1.Introduction

China's economy has shifted from a phase of rapid growth to one of high-quality development. Traditional industries still occupy a large share of the economy, with the energy structure primarily relying on coal-fired power generation. Additionally, the industrial structure is heavily skewed toward manufacturing, and energy demand continues to grow rigidly. Achieving the goals of "carbon peak" by 2030 and "carbon neutrality" by 2060 is a challenging task. The impact of the "dual carbon" goals on the financial risks of electric power enterprises mainly includes two aspects: operational risks and policy risks. Operational risks are mainly reflected in the changes in the operational environment of power enterprises due to the promotion of clean energy and the intensification of competition in the power market. These changes may affect supply-demand relationships, price fluctuations, and more, potentially bringing risks to enterprise operations. Policy risks primarily stem from the series of policies that the government may implement to achieve the "dual carbon" targets, such as carbon emission trading systems and energy taxes, which may impact the financial conditions of power enterprises. Therefore, it is of significant practical and theoretical value to study financial risk management in power enterprises under the "dual carbon" background.

2.Literature Review

Under the current "low-carbon" economic context, enterprises have gained a clearer understanding of emission reduction, environmental protection, and other related areas. However, they also face significant financial risks, which have led to an increase in production costs. Among these, the low-carbon economy influences the operational models of enterprises, thus having a significant effect on their financing behavior and increasing financial risks for the enterprises. [1]

In the context of high costs brought by carbon reduction, high-emission enterprises need to focus on how to effectively reduce the financial risks caused by these costs in order to protect their interests. [2]Yani Qu, based on research into financial risks in the low-carbon economy context, proposed that coal enterprises in China, if they fail to develop effective coping strategies, will face increased financial risks. [3] When enterprises obtain credit, they transfer part of the carbon financial risk to commercial banks, which in turn bear the carbon financial risks posed by different enterprises. [4]

By establishing a financial risk analysis model for enterprises and combining the low-carbon economy with financial indicators, references and insights can be provided for modern enterprises to carry out scientific and effective carbon financial management in the low-carbon economy context. For example, a study of 39 representative listed power enterprises established 12 dimensions of financial risk management indices and used factor analysis and clustering methods to predict the overall financial risk of China’s power enterprises. The study also conducted a detailed assessment of the financial risks faced by power enterprises and proposed corresponding improvements and enhancements. [5]Research on the different types of transition risks that enterprises face in the context of carbon neutrality and the possible financial impacts introduces the “carbon business” method to capture and measure China’s carbon reduction financial risks, while offering policy recommendations to improve the application effectiveness of the "carbon business" method. [6] The direct impact of the low-carbon economy on enterprise financial performance needs to be evaluated through scientific methods. By using diversified evaluation methods and different levels of evaluation results, carbon financial risks can be clarified. [7] A carbon financial risk analysis model that combines the low-carbon indicators of enterprises with financial indicators helps clarify the impact of low-carbon activities on financial performance and, in turn, identify the financial risks caused by low-carbon activities. [8]

In summary, while there is a substantial body of qualitative and quantitative research on enterprise financial risk management, studies focusing on the financial risks of power enterprises under the "dual carbon" context remain relatively scarce. Given the operational model differences between power enterprises and other industries, exploring the financial risks of power enterprises under the "dual carbon" framework holds significant research value.

3.Financial Risks Faced by Electric Power Enterprises under the "Dual Carbon" Background

3.1.Limited Financing Channels for Enterprises

The introduction of the "dual carbon" strategy urgently requires Chinese power enterprises to accelerate the transformation and development of their industrial structure by adopting new energy-saving technologies. The "China’s Long-Term Low-Carbon Development Strategy and Transformation Path Research: Comprehensive Report" indicates that in the next 30 years, achieving net-zero emissions will require at least 138 trillion RMB in continuous investment in the energy industry. According to the estimates of the China Investment Bureau, nearly 7 trillion RMB in funding will be required for emerging industries such as new energy and technology.

From the funding requirements, it is evident that achieving the "dual carbon" goals will involve significant investments. Relying solely on national fiscal input may lead to financial tensions in industries related to energy and finance. Regarding capital income, the main sources include electricity fees, loans, and local government support. Although revenues and government subsidies can help alleviate the financing difficulties of power enterprises, it remains challenging to offset losses due to rising raw material prices, as power enterprises are essential industries, and electricity revenue cannot easily cover the losses under such circumstances.

For the growing capital demands, financing has become an important approach. However, since thermal power enterprises are environmentally polluting industries, they face relatively high financing costs when obtaining loans from financial institutions in China, where energy-saving industries are being actively promoted. This increases enterprise costs, reduces debt repayment ability, and leads to financial risks. Furthermore, financing channels for China’s power enterprises still rely primarily on traditional credit, with insufficient participation in capital markets, leading to a narrow range of funding sources.

3.2.Significant Increase in Enterprise Debt-to-Asset Ratio

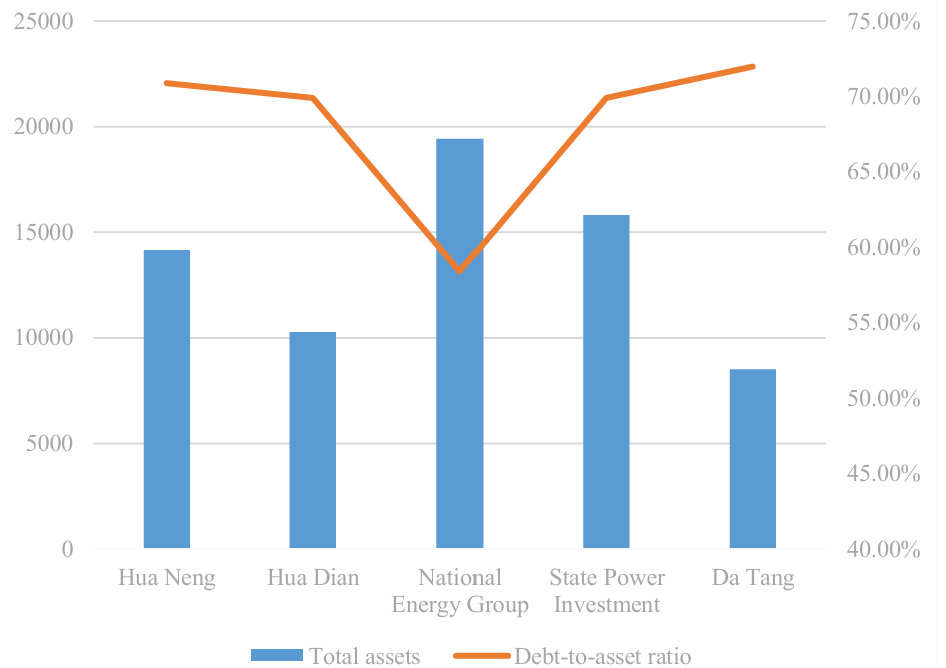

The introduction of the "dual carbon" strategy is of significant importance for the development of the coal power industry and the energy sector. However, as the "dual carbon" strategy progresses, coal-fired power enterprises are forced to increase investment to transform outdated and inefficient power generation methods. For coal enterprises, upgrading and implementing production equipment requires substantial capital, and these enterprises urgently need to find ways to alleviate the funding shortages required for the transformation. At the same time, under the implementation of the "dual carbon" strategy, coal prices have continued to rise in recent years, significantly impacting the generation costs of thermal power enterprises. The combination of these two factors has exacerbated the debt burden on enterprises. As shown in Figure 1 and Table 1, in recent years, the debt-to-asset ratios of major power enterprises have remained at relatively high levels.

Figure 1: Total Assets and Debt Ratios (%) of Huaneng, Huadian, State Energy Group, Guodian Power, and Datang

Table 1: Changes in the Debt-to-Asset Ratios of Huadian and Datang Groups from 2017 to 2022

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|

|

Huadian |

80.8% |

77.83 |

65.6% |

60.37% |

66.4% |

69.89% |

|

Datang Groups |

79.96% |

76.1% |

71.02% |

83.2% |

83.3% |

71.98% |

3.3.Increase in Enterprise Operating Costs

Under the "dual carbon" goals, the operating costs of electric power enterprises have continued to rise, narrowing profit margins, which is reflected in the following two aspects.

First, with the advancement of the "dual carbon" strategy, the cost of raw materials for power enterprises has risen, and profitability has declined. One major factor influencing this change is the sharp rise in coal prices. For example, the average price of long-term contract coal (5500 kcal raw coal) in 2019 was 555.3 RMB per ton, while in 2022 it increased to 722 RMB per ton. As a result, conventional coal-fired power enterprises will face higher material procurement costs, leading to reduced profits.

Second, with the implementation of the "dual carbon" goals, Chinese power enterprises are expected to gradually shift towards green energy and adopt a management approach oriented towards low carbon emissions. However, most of the current power enterprises in China are still operating under an extensive management model, which results in weak value-added capabilities in the market, thereby lowering the overall effectiveness of these enterprises.

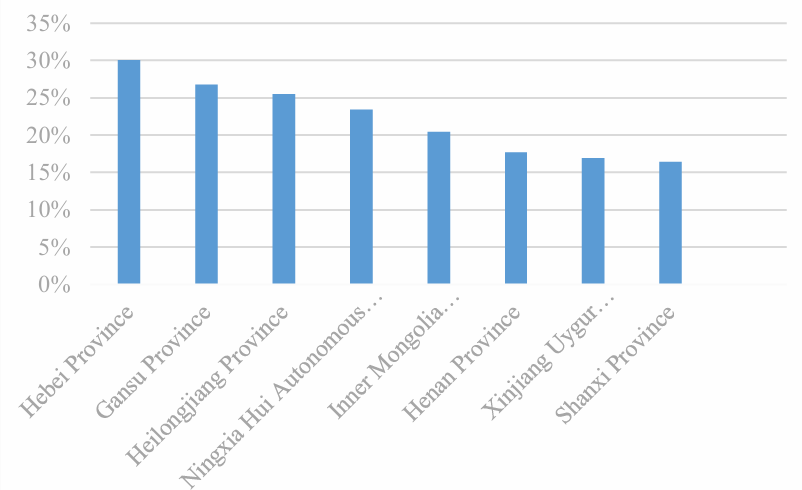

With advancements in science and technology, the development and utilization of new energy sources have become more mature. Currently, the average cost of domestic wind power has gradually reached the level of coal power, and in the near future, the cost of onshore wind power will be lower than coal-fired power generation. However, coal-fired power plants still tend to use conventional coal. This is primarily because, although solar and wind energy are more carbon-friendly, the current technological level and over-reliance on natural conditions prevent renewable energy from providing a stable and sufficient power supply. On one hand, large-scale renewable energy generation in China is currently concentrated in regions with abundant wind or sunlight (as shown in Figure 2, data from the China Electric Power Union), while the two major power markets in Central and Eastern China are far from these renewable energy generation hubs. On the other hand, the technology for long-distance transmission is still immature, and large-scale storage technologies and equipment are not fully developed, making the large-scale development of renewable energy costly.

Figure 2: Share of Wind and Solar Energy in Total Electricity Generation by Province in China (%)

4.Improvement Measures for Financial Risk Management of Electric Power Enterprises under the "Dual Carbon" Background

4.1.Addressing Limited Financing Channels – Constructing Diversified Financing Channels

As a forerunner of the "dual carbon" policy, China has established a diversified capital market regulatory mechanism to address the funding requirements for the "dual carbon" goals. For example, after the launch of the national carbon trading system in 2022, enterprises can participate in carbon trading by buying or selling carbon emission allowances to obtain funds or reduce costs, thereby opening up a new financing avenue for the development of power enterprises. Furthermore, to meet the growing demand for electricity in national economic and social development, China’s power industry primarily relies on the addition of new, traditional thermal power units to meet the continuously increasing electricity demand. According to data from the National Energy Administration, the scale of new coal-fired power projects in China between 2020 and 2022 was 38 million kW, 28.03 million kW, and 90.716 million kW, respectively. Therefore, under the "dual carbon" framework, it is crucial to effectively use capital market tools to reduce the financial risks of enterprises.

Firstly, it is necessary to actively promote the securitization of green assets to make effective use of resources that are constrained by electric power enterprises. For a long time, power enterprises have commonly relied on financing channels like mortgages to obtain financial support, but these financing methods often come with relatively high constraints. Therefore, it is essential to actively utilize methods such as green asset securitization to activate these restricted assets. For example, limited receivables can be traded in a trust-based manner through asset-backed securities provided by trust companies, or by issuing ABNs (Asset-Backed Notes) or ABCPs (Asset-Backed Commercial Papers) in the interbank market. After the issuance, the funds obtained can be transferred as the asset package's consideration and used as a financing tool to provide cash flow to the power enterprises, thereby meeting their financing needs in the interbank market.[9]

Secondly, new environmental energy asset securitization products should be developed. For example, for new energy projects with strong cash flows, the assets can be transferred in their entirety to Real Estate Investment Trusts (REITs), and the newly raised capital can be continuously invested in the construction of new energy projects. This would increase the turnover and recovery efficiency of capital without increasing debt. In the future, clean energy will become a primary underlying asset for real estate investment trusts, and the issuance of renewable energy real estate investment trusts will present good opportunities. [10]

4.2.Addressing the Significant Increase in Debt-to-Asset Ratio – Optimizing the Efficiency of Asset Operations

Considering the relatively high debt ratio of electric power enterprises, it is crucial for these enterprises to fully utilize favorable policies and continuously improve the operational efficiency of their carbon assets in order to reduce their debt-to-asset ratios.

Firstly, it is important to make full use of relevant policies to reduce the capital pressure on enterprises. With the implementation of the "dual carbon" strategy, Chinese power enterprises must achieve energy-saving and green development. Therefore, these enterprises should proactively embrace the significance of the "dual carbon" strategy and actively utilize existing tax policies to reduce taxes and alleviate capital pressure. For example, to reduce taxes, power enterprises must actively respond to the "dual carbon" initiative by increasing investments in new energy projects, thereby enhancing their market competitiveness.

Secondly, efforts should be made to accelerate structural adjustments and optimization to improve the enterprises' capital management capabilities. With the advancement of the "dual carbon" strategy, the government has provided strong support for outdated capacities in power enterprises, but this has also led to significant idle capacity in some of the enterprises' equipment. Therefore, it is essential to actively engage in "balance sheet reduction," transforming idle assets into cash flow to pay off debts and reduce the debt-to-asset ratio.

Finally, it is necessary to improve the operational efficiency of carbon assets in power enterprises. Capital management is an important way to achieve high-quality development. Under the "dual carbon" strategy, enterprises should strengthen the management of capital operations, ensuring that cash inflows and outflows are properly allocated, while also enhancing the management of carbon assets. Timely collection of matured funds will improve their utilization efficiency. On this basis, a financial philosophy based on "dual carbon" principles should be established, strengthening inventory management and optimizing resources using their inherent advantages to reduce financial costs.

4.3.Addressing the Increase in Operating Costs – Enhancing the Enterprise's Cost Management Level

Firstly, it is important to increase research and development in low-carbon technologies and strengthen cost control within enterprises. Under the "dual carbon" strategy, China's traditional extensive business model can no longer meet the needs of high-quality development. There is an urgent need to ramp up research and development efforts, focusing on the construction of new energy projects to effectively improve energy utilization efficiency and control costs. Specifically, power enterprises should gradually achieve low-carbon, zero-carbon, and negative-carbon emissions, with a focus on technological breakthroughs in three key areas: energy-saving retrofit technologies, biomass and other non-coal fuel blending technologies, and carbon capture, utilization, and storage (CCUS) technologies for coal-fired power units.

Secondly, reducing environmental costs and carbon tax risks is essential. Power enterprises are part of highly polluting industries, and the realization of the "dual carbon" strategy imposes higher environmental protection requirements on them. The primary task is to fulfill environmental protection obligations, which is a key component of China's environmental protection accounting. To avoid fines caused by excessive carbon emissions, power enterprises should strengthen financial management and fully utilize existing tax incentives to reduce their tax burdens.

Thirdly, it is necessary to establish a financial risk early-warning system. In recent years, the cost expenses of power enterprises have continued to rise, and therefore, it is crucial to establish a sound cost supervision system to monitor expenditure comprehensively.

Lastly, actively utilizing big data technology can facilitate the precise calculation of carbon footprints, thereby empowering production and operational decisions, effectively managing costs, and increasing profits. For example, in response to the difficulty in accurately calculating carbon emissions from power consumption, a region in China, in cooperation with Tsinghua University's School of Electrical Engineering, launched the country's first comprehensive power carbon emissions evaluation platform online on April 21, 2022. Through this platform, consumers can adjust their energy consumption, promoting low-carbon emissions reductions and assisting the government in formulating emission reduction measures.

5.Conclusion

Electricity is the foundation of modern society and an essential energy source for various industries, including manufacturing, agriculture, and services. By constructing and operating power generation facilities, power enterprises ensure a stable supply of electricity, which in turn supports the rapid development of China's economy. Through this research, it has been found that with the in-depth implementation of the "dual carbon" strategy, China's power enterprises face challenges such as limited financing channels, rising debt-to-asset ratios, and increased operating costs. These challenges require improvements by constructing diversified financing channels, optimizing asset operation efficiency, and enhancing cost management levels to achieve high-quality development for China's power enterprises.