1. Introduction

With the increase in China's population and the improvement of living standards, people's awareness of health has also increased, and dairy products have gradually become an indispensable part of people's daily lives [1-4]. In recent years, China's dairy industry has developed rapidly. At the same time, with the increase in urbanization and the continuous enhancement of consumers' requirements for quality and health, the industry still has huge potential for development, as well as facing many challenges and opportunities [5-8].

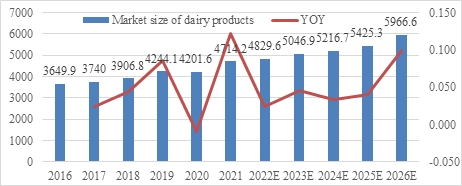

Figure 1: Market size of dairy products (100 million yuan).

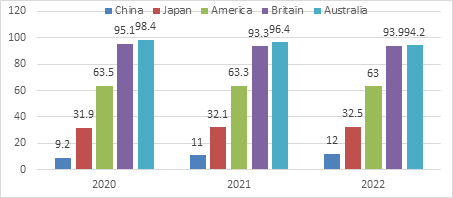

The scale of China's dairy industry continues to grow as shown in Fig. 1. The retail scale of China's dairy industry has increased from approximately RMB 365 billion in 2016 to RMB 471.4 billion in 2021, with a CAGR of 5.25% during the period. It is estimated that the retail scale of China's dairy industry will reach RMB 596.7 billion in 2026 [9, 10]. It is expected that the compound growth rate in the next four years will be 5.43%. China's future dairy development has great potential, and there is still a lot of room for development in per capita milk consumption compared with developed countries (seen from Fig. 2) [11-14]. This article will conduct an in-depth analysis of the current situation and future trends of China's dairy industry, and introduce the leading companies Mengniu and Yili for valuation research.

Figure 2: Per capita consumption of dairy products (kilograms) in various countries.

2. Industry Analysis

The dairy industry chain consists of upstream pasture, brand manufacturers, distributors, and downstream consumers. Brand manufacturers are responsible for the production of dairy products and occupy a central position in the supply chain. In the Chinese dairy industry, the market structure of the upstream is very scattered, and the bargaining power is relatively limited compared to downstream enterprises. The competition structure of downstream enterprises is relatively concentrated, and they have the greatest profitability and negotiation power in the industry chain [12].

The sales of China's dairy industry can be divided into two types. The first is the cost distribution, where raw milk production and dairy farming account for 63%, dairy processing accounts for 30%, and circulation and sales account for 8%. The second is the profit distribution, where raw milk production and dairy farming account for 9%, dairy processing accounts for 32%, and circulation and sales account for 59% [8]. With the help of advanced technologies such as big data analysis, artificial intelligence, and cloud computing, Chinese dairy companies can now collect and analyze large amounts of data from milk production to consumer behavior and preferences, optimizing the entire dairy production process. Digital transformation has also driven the development of the dairy industry by directly reaching consumers through e-commerce platforms and online markets, reducing costs. Digital transformation has improved the maturity of China's dairy production technology, thereby improving efficiency, productivity, and sustainability. International dairy prices have slightly decreased, while domestic dairy prices have slightly increased. The number of dairy cows has decreased, and the supply of milk sources is tight, leading to the rise in domestic milk prices. There is a strong positive correlation between international and domestic milk prices. When the international raw milk price rises, the price difference between domestic and international prices will become smaller and smaller, and domestic companies will be more inclined to choose domestic raw milk, thereby driving up domestic milk prices. With the decrease in raw milk production in New Zealand, international milk prices can no longer compete with domestic raw milk, and the acquisition of domestic milk by dairy companies has increased, directly driving the rise in domestic milk prices. International milk prices have slightly decreased, and the growth of dairy production worldwide has put pressure on international milk prices, but the domestic milk supply is still tight, leading to a slight increase in domestic dairy prices [3].

The Chinese dairy market has shown a fluctuating growth trend in recent years. According to the "China Statistical Yearbook 2021," China's per capita annual consumption of dairy products reached a historical high in 2022, but the per capita consumption of liquid milk is only one-third of the world average, and the market still has great potential. There is still a big difference in the consumption level of dairy products between urban and rural residents in China. The per capita consumption of dairy products in cities has increased from 17.1 kg/person/year in 2015 to 18.20 kg/person/year in 2021, while the per capita consumption of dairy products in rural areas is constantly increasing, reaching 9.3 kg/person/year in 2021.

With the development of China, the per capita consumption level has increased, and consumers' requirements for the quality, nutrition, and taste of dairy products have been continuously improving. From 2014 to 2019, the retail sales of high-end liquid milk in China increased from RMB 67 billion to RMB 135 billion, with an average annual compound growth rate of 15.04%, which is higher than that of ordinary liquid milk. In terms of proportion, the proportion of high-end liquid milk in the total retail sales of liquid milk in China increased from 30.70% in 2014 to 40.10% in 2019. High-end products have strong pricing power, thus promoting the expansion of the dairy industry by increasing consumer prices [4]. Consumer upgrade is an important driving force for the future development of China's dairy industry. As consumers' requirements for quality and health continue to increase, market demand is gradually shifting to high-quality, high-nutrition, and low-additive dairy products. In addition, with the improvement of people's living standards, the demand for functional dairy products, such as those added with probiotics, is also increasing [2].

3. Valuation of Leading Dairy Companies: Yili and Mengniu

From 1993 to 2021, both Yili and Mengniu have achieved significant milestones in the Chinese dairy industry. Yili Group, established as a state-owned enterprise in 1993, underwent a restructuring process in the early 2000s and became a joint-stock company, setting the stage for future growth. With a diverse product portfolio including milk, yogurt, ice cream, and infant formula, Yili became the largest dairy company in China by 2010, capturing a substantial market share. Specifically, Yili held a dominant market share of 26% in segments such as liquid milk, yogurt, and infant formula, solidifying its position as a leader in the industry. Additionally, Yili expanded its global presence, becoming a leading global dairy company operating in over 30 countries [14].

Meanwhile, Mengniu Dairy Group, founded in 1999, initially focused on liquid milk products. It successfully went public in 2004, listing on the Hong Kong Stock Exchange. Mengniu experienced rapid growth and established itself as one of the top dairy companies in China, offering a wide range of dairy products such as milk, yogurt, cheese, and ice cream. Mengniu held a significant market share, with a notable share of 21% in the Chinese dairy industry, particularly in the liquid milk market. However, specific market share figures for Mengniu and Yili in the dairy industry during the mentioned period are not provided in the available information. The growth trajectories, market dominance, and substantial market shares of Yili and Mengniu highlight their significant contributions to the development of the Chinese dairy industry over the past decades [9]. As of H1 2022, Mengniu Group's operating income was RMB 63.464 billion, a YoY increase of 12.31%, while its net profit was RMB 6.139 billion, a YoY increase of 19.9%. In terms of ROE, Mengniu ROE in H1 2022 was 12.58%, a decrease of 3.89% from the same period last year, mainly due to the decrease in total asset turnover, which was caused by the increase in monetary funds and inventory. The reason for the increase in monetary funds was the increase in operating income by RMB 20 billion and the increase in inventory by RMB 6 billion [12].

As of H1 2022, Mengniu Group's operating income was RMB 47.722 billion, a YoY increase of 4%, while its net profit was RMB 3.643 billion, a YoY increase of 36.44%. The increase in Mengniu's ROE from 6.66% in H1 2021 to 7.44% in H1 2022 was mainly due to the increase in the proportion of net profit to total assets by 1.12%, which indicates that the company's business operation efficiency and management capability have been improved [13]. Fresh milk and yogurt are still the two major categories in the dairy industry. In the short term, ambient temperature fresh milk is still the main source of growth, while the market penetration rate of basic fresh milk has gradually saturated, and the terminal price tends to be stable. Therefore, the competition in the dairy industry is gradually shifting to high-end fresh milk. Taking Yili and Mengniu's high-end fresh milk products Yili Gold and Mengniu Premium as examples, their prices have decreased from RMB 21.25/19.8 in 2017 to RMB 19.48/19.36 at the end of 2021. After the epidemic, consumer health awareness has significantly increased. Yili and Mengniu's high-end milk products Yili Gold and Mengniu Premium have achieved a growth rate of over 20% in 5-10 years under the premise of consumption upgrading, and high-end organic fresh milk has achieved rapid growth. According to Euromonitor International, the CR3 of ambient yogurt are Anmuxi, Chobani, and Muller, with market shares of 19.9%, 10.17%, and 4.71%, respectively, in 2020, with a total market share of 34.7% [5].

Table 1: Summary of financial statements of different corporations.

RMB(100million) | Market Capitalization | Revenue | Net Profit | PE | |||

2022 | 2022 | 2025E | 2022 | 2025E | 2022 | 2025E | |

Yili Group | 3183 | 938 | 80.53(Q3) | 150.64 | 39.5 | 21.13 | |

Mengniu Dairy Group | 1123 | 925 | 1500 | 51.85 | 84.15 | 21.53 | 13.35 |

Average of comparable companies | 16.06 | ||||||

Table 1: (continued).

Bright Dairy & Food Co., Ltd. | 143 | 282.15 | 3.91 | 8.99 | 39.71 | 15.9 | |

Yantang Dairy | 2.2 | 18.75 | 1.01 | 3.11 | 29.39 | 9.38 | |

Xinjiang Tianrun Dairy Company Limited | 147 | 74.8 | 3.16 | 6.42 | 40.2 | 22.89 |

The channel trend is a strategy of extensive development followed by refinement. With the improvement of market penetration and intensifying competition in first- and second-tier cities, companies' channel operations in these cities will become more refined, while the focus will shift to the sinking market. Yili and Mengniu, as benchmarks in the dairy industry, adopted channel refinement and large distributor strategies, respectively, in the early stages. Yili's sales system is flat, with one or more sales representatives assigned to each distributor to manage the channels in depth, while Mengniu uses large distributors to quickly expand channels. However, as the scale expands, the channel price system and operation become chaotic, which is not conducive to channel sinking and transformation. Currently, channel refinement strategies are more suitable for exploring the sinking market [5].

In the new five-year plan, Yili and Mengniu will shift their core strategy towards high-quality differentiated competition. Their strategic goal is to transform their dairy products into high-margin and high-end categories. Under this plan, Mengniu expects its revenue scale to reach 150 billion yuan and its CAGR to reach 15% by 2025; while Yili expects its revenue scale to reach 160 billion yuan by 2025, with a 0.5% increase in net profit margin each year. In the past few years, Yili has chosen to develop through internal growth, while Mengniu has chosen to accelerate its layout in upstream milk sources and milk powder [10]. Based on comparable company valuation analysis, Yili's current market value is 318.3 billion yuan, corresponding to a P/E ratio of 39.5 times, and the estimated net profit of Yili in 2025 is 15.064 billion yuan. Compared with the market value in 2022 (318.3 billion yuan), the estimated P/E ratio in 2025 is 21.13. Compared with the market value in 2022 (112.3 billion yuan), the estimated P/E ratio of Mengniu in 2025 is 13.35.(As shown in Table.1) [12].

4. Limitations & Prospects

Limitations of the study include the limited scope of analysis, focusing primarily on Yili and Mengniu as leading companies, which may not fully represent the entire Chinese dairy industry. Additionally, reliance on available data could introduce limitations in terms of accuracy and completeness [12]. Looking ahead, future research can explore consumer preferences, emerging trends, and changing consumption patterns in the Chinese dairy industry. It can also investigate sustainability practices and the environmental impact of the industry, guiding efforts towards sustainable practices [14]. For future industry development, it is recommended to prioritize innovation and research and development, introducing new and improved dairy products aligned with changing consumer needs. Embracing digital transformation and advanced technologies can optimize production processes and enhance supply chain efficiency. Exploring market diversification opportunities, both domestically and internationally, can mitigate risks associated with market fluctuations. Promoting sustainable practices, responsible sourcing, waste reduction, and environmental conservation will contribute to long-term viability and address consumer concerns about sustainability [13]. In conclusion, understanding the limitations of this study and focusing on future research prospects and industry recommendations will drive the growth and sustainability of the Chinese dairy industry in the coming years [14].

5. Conclusion

In summary, the Chinese dairy industry is continuously expanding, with a projected CAGR of 5.43% over the next four years. Brand owners bear the manufacturing responsibility and are in a central position in the supply chain. Downstream enterprises have a relatively concentrated competitive structure and possess the greatest profitability and negotiation power. The production and breeding cost of raw milk accounts for 63%, while dairy processing costs account for 30%, and distribution and sales costs account for 8%. The profit of raw milk production and breeding accounts for 9%, while the profit of dairy processing accounts for 32%, and the profit of distribution and sales accounts for 59%. The digital transformation is driving the development of the Chinese dairy industry, and dairy companies can optimize the entire dairy production process by collecting and analyzing large amounts of data through advanced technologies such as big data analysis and artificial intelligence. There is a strong positive correlation between international and domestic milk prices, and while international dairy prices have slightly decreased, domestic dairy prices have slightly increased. The upgrading of consumption promotes the recovery of the dairy market.

Through the analysis of leading companies Yili and Mengniu, the main potential for improvement in the future lies in product and channel development. As leading companies in the Chinese dairy industry, Yili and Mengniu can continuously innovate and introduce healthier, safer, and higher-quality products, such as premium liquid milk, to meet the increasing demand of consumers for nutritious and high-quality dairy products. The channel trend is first extensive and then refined, and Yili and Mengniu have adopted channel refinement and large commerce strategies respectively. Currently, channel refinement is more suitable for exploring the lower-tier market. The research findings outlined above provide important insights into the dynamics and opportunities within the Chinese dairy industry. By analyzing the expansion of the industry, cost structure, profitability, digital transformation, market correlations, and the strategies of leading companies Yili and Mengniu, this research contributes to a comprehensive understanding of the industry's current state and future prospects. These insights can guide further research and inform decision-making for stakeholders, including dairy companies, investors, policymakers, and industry professionals, facilitating the development of effective strategies for product innovation, channel development, and market expansion. Understanding the research significance helps in driving the growth and sustainability of the Chinese dairy industry in the coming years.