mini-budget, inflation, commercial bank

1. Introduction

Since august 2022, the global epidemic, the Russian-Ukrainian war, and other factors have caused the decrease in the pound. The government and the central bank have used the mini-budget and interest rate hikes as two typical policy instruments to curb inflation and raise and stabilize the value of the pound. The UK government's new tax cuts, known as the mini-budget [1], were released against a cost-of-living crisis but increased hyperinflationary expectations and spread market fears. The pound fell to 1.035 against the US dollar, close to parity and a record low [2]. In addition, the central bank's interest rate hikes will also lead the fluctuations in the pound. Therefore, based on the new tax cuts and the bank's interest rate hikes, this paper will critically assess the impact of the fluctuations in the pound's value on the activities of commercial banks in the financial markets and analyze the causes and benefits.

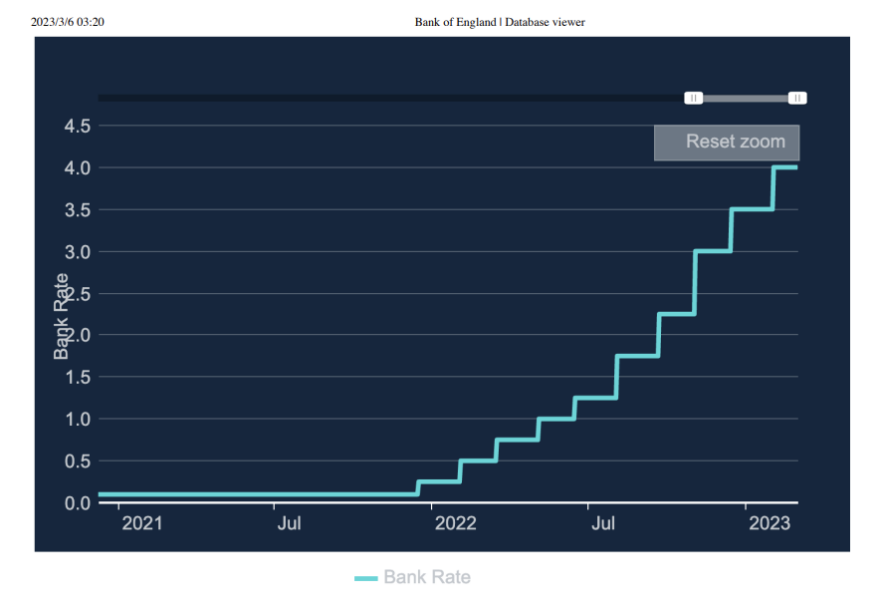

Figure 1: Raised interest rate to 4 % Till 02/2023(Bank of England,2023).

2. Detailed Reasons for Exchange Rate Changes and Their Impact on Business Activities of Commercial Banks

2.1. The Trigger and Background of Sterling Exchange Rate Decline

The timing of the new tax cuts was the "trigger" for the sharp fall in the pound's exchange rate. When the Truss government came to power, it introduced an energy bailout and a 'mini-budget' to boost economic growth. The core of the energy rescue package is the government's commitment to covering part of the cost of energy for individuals and businesses, with a total financial outlay of £150 billion, or around 6% of the UK economy [3]. In the meantime, "The mini-budget is a package of tax cuts, including a reduction in the personal base rate, the abolition of increases in National Insurance contributions and business rates, and financial support to promote services such as property and tourism, totaling £45 billion, or around 2% of the UK economy [4]. This undoubtedly reduced the UK government's tax revenues significantly and required a massive sale of UK government bonds to finance it, which led to a sharp rise in bond yields and increased market fears [5].

On the one hand, the Bank of England must "underwrite" the Treasury's massive debt issuance, and the market is worried that the independence of the Bank of England has been weakened, further triggering the risk of runaway inflation and de-anchoring. On the other hand, the lack of a reasonable financing plan for the UK government and the widespread perception among investors that the high debt risk would have an impact on the long-term economic development of the UK led to a wave of shorting of the pound and its assets, which meant an increase in inflation [6] . As a result, the pound's value fluctuated to its lowest point due to the New Deal. Commercial banks are also inevitably affected by the lack of independence of central bank decisions.

Figure 2: British Pound / U.S Dollar Trend (PoundSterlingLive,2023).

2.2. The Impact of the Mini-budget Led to the Central Bank Raising the Interest Rates in Order to Curb Inflation and Stabilize the Value of the Pound

For commercial banks, the introduction of the mini-budget implies multiple risks. Firstly, there is the market risk that if the price of UK government bonds falls, commercial banks will likely suffer investment losses, leading to a decline in the quality of their assets [7] . Secondly, it will cause asset liquidity risk, and if commercial banks hold a large amount of UK government bonds and there are not enough buyers in the market willing to buy these bonds, then the bank may face liquidity risk and not be able to secure sufficient capital reserves [8] . This situation could result in the bank being unable to meet its customers' normal withdrawal or other payment requirements, which would undoubtedly cause significant distress to the working or middle class under severe inflationary pressures.

In addition, the profitability of commercial banks will be reduced. As a result of the new tax cuts and the energy subsidy package, the government needs to raise capital by issuing large amounts of government bonds, so the price of government bonds has fallen sharply. Suppose a commercial bank holds a large amount of UK government bonds and a significant sell-off of UK government bonds in the market, which will vastly reduce the bank's investment return and affect its profitability. Moreover, as a result of the fall in the price of UK government bonds, commercial banks' domestic and overseas investment returns may also be affected to a considerable extent [9]. Furthermore, it could also lead to a decline in market confidence in the UK economy. Therefore, crucial that commercial banks take timely and appropriate measures to address these risks, such as optimizing their balance sheets, managing liquidity risk, and strengthening risk controls on their portfolios in line with market conditions.

Due to the large number of extreme knock-on effects following the mini-budget [10], by February 2023, the Bank of England had raised interest rates ten times in a row, raising them by 50 basis points to 4.0% and pushing borrowing costs to their highest point since late 2008, in an attempt to reduce inflation and stabilize and increase the value of the pound. Going forward, Bank Rate is expected to rise to around 4.50% by mid-2023 before falling back to just above 3.25% three years later. CPI inflation is expected to fall to around 8.0% by mid-2023 and to around 4.0% by the end of the year [11].

Figure 3: Official Bank Rate History Data (Bank of England,2023).

2.3. The Impact of the Exchange Rate Fluctuations Caused by the Mini-budget and the Central Bank's Interest Rate Hike on Commercial Banks' Business Activities

For commercial banks, different business models, product portfolios, and customer segments will be affected to varying degrees. On the upside, as the central bank raises interest rates, deposit returns will also increase accordingly. Interest income will increase for savers and investors, especially those who save in banks or hold fixed-income securities [12]. This will increase the attractiveness of commercial banks and thus help them to increase their deposit reserves. Secondly, higher interest rates could reduce the risk of inflation and make borrowing more expensive, thereby reducing the demand for borrowing by consumers and businesses and giving banks more time and leeway to turn over funds. Customers may seek other ways to increase the return on their assets, such as turning to equities or other investments. Moreover, the central bank's interest rate hikes have raised base rates, most notably on mortgages, and UK residents who bought their homes with mortgages have had to pay back more money to their banks. Finally, as the pound's value stabilizes and gradually increases, commercial banks can benefit from higher interest rates on foreign exchange transactions and other businesses, thus increasing their business capacity and the market value of their shares.

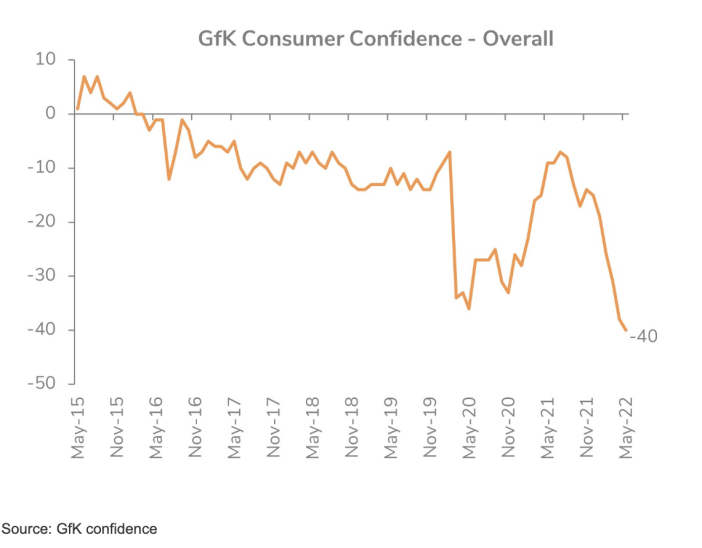

However, although the value of the pound will gradually increase in value as a result of central bank interest rate increases to stabilize inflation, the constant fluctuation in the pound's value will also negatively impact commercial banks' operations. Firstly, the increase in interest rates will lead to an increase in the cost of debt for commercial banks, which will lead to an increase in the interest rates offered by commercial banks to borrowers, who may reduce their borrowing needs. A typical example is that people who buy a house with a mortgage will have to pay a much higher amount of money back, making it very burdensome to live and even unaffordable to own a home [13]. Secondly, the appreciation of the pound could affect commercial banks' risk management strategies. If banks fail to anticipate changes in exchange rates, they may take on higher foreign exchange risks. This could lead to increased losses for banks and negatively affect their profitability. Also, banks may face large redemption requests from domestic and foreign customers due to changes in the pound exchange rate, which may decrease their net profits [14]. Another point is that the pound's appreciation may expose commercial banks to greater competitive pressure in international markets. The cost of goods and services in the UK may increase due to the pound's appreciation, which may cause banks to lose some international customers.

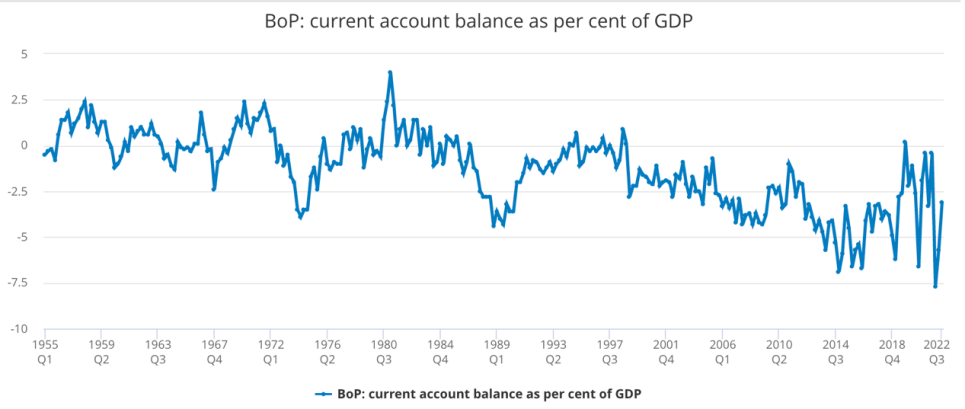

While an interest rate increase by the Bank of England would help improve banks' profitability, credit risk, and asset quality in the short term, a fall in sterling would jeopardize the banking sector's stability in a poor overall economic environment which could also reduce economic growth. However, an increase in central bank interest rates may increase the currency's relative value, thus helping to maintain the currency's exchange rate. This is particularly important for countries like the UK that rely heavily on commodity imports as it can reduce the cost of imported goods and thus curb inflation [15] .

Figure 4: Current account balance as per cent of GDP (BOP, 2023).

Figure 5: GfK Consumer Confidence-Overall (Retail Economics ,2023).

3. Conclusion

In summary, this article analyses the pound volatility since 2022 based on the mini-Budget tweed and the Bank of England interest rate hike. In addition, the paper assesses the challenges and benefits of these changes to commercial bank operations. Sterling volatility may positively affect commercial banks, including increased trading revenue and asset liquidity, attracting capital inflows and providing more trading opportunities, and increasing equity market capitalization. On the other hand, the same appreciation of the pound could have several negative impacts on commercial bank operations, including risk management, net profitability, policy rates, and international competition. For the future, it is suggested that in a depressed environment, commercial banks may need to adapt their operations and strategies to these changes promptly in order to protect themselves against the business risks associated with exchange rate fluctuations, such as changes in interest rates, spreads and the cost of capital [16].