1. Introduction

In recent years, Environmental, Social, and Governance (ESG) factors have increasingly shaped corporate strategies, particularly in mergers and acquisitions (M&A). As global concerns over climate change, environmental degradation, and social responsibility intensify, ESG has become critical for companies seeking to enhance market credibility and long-term sustainability. Introduced in 2004 by the United Nations Global Compact (UNGC) and the International Finance Corporation (IFC), the ESG framework provides a comprehensive approach to evaluating companies based on their environmental impact, social responsibilities, and governance practices [1].

Sustainability has become a central business imperative, with firms integrating ESG principles to reduce risks, lower costs, and attract new customers, especially smaller companies. In the pursuit of "Net Zero" emissions by 2050, companies are setting sustainability targets aligned with global climate goals [2]. Beyond environmental factors, social considerations, such as board gender diversity, are crucial for mitigating financial risks and enhancing business performance [3].

M&A represents pivotal events in a company’s lifecycle, driving growth and operational expansion through access to new markets, customers, and technologies. However, these transactions involve risks, including integration challenges and market volatility. ESG factors help mitigate such risks by enhancing corporate reputation, fostering stakeholder trust, and improving efficiency. Acquirers with higher ESG scores are more likely to benefit from smoother post-merger integration and long-term value creation [4].

Globally, M&A activity has surged, with over 1.5 million transactions since 1970. ESG-related M&A deals, driven by industries transforming to meet sustainability goals, have grown rapidly. Green M&A, particularly in the energy and utilities sectors, represents a growing share of deals, often commanding price premiums that reflect the strategic importance of sustainability-focused acquisitions.

This paper explores the impact of ESG factors on M&A transactions and firm value. The study uses data from 1,201 publicly traded companies with market values above $300 million. It uses linear regression analysis to look at ESG scores as the independent variable and market values as the dependent variable. Drawing on the BCG 2022 M&A Report, this study highlights trends in ESG-related transactions, emphasizing their strategic importance.

Grounded in instrumental stakeholder theory, the paper hypothesizes that high-ESG firms achieve better post-M&A outcomes due to enhanced stakeholder trust. By contextualizing these trends, this research underscores ESG's critical role in shaping corporate strategies, M&A dynamics, and firm valuations.

2. Literature review

The impact of Environmental, Social, and Governance (ESG) factors on business operations and valuations has been widely examined across various studies. These factors are increasingly influencing corporate strategies and investment decisions, particularly in the context of mergers and acquisitions (M&A) and overall firm value. In recent years, ESG performance has emerged as a critical determinant of a company’s attractiveness in M&A transactions. Companies with higher ESG scores often signal resilience, ethical governance, and a proactive stance toward risk mitigation, which appeals to potential acquirers. According to Qian[5], firms with strong ESG credentials demonstrate better financial stability and are perceived as less risky investments. High ESG performers tend to be better prepared for regulatory shifts, societal expectations, and environmental challenges, making them strategic assets in an M&A landscape increasingly shaped by sustainability considerations.

Stakeholders, including investors and institutional buyers, are drawn to companies with superior ESG scores due to their alignment with long-term value creation. These companies not only enjoy enhanced reputational capital but are also more likely to secure favourable terms in transactions. Furthermore, acquisitions of high ESG performers provide potential buyers with a range of strategic advantages, such as enhanced market competitiveness, access to green financing, and better integration with regulatory frameworks that emphasize sustainability. As more institutional investors demand responsible investment practices, firms with weak ESG credentials may find themselves facing reduced valuations or exclusion from consideration altogether. Companies with strong ESG profiles, therefore, have a higher likelihood of attracting acquisition interest, as they present less regulatory and reputational risk, and more potential for long-term growth.

On the other hand, the effect of ESG factors on firm value has garnered significant attention in recent years. Studies have consistently shown that companies with high ESG scores tend to have higher valuations, as they are seen as more sustainable and less prone to the financial or reputational risks associated with poor ESG performance. Almaqtari et al. [6] found that sustainability indicators, such as strong environmental and social policies, are directly linked to a firm’s total market value, reflecting not only short-term stock or equity value but also long-term business potential. High ESG performance signals that a company is not just focused on immediate financial gains but is committed to long-term value creation, aligning with broader societal goals and stakeholder interests. This aligns with findings from Aydoğmuş et al. [7], which emphasize that social and governance factors are particularly influential in boosting firm value, suggesting that strong governance and social responsibility practices foster investor confidence and enhance a company's standing in the market.

Moreover, studies such as those by Kim et al. [8] highlight that better ESG engagement, especially in cross-border M&A, can positively influence business performance. This suggests that ESG-oriented firms, particularly in international transactions, are better positioned to manage cultural and regulatory differences, thus driving efficiencies and performance improvements post-acquisition. Conversely, the absence of strong ESG practices can lead to poor performance post-M&A, as firms struggle with integration challenges and face external pressures from regulators and consumers.

Overall, the relationship between ESG performance and firm value highlights a growing trend where sustainability is increasingly viewed as a strategic advantage, rather than just a moral or ethical responsibility. Companies that prioritize and manage their ESG practices are more likely to attract investor confidence, reduce risks, and improve overall operational efficiency. In contrast, poor ESG performance can undermine a company’s market value, making it less attractive to investors and acquirers. However, much of the existing studies has been limited to single-country analyses. In this study, I aim to expand this perspective by gathering data from 79 countries, allowing for a more robust investigation of how ESG performance influences M&A transactions and firm value globally. By doing so, the study will provide a clearer, more comprehensive understanding of the dynamic relationship between ESG factors, M&A outcomes, and firm valuations across diverse international markets.

This paper aims to investigate how ESG factors impact M&A transactions and firm value, using recent global data instead of focusing on single countries. Specifically, we explore how companies with higher ESG scores are more likely to attract stakeholder interest compared to those with lower scores.

Recent research shows that ESG performance has become a key factor in M&A decisions. Companies with strong ESG scores tend to attract more investor attention, as sustainability is now a critical consideration in assessing long-term potential. High ESG scores signal responsible governance, ethical management, and resilience to risks, making these companies more appealing as acquisition targets. Furthermore, companies with strong ESG performance often benefit from enhanced reputational capital and operational efficiency, boosting buyer confidence. As institutional investors prioritize responsible investment practices, companies with weak ESG credentials may face lower valuations or exclusion from M&A opportunities. Conversely, acquiring high-ESG firms can offer strategic advantages, such as improved competitiveness and access to green financing, making ESG a key driver in M&A attractiveness.

This study also explores how ESG factors influence firm value. Investors generally place a higher value on companies with high ESG scores, perceiving them as less risky and better positioned for sustained growth. Strong ESG performance signals stability and responsible business practices, which are increasingly important to investors. In contrast, poor ESG performance can reduce firm value by raising risks and lowering investor confidence. Thus, integrating ESG factors into corporate strategies is becoming essential for improving long-term performance and enhancing firm valuations.

3. Data, sample, methodology

3.1. Sample data

Based on Table 1, this study explores the relationship between ESG factors, M&A transactions, and their impact on firm value. Using data from Refinitiv Eikon, the study analyzed 1,201 publicly listed companies with a market capitalization of USD 300 mm or more, where the Merger and Acquisition target status is marked as True. The market capitalization of these companies ranges from USD 300 mm to USD 1,068,597 mm, and their ESG scores range from 1.48 to 92.00.

Table 1: Sample data

Sample data | ||

Companies with an ESG score in Refinitiv | ||

Number of Companies | 129 | |

Number of Countries | 67 | |

Total Observations | 1201 | |

Market Cap | >= USD 300 mm | |

Market Cap Range | USD 300 mm - USD 1,068,597 mm | |

ESG Score | Available | |

ESG Score Range | 1.48 - 92.00 | |

Merger and Acquisition Target | TRUE | |

3.2. Linear regression analysis

Let the independent variable X represent ESG scores and the dependent variable Y represent market capitalization. The objective of this analysis was to assess the relationship between the ESG score (FY0) and market capitalization. A linear regression model was employed using 1,201 observations to examine this relationship. The results, as summarized in Table 2, are as follows:

\( Market Capitalization = β0 + β1(ESG Score) \)

Table 2: Regression result

Regression Statistics | |

Multiple R | 0.148017209 |

R Square | 0.021909094 |

Adjusted R | |

Square | 0.021093339 |

Standard | |

Error | 38771.35117 |

Observations | 1201 |

ANOVA

df | SS | MS | F | Significance F | |

Regression | 1 | 40372556852 | 40372556852 | 26.85742565 | 2.56806E - 07 |

Residual | 1199 | 1.80236E + 12 | 1503217671 | ||

Total | 1200 | 1.84273E + 12 |

Coefficients | Standard Error | t Stat | P - value | Lower 95% | Upper 95% | Lower 95.0% | Upper 95.0% | |

Intercept | -6272.61839 | 3207.328104 | 1.955714597 | 0.050730755 | 12565.21809 | 19.98131408 | 12565.21809 | 19.98131408 |

ESG Score (FY0) | 305.4340816 | 58.93663074 | 5.182415041 | 2.56806E - 07 | 189.8036836 | 421.0644796 | 189.8036836 | 421.0644796 |

The regression analysis revealed that the ESG Score (FY0) exhibited a statistically significant positive relationship with market capitalization. Specifically, the regression coefficient for the ESG score was found to be 305.43 (see Table 1), implying that for each unit increase in the ESG score, market capitalization is expected to increase by 305.43 units. This suggests that firms with higher ESG scores tend to have higher market capitalization.

The statistical significance of the relationship was confirmed by the t-statistic of 5.18 and a p-value of 2.57 x 10^-7. As the p-value is well below the conventional significance level of 0.05, we can conclude that the relationship between the ESG score and market capitalization is robust and unlikely to have occurred by chance.

Further, the 95% confidence interval for the ESG score’s coefficient ranged from 189.80 to 421.06, indicating that the true effect of ESG on market capitalization is likely to fall within this range, and the interval does not include zero, reinforcing the direction and significance of the relationship.

Although the R-squared value for the model was 0.022, which suggests that the ESG score accounts for only 2.2% of the variation in market capitalization, the positive and statistically significant coefficient implies that ESG scores are an important factor in explaining market capitalization, albeit other factors not captured in this model may contribute to the remaining variation.

The findings show that ESG performance is positively related to market capitalization. This means that companies with higher ESG scores are likely to be worth more on the market, but the link is still not very strong.

3.3. BCG 2022 M&A report analysis overview

According to the BCG 2022 M&A Report, the analysis was based on BCG's database of approximately 700,000 deals since 2001. Due to limited data on ESG dealmaking, a proprietary method was employed to identify and classify ESG-related deals. Over 550 ESG-related keywords were sourced from various organizations, investment firms, and academic research. This process resulted in a list of approximately 120,000 ESG-related transactions.

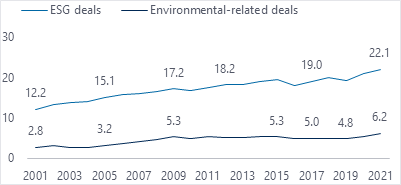

Figure 1: The volume and the value of ESG deals have risen over the past two decades

Figure 2: The shares of ESG deals and environmental-related deals have grown continuously

According to the BCG research report, and as illustrated in Figure 1, the global volume of ESG deals increased from approximately 5,700 in 2011 to a record high of about 9,200 in 2021, marking a 60% rise. This surge in activity was particularly significant in 2021, with deal volumes increasing by 35% following two relatively slow years for both general M&A activity and ESG-related transactions [9].

Figure 2 highlights a substantial increase in ESG-related M&A activity over the past decade, with green deals now accounting for roughly 6% of all transactions. The energy and utilities sector experienced the most notable growth, with green M&A deals in this industry rising from about 20% in 2011 to nearly 40% by 2021. This growth is driven by the industry's need to transition away from carbon-heavy operations and invest in renewable energy sources such as solar, wind, and biofuels. In contrast, sectors such as telecommunications, healthcare, and real estate have shown limited green M&A activity, as companies in these fields tend to focus on internal sustainability initiatives rather than external acquisitions. Nevertheless, the growing emphasis on environmental-related transactions indicates that businesses are increasingly recognizing the strategic value of green M&A to meet ESG pressures [9].

The overall volume of ESG-related M&A transactions has risen significantly, increasing by 60% between 2011 and 2021. ESG deals as a proportion of all transactions grew from 12% in 2001 to 22% in 2021. While social-related deals, particularly in telecommunications, healthcare, and real estate, have expanded, governance-related deals remain a small portion of the M&A landscape. Although environmental-related M&A deals still represent a modest share of total transactions, there has been a noticeable increase, particularly in industries like energy, utilities, and materials. Green M&A deals often command a significant price premium, with average acquisition prices surpassing the market average by 7% and increases reaching 20% to 30% in some sectors. These premiums reflect heightened competition for green targets and the superior growth potential of sustainability-focused companies [9].

Regionally, the Middle East and Asia-Pacific have emerged as leaders in green M&A activity. In the Middle East, environmental-related deals accounted for more than 10% of all M&A transactions in 2021, up sharply from the previous 3-5% range. This growth is driven by the region's dependence on carbon-intensive industries such as oil and gas, motivating companies to diversify into clean energy. Asia-Pacific, particularly China, has also seen rapid growth in green M&A, led by the energy and utilities sector. Europe has maintained relatively stable green M&A activity at about 5-6% since the financial crisis, potentially due to stronger organic investment capabilities. Meanwhile, in North America, particularly the U.S., green M&A activity saw an uptick in 2020 and 2021, spurred by regulatory changes under the Biden administration. These regional trends underscore the varied pace of green M&A adoption across different markets and highlight ongoing opportunities for companies to leverage M&A in advancing their environmental and sustainability goals [9].

4. Results

From the regression analysis of the relationship between ESG scores (FY0) and market capitalization, based on 1201 observations, it indicates a statistically significant positive correlation. The regression coefficient for the ESG score is 305.43, meaning a one-unit increase in the ESG score is associated with a 305.43-unit rise in market capitalization. The t-statistic of 5.18 and a p-value of 2.57 x 10^-7 confirm the statistical significance, well below the 0.05 threshold. The 95% confidence interval for the ESG score’s coefficient ranges from 189.80 to 421.06, further supporting the positive direction of the relationship. Despite a low R-squared value of 0.022, indicating that ESG scores explain only 2.2% of the variation in market capitalization, the statistically significant coefficient underscores ESG performance as a contributing factor to market value. Firms with higher ESG scores tend to have higher market capitalization, though other factors influence the remaining variation.

Over the past decade, ESG-related M&A transactions have seen a significant global upward trend. According to BCG’s research [9], the volume of ESG deals increased from about 5,700 in 2011 to 9,200 in 2021, reflecting a 60% rise. A particularly sharp increase occurred in 2021, with deal volumes surging by 35% after two slower years for general M&A activity and ESG-related transactions. The share of ESG deals in total M&A transactions also rose from 12% in 2001 to 22% in 2021 [9]. Green M&A deals have become central to this growth, representing 6% of all deals by 2021. The energy and utilities sector experienced the most substantial rise, with green deals increasing from 20% in 2011 to nearly 40% by 2021. This growth is driven by the industry’s transition from carbon-intensive operations to renewable energy sources such as solar, wind, and biofuels.

In contrast, sectors like telecommunications, healthcare, and real estate have shown limited green M&A activity, focusing more on internal sustainability initiatives rather than acquisitions. Despite this, green M&A has become a key strategic tool for addressing ESG pressures, with associated price premiums averaging 7% above market prices. Some sectors report premiums of 20% to 30%, driven by competition for green targets and the perceived superior growth potential of sustainability-focused companies.

Regionally, the Middle East and Asia-Pacific have emerged as leaders in green M&A. By 2021, environmental-related deals in the Middle East accounted for over 10% of all M&A transactions, up from 3-5% in prior years. This rise reflects the region’s reliance on carbon-intensive industries like oil and gas, driving diversification into clean energy. Asia-Pacific, particularly China, also saw rapid growth, led by energy and utilities. Europe maintained steady green M&A activity, with green deals consistently representing 5-6% of total transactions since the financial crisis, due to organic investment capabilities. In North America, green M&A saw an increase in 2020-2021, driven by regulatory changes under the Biden administration. These variations underscore the differing regional pace of green M&A adoption and highlight its growing role in global sustainability efforts.

5. Discussion

Overall, the results strongly support that ESG performance drives M&A growth and enhances firm value. High ESG ratings make companies more appealing to acquirers and align with investor priorities, reflecting the increasing importance of sustainability in decision-making. ESG offers a dual benefit: it fosters long-term stability and operational resilience by mitigating environmental, social, and governance risks [10] and enhances strategic value by unlocking market opportunities, securing favourable financing, and maintaining competitiveness [11].

From an investor’s perspective, ESG is integral to investment strategies, influencing corporate transactions by aligning financial returns with broader societal goals such as environmental preservation, improved governance, and social equity. This demonstrates how financial performance and sustainable practices are becoming interconnected, signalling a shift in market dynamics.

The findings further emphasize ESG’s transformative potential in promoting better governance, ethical management, and long-term value creation [12]. Companies with strong ESG credentials outperform in M&A markets, driving systemic improvements in business operations and fostering a sustainable economy. ESG thus emerges as a critical driver of modern business strategies, reflecting evolving stakeholder expectations.

Due to data constraints, this study focuses on potential M&A targets rather than completed transactions. Lacking access to comprehensive data, I could not perform multi-variable analyses. Future research incorporating broader datasets and additional variables could provide a more nuanced understanding of ESG’s influence on market capitalization and M&A dynamics.

6. Conclusion

Based on the analysis of 1,021 observations with ESG scores and employing a linear regression model, this study concludes that ESG scores are highly correlated with market capitalization. Companies with higher ESG scores tend to have larger market capitalizations and command more favourable pricing in the market. This finding underscores the growing importance of ESG as a key determinant of corporate valuation and market perception.

The findings align with broader trends identified in recent reports, such as those by BCG, which highlight a substantial increase in ESG-related M&A activity between 2011 and 2021. Green M&A deals, particularly prominent in sectors like energy and utilities, have surged, reflecting the strategic importance of sustainability and the industry-wide shift toward cleaner energy solutions. These transactions often come with price premiums, signalling intensified competition for sustainable assets. Regionally, the Middle East and Asia-Pacific have emerged as leaders in green M&A activity, while Europe and North America show steady growth, with the U.S. benefiting from recent regulatory shifts supporting ESG initiatives.

This study reaffirms that ESG scores not only enhance firm value but also drive trends in greener M&A transactions, offering companies a strategic pathway to achieve their sustainability objectives. Sustainability is becoming more and more valued as a way to differentiate a business in the market and as a way to achieve larger social and environmental goals. This is reflected in the growing focus on ESG-focused acquisitions. As ESG continues to shape market dynamics, it is evident that prioritizing these factors is essential for long-term corporate success and competitive advantage.