operational digitisation and managerial digitisation, and finds significant differences in their impact on NPL rates.

First, strategic digitisation has the most significant impact on NPL rates, which can be attributed to its central role in risk management. Strategic digitisation typically involves banks' investments in core technology infrastructure and the implementation of an overall digitisation strategy. These investments and strategic placements significantly improve banks' risk identification and management. Through data mining and machine learning technologies, banks are able to identify potentially high-risk customers earlier and take more stringent risk control measures during the credit approval process, thereby effectively reducing the incidence of non-performing loans. These technological tools not only optimise the credit decision-making process, but also reduce the problem of information asymmetry. In addition, strategic digitisation is an ongoing process. The gradual accumulation of long-term strategic digitisation investments by banks enables them to continuously optimise their overall operational structure and risk control mechanisms, thereby maintaining stable credit quality in a volatile economic environment. This long-term strategic investment enables banks to systematically control and respond to various risks, especially in the area of systemic risk management. Strategic digitisation effectively reduces the impact of external market volatility on credit quality by strengthening banks' internal and external risk management systems.

The insignificant impact of business digitalisation on the NPL ratio may be due to the fact that the role of business digitalisation is mainly in improving operational efficiency and customer service quality, rather than directly regulating credit risk. Business digitisation tends to optimise business operations and services through digital channels, and while these initiatives can enhance customer experience and business processing efficiency, they affect front-end business processes more than they directly impact credit risk management. In addition, business digitisation attracts a customer base that is typically young and highly digitised, which has a relatively good credit history and repayment ability, resulting in a lower level of risk for customers accessing loans through digital channels, and thus business digitisation has had a limited impact on the overall NPL rate.

Management digitisation similarly did not have a significant impact on the NPL ratio, mainly because it focused on the digital upgrading of banks' internal management systems and automation of processes. While these systems have improved internal operational efficiency and reduced manual errors and internal management costs, their impact has been more on internal process optimisation rather than directly on external credit risk management. While management digitisation has improved the accuracy and timeliness of the bank's internal reporting, its role in responding to the external economic environment and market volatility is relatively weak and lacks the ability to directly regulate external credit risk. This explains why management digitisation has been less effective than strategic digitisation in reducing NPL ratios.

Overall, the impact of different dimensions of digital transformation on the NPL ratio is focused, with strategic digitalisation playing the most significant role in reducing the NPL ratio due to its comprehensive and continuous risk management capabilities.

5. Conclusions

5.1. Findings

This paper reveals the significant impact of digital transformation of banks on non-performing loan ratio through empirical analysis. The study shows that with the increase of digitalisation, the NPL rate shows a significant downward trend, especially the strategic digitalisation plays a key role in reducing credit risk. This suggests that the digital layout of banks not only optimises information processing and risk prediction capabilities, but also significantly improves overall risk management.

In addition, although the direct impact of operational digitisation and management digitisation is relatively weak, their contribution in improving operational efficiency and internal management is equally important. By introducing several control variables, this paper ensures the robustness of the findings and further validates the independent role and importance of digital transformation in bank risk control.

5.2. Suggestions

Based on the above findings, this paper makes the following recommendations:

1. Prioritise and strengthen strategic digital investment: Banks should focus on digital layout at the strategic level, especially investing more in information system construction, intelligent risk control mechanisms and decision support systems. Technological upgrades in these areas will significantly improve risk management capabilities, which in turn will effectively reduce the NPL ratio.

2. Enhance the operational effectiveness of business and management digitisation: while business and management digitisation will have a limited role in directly reducing the NPL ratio, they are critical to improving the overall operational efficiency and internal management of banks. Banks should continue to promote digital transformation in these areas to ensure process optimisation and operational efficiency, which indirectly support credit risk management.

3. Comprehensive consideration of multi-dimensional digital needs: Banks should comprehensively measure the needs of all levels of strategy, operations and management when pushing forward with digital transformation, and rationally allocate resources to ensure that they can both optimise their operations and enhance their risk control, so as to achieve a comprehensive digital upgrade.

4. Policy support for the digital transformation of small and medium-sized banks: Policymakers should provide technical support and policy concessions to small and medium-sized banks to help them narrow the gap with large banks in the digitalisation process, enhance their competitiveness and risk-resistance in the financial system, and contribute to the stability and security of the overall financial system.

Through these measures, banks can make full use of the advantages of fintech to achieve a more efficient operation model and more robust risk management, so as to better cope with the complex and volatile market environment and systemic financial risks.