1. Introduction

Since the Industrial Revolution, a sharp increase in carbon emissions especially greenhouse gas emission (GHG) along with global economic growth has been observed. The persistent emission of carbon at high intensities not only poses threat to climate change but also has a detrimental effect on economic development. Consequently, countries worldwide are facing critical challenges: reducing carbon emissions, mitigating the pace of global warming, and fostering sustainable economic growth. In September 2015, the United Nations Sustainable Development Summit adopted a resolution entitled the 2030 Agenda for Sustainable Development in which outlined 17 Sustainable Development Goals (SDGs) designed to promote global cooperation in three key aspects: sustainable economic prosperity, social justice and harmony, and global environmental security.

Singapore, ranking high on the Human Development Index, was considered an outstanding model for complying the SDG of achieving sustainable and prosperous future for its residents. As a densely populated city-state located at Southeast Asia with above 5.9 million residents, adjacent to the Strait of Malacca, it has a land area of only 734 km2. This small island city has very scarce resources, Singapore has had to carefully balance economic, social, and environmental priorities to ensure consistent sustainable development for the nation. While Singapore has been recognized as a model for achieving SDGs, there remains a need for further research and analysis on the economic and socio-cultural impacts of specific policies and regulations implemented by the country, particularly in the context of SDGs 1 (No Poverty), 8 (Decent Work and Economic Growth), 10 (Reduced Inequalities) and 13 (Climate Action). Specifically, the research gap lies in assessing the effectiveness and limitations of Singapore's public housing system and carbon pricing mechanism in promoting sustainable economic growth, social equity, reducing inequalities, and climate change mitigation. By examining them, the study aims to provide insights and recommendations for optimizing their efficiency and maximizing their contributions toward achieving the relevant SDGs. To achieve these research goals, secondary research method with information gathered from institutional reports and scholarly literature was used, literature analysis and comparative analysis method was employed. The research closely exam the relevant text, supported by textual evidence and scholarly sources, also doing systematic comparison. The paper planned to accessed the public housing policy from both economic and sociocultural point of view through comparing the property price before and after the issuing of policy regulation, inspection of aggregate and sector GDP growth, employment rate and communities welfare, as well as assessed the carbon tax policy from economic, social, and environmental perspectives by examining the potential impact on energy costs for households and businesses, analyzing the revenue generated and its allocation, evaluating the effectiveness in reducing carbon emissions, and comparing Singapore's approach with other countries' carbon pricing mechanisms and complementary measures. The conclusions of this study will contribute to a better understanding of the current situation of both carbon market and housing market in Singapore, enabling the development of targeted strategies for promoting both industries.

2. Public Housing Policy Guarantees Social Welfare

The achievement of Singapore domestic housing was phenomenal, believed that a strong driver of it was its socialist housing system policy. The three primary policy pillars that works are Housing and Development Board (HDB), established in 1960 which was responsible for the clearing of slums, the development of rural or agricultural areas for resettlement, and the construction of housing and other real estate. HDB formulates plans and manages the allocation of houses. The Land Acquisition Act soon after enabled government to compulsorily acquire private land for public purpose at prices below market equilibrium. For financial support, the Central Provident Fund (CPF) approved scheme that allows residents to use their mandatory retirement savings to purchase flats from HDB and provides housing grants to targeted buyers. Singapore's public housing policy are heavily corresponded to the SDGs since it works on various aspects to comply with it. Making connection with respectively the 1, 8, 10 and 15 SDG, including end poverty, increase employment, reduce inequality, and promote inclusive societies. In order to access the impact of public housing policy from SDG's perspective economically and socially, the research looked into specific investigation on its house price, GDP growth, employment rate, extent of welfare created and level of social integration. From the economic point of view, firstly, the public housing policy has impacted Singapore widely as a macro-stabilizer to stabilize the real estate market and the overall performance of the economy such as employment rate; Secondly, it has boosted the construction sector and GDP growth. From the social point of view, it has made housing more generally affordable for households that helps to address wealth and racial inequality to reduce disparities.

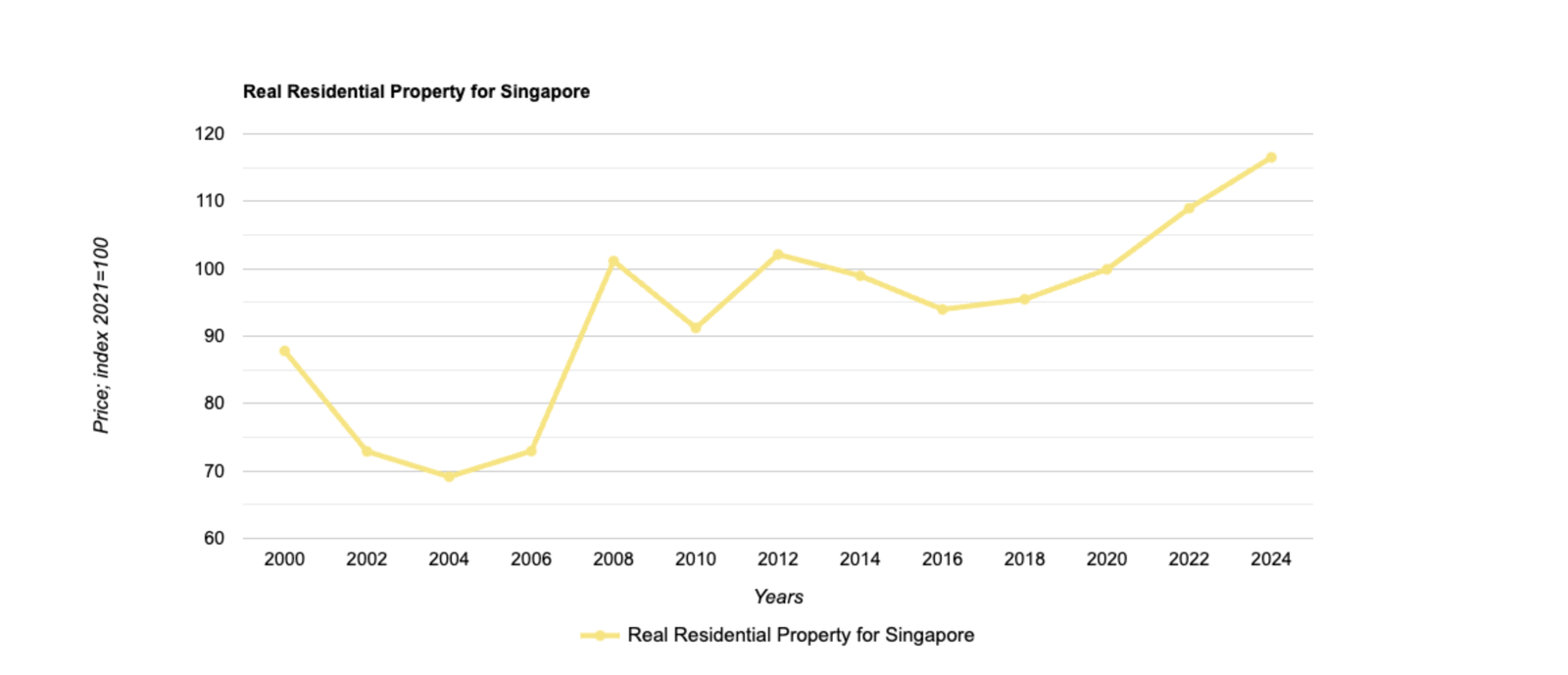

The public housing policy affect Singapore positively by stabilized its housing market. Within tight control, Singapore government can monitor and manage the market fluctuation. In the state-dominated housing market, public houses built by HDB are only sold on a 99-years leasehold to applicants who meet requirements such as income level and citizenship with the estate’s land and common area owned by the government [1]. For instance, in the late 2000s, the increase in public housing price outpaced the increase in income, triggered concern of housing affordability. In this case, policymakers managed the price level by calibrating the restriction that determine the eligibility, also adjusting taxation such as differentiated stamp duties for foreign buyers. There have been two round of demand restrictions introduced in 2010 and 2013 prohibiting the simultaneous ownership of private housing and public housing flats. As a result, a reduction of 2.4% and 1.8% in housing price occurred respectively after the two-round restriction [2]. As observed in figure 1 below, property price fluctuated considerably from 2000 and along the next ten years, the price was very unstable. Especially during the period of time of 2006-2008, house price increased dramatically for more than 25 units. However, after government had issued the related restrictive policy start in 2010, house price remained at a relatively stable level. A relatively consistent trend was preserved till now, which the residential property price experienced modest growth every year. Therefore, I suggested that directly, or indirectly, the regulations impact the housing demand, in which the public housing policy stabilized Singapore 's housing market.

Figure 1: Real residential property price for Singapore from 2000 to 2024 [3].

Influenced by the policy, construction sector became the leading shares in GDP composition for Singapore. The construction sector growth rate was around 6% (2022), higher than the real GDP growth (3.8%) in Singapore [4], the construction sector also accounts for nearly 3.5% of the country’s GDP [5]. Therefore, it can be suggested that the housing policy has contributed to rising economic growth and performance.

In addition, the housing policy have been deployed as a pumping-up device used when experienced economic downturn. When Singapore faced recession during 1975-76 and 1982-83, government have utilized public housing policy to increase job opportunity and household income, and endeavor to recover the economy by HDB's construction projects. Employment opportunities has grown fast despite the massive inflow of economic immigrants from 1976, the unemployment rate declined steadily to an all-time low of around 3.3% in 1979 [6]. A total of 189,000 flats was built during the Fifth-five-year building program in which the initial plan set was to build 85,000 ~ 10,000 flats [7]. Even though, it was argued that the aggressive acceleration of housing construction has been excessive to potentially contribute to the later “overheating” and property slump. But along with the Keynesian view, it shows that public housing policy indeed can be a tool for adjusting macroeconomic performance and has been deployed as a fiscal policy tool.

Furthermore, it was believed that the effect of policy has the potential of income redistribution and reducing inequality weather is from the economic or social perspective. It corresponded to the 10th SDG which addressing inequality that threaten long-term social and economic development, harm people 's sense of fulfillment. First of all, the provision of housing for low-income group and tax cut allows affordable housing option that enables residents to release stress in housing, allowing more disposable income spent in improving living standard, make them better off while stimulating consumption and aggregate demand. Also, CPF include some obvious re-distributive and progressive features that benefit less well-off members. Accompany with other scheme such as Workforce Income Supplement Scheme (WIS), the actions benefiting about 439000 Singaporean by providing transfer payment and help people to build retirement saving. Since 2016, an addition 1% of interest is paid on the first 30000$ of CPF balance member for age 55 and above, these measure help boost members’ retirement payout, especially those with lower balance.

More than providing the chance for secure housing, public housing policy implemented compulsory limitation on racial concentration. Singapore was a multiracial state, compromising citizens form different racial and religious, racial enclaves that build and perpetuated often contribute to racial conflict, especially when the race coincides with economic and social hierarchy. In HDB’s blocks and neighborhoods, Chinese, Malays, Indians/others household limits were set at 84%, 22% and 10% respectively [8]. The regulation indicates that if the quota for a specific ethnic group has been reached, they will not be able to purchase a new unit from the HDB. In the resale market, sellers of HDB flats in each block or neighborhood are restricted to selling to households belonging to the same ethnic group after the block's designated ethnic group restrictions are met. Due to the restriction, the three major ethnic group must live within the same community at the same time. The mingling means people from various racial and economic backgrounds have relatively comparable upbringings in terms of housing quality, services supplied, and even the caliber of their basic education. So the policies are working to mitigating inequality, ensuring social mobility, and enhancing social integration, corresponding to the 10th SDG.

The 11th SDG, that promote peaceful and inclusive societies are aimed to eliminate any violence and insecurity. Misunderstanding and disparities in society generally trigged hate and lead to conflict. From a sociological and psychological point of view, ethnically separated communities usually generate and reinforce more stereotype [9]. Accordingly, by bring diverse people together in integrated environment through HDB's housing quota could initiate a change to a more tolerant attitudes toward member of "outside-group". Which the frequent contact of out-group member who might be contradict to the stereotype, biased image will be reduced, group barrier became less visible through acculturation. In Singapore, for its sack of stability, safety and sustained survival, it is urgent that intergroup harmony to be promoted. The outcome of intergroup interaction will have profound consequence for future development. So, in general, the HDB's housing policy are also complying the 15th SDG.

3. Carbon Tax Policy as a Key Instrument

SDG 13, one of the 17 global goals established by the UN, aims to take urgent action to combat climate change with its impacts. It recognizes the importance of addressing climate change as a critical step towards achieving sustainable development. To combat global warming and contribute to the achievement of SDG 13, more than 130 nations worldwide have set targets in 2021 to achieve carbon neutrality by the middle of the 21st century. In particular, the European Union (EU) had reached its carbon peak by 1990 and has set a goal of achieving overall carbon neutrality by 2050. Singapore also recognizes the importance of addressing climate change and has implemented carbon tax as a key instrument in its efforts to reduce GHG.

In 2019, Singapore's carbon emissions amounted to 51.6 million tons, accounting for 0.11% of global carbon emissions [10]. As a world-class refining center, ship repair center, and semi-conductor industry hub, industry has been the primary source of carbon emissions in the country, making domestic per capita emissions relatively high at around 9 tons of CO2 per person. In response, the government has made commitments under the Paris Agreement to reduce emission intensity by 36% from 2005 levels by 2030 and to stabilize its GHG emissions, with the goal of reaching carbon peak in the same year [11]. The implementation of the carbon tax is a fundamental and essential step towards achieving these commitments and demonstrating Singapore's dedication to SDG 13. To be specific, Singapore passed the Carbon Pricing (Amendment) Act in 2022, which adopts a phased approach characterized by low carbon tax rates and broad coverage. This approach could ensure business certainty and confidence since it gives more time for adaption. According to the Act, Singapore has set the carbon tax for 2024 and 2025 at S$25 per ton of carbon dioxide emitted, compared to the tax level of S$5 per ton since 2019, which will be raised to S$50-80 in 2030.

To better consider the effect on different stakeholders, 3 main parties, consumers, suppliers, and governments, are analyzed. From consumers' perspectives, currently, 40% of Singapore's carbon emissions come from the electricity sector, with 95% of the electricity supply coming from gas-fired power plants. Electricity suppliers will naturally pass on some of the tax burden to consumers, but not all of it. According to the National Climate Change Secretariat, every increase of $5 in carbon tax would cause electricity prices to rise by 1%, meaning that electricity bills could go up by about 4% in 2024, directly influencing the daily lives of households [12]. Furthermore, the implementation may have implications for employment in certain sectors. Industries that are heavily reliant on fossil fuels, such as manufacturing and transportation, may face higher costs and potentially reduced competitiveness. This could lead to job losses or slower job growth in these sectors. However, the carbon tax may also create opportunities for employment in green industries, such as renewable energy. While the implementation of a carbon tax can help alleviate the negative consumption and production externalities associated with climate change, the long-term benefits may not be immediately apparent. In contrast, the short-term impact on consumers may be more readily observable.

The carbon tax in Singapore will have far-reaching consequences for enterprises and suppliers, particularly those in energy-intensive industries. As these industries grapple with higher expenses, they may seek to mitigate the impact by negotiating lower prices from their suppliers or reducing their demand for raw materials, energy, and other inputs. Consequently, suppliers will face the difficult choice of either absorbing the increased costs, thereby reducing their profit margins, or passing on the costs to their clients, which could lead to a loss of business to competitors. Moreover, the taxation may have indirect influence on suppliers by influencing the investment decisions of energy-intensive industries. Faced with higher costs and the need to invest in cleaner technologies to reduce their carbon footprint, these industries may delay or cancel expansion plans. This, in turn, could lead to reduced demand for supplies and services, creating a ripple effect that extends beyond direct suppliers to secondary and tertiary suppliers throughout the supply chain. The impact of the carbon tax on suppliers is likely to be most severe for smaller enterprises with limited financial resources and bargaining power. These suppliers may find it particularly challenging to absorb the increased costs or pass them on to their clients, as they often lack the economies of scale and negotiating leverage of larger suppliers. Consequently, they may experience reduced profitability and even potential business closures, further exacerbating the economic impact of the carbon tax on the broader supply chain.

In the perspective of the government, the act of solely carbon tax without a cap-and-trade system could generate numerous issues. In Singapore’s carbon tax system, companies are ought to pay a fixed price for each unit of carbon emitted, meaning that as long as they are willing and able to pay, the emission could continue without upper limit. A particular limit for carbon emission cannot be guaranteed under such system and the target set may not be approached with the negative externality to remain. Undoubtedly, the carbon tax serves as a source of revenue that can be used to support sustainable development projects and assist industries in transitioning to a low-carbon economy. The carbon tax is projected to generate revenue of around S$1 billion in the first five years. This revenue can be used to fund research and development in clean energy technologies, provide subsidies for energy-efficient investments, and support lower-income households through utility rebates. However, unlike some other jurisdictions, Singapore does not currently have a carbon tax rebate system in place, which could help to mitigate the financial impact of the tax on businesses and households while still incentivizing emission reductions. The absence of such a rebate system may limit the overall effectiveness of the carbon tax in achieving Singapore's climate goals, as it places a greater burden on consumers and businesses without providing a direct mechanism for reinvesting the revenue into sustainable initiatives.

4. Discussion

As mentioned above, the public housing policy correspond with the 1, 8, 10 and 13 SDG benefit Singapore from varies of aspect, neither economic nor sociocultural. We believe it should be utilized by the government to position itself as a global city with stable and considerable growth, also promoting a justice and inclusive environment. On a very large extent, the public housing policy are aligned with the SDG to address the global problem and endeavor to achieve a better and more sustainable future for all.

Although Singapore has designed an extraordinary public housing system that serves as a model for socialist national housing, the system is not without limitation and risks. Firstly, public housing could bring extra fiscal burden in which Singapore incurred a fiscal deficit of 2.59 billion in 2023 [13]. The deficit works out more than 0.5% of Singapore’s GDP of that year. Secondly, one-fifth of Singapore population are non-citizens who are excluded from the public housing system because Singapore is a very attractive migration destination for its overall strong and stable performance. Among them, over 30,000 economic migrants without access to HBD flats are living under poor condition. Also, difficulty confronted by public housing sector with forth-fifth of population lived in is the need to cater for diversity since there must be consideration of the diverse need from household of different size, financial means, and social need. On top of that, the public housing system are encountering obstacles such as fast growing immigrate number, aging population, and a future when land resources are increasingly scarce. Consequently, it is believed that Singapore’s public housing system is likely to be a domain of significant and continued innovation in the future.

Believed that Singapore government can alter some approaches to address the challenges facing in its public housing system and ensure consistent and continuous success. Our suggestions include diversifying funding sources, explore alternative funding mechanisms such as public-private partnerships (PPPs), housing bonds, it will somehow release the extra fiscal stress from government. Subsidized housing schemes and affordable rental housing target for non-citizens should be issued widely, which will make Singapore more attractive for foreign investment and quality immigration. Next, public house was in urgent to catering for diverse needs. Urban planners and architects will have to make effort on introducing innovative flexible housing and urban design or elder friendly infrastructure that can be easily adapted to accommodate different household size, financial means, etc. Moreover, within Singapore extremely limited land resources, leaders need to closely emphasize on optimizing land use and maximize land use with efficiency, it could be achieved by method like vertical expansion. Suggested that these are some crucial steps towards creating an inclusive, efficient, and resilient public housing system for the future.

The implementation of a carbon tax in Singapore has both advantages and disadvantages. On one hand, it serves as a powerful tool to incentive businesses and individuals to reduce their carbon emissions, contributing to the country's efforts to combat climate change and achieve its sustainability goals. On the other hand, the direct tax can have negative impacts on the economy, particularly on energy-intensive industries and low-income households.

To address these drawbacks, some countries have used complementary measures such as carbon tax rebates and cap-and-trade systems. For instance, Sweden, which introduced a carbon tax in 1991, has been using a portion of the revenue generated by the tax to lower other taxes, such as labor and corporate taxes, while also providing targeted support for low-income households and energy-intensive industries. Additionally, Sweden participates in the European Union Emissions Trading System (EU ETS), a cap-and-trade system for GHG emissions, which has contributed to a 33% reduction in emissions from Swedish installations covered by the system between 2005 and 2020 [14]. While Singapore and Sweden share some similarities, such as being highly developed nations with strong economies and high GDP per capita, Singapore has not yet implemented a carbon tax rebate system or a cap-and-trade system. To maximize the efficiency of the carbon market in Singapore, it is necessary to utilize appropriate and targeted strategies, learning from successful examples like Sweden.

One potential strategy for Singapore is to use the revenue generated from the carbon tax to reduce the burden of other distorting taxes, such as consumption tax, production tax, value-added tax, or corporate income tax. This approach can not only minimize the negative effect on social welfare but also maintain the environmental benefits of the carbon tax. Additionally, the implementation of a tax rebate system would be very beneficial. Research from Fremstad et al. has shown that tax rebates play a crucial role in establishing public support for carbon taxes. When respondents are provided with accurate information about the impacts of carbon pricing and rebate policies, rebates have a positive influence on public support. In the United States and Switzerland, incorporating rebates significantly increases support for carbon taxes, even at high tax rates that would substantially reduce emissions [15]. Nonetheless, Timilsina et al. cautioned that carbon tax rebate measures can diminish the carbon emission reduction effect of the tax [16]. Therefore, Singapore should carefully consider and selectively choose carbon tax rebate principles based on the country's specific needs and priorities.

In addition to carbon tax rebates, Singapore could benefit from initiating a permit trading system similar to the EU ETS and entering the global carbon market. By combining a carbon tax with a cap-and-trade system, Singapore can promote fair regional collaboration and ensure cost-effective emission abatement. Firms that emit less than their allocated quota can sell the excess quota at market prices, while those struggling to stay within their limits can invest in R&D to boost productivity or purchase additional quotas from the market. This flexibility ensures that emissions are reduced in the most effective way.

5. Conclusion

To conclude, along with the country’s history, Singapore’s success has been obvious for all. The public housing policy plays a key factor in it, which influences Singapore in mainly two aspects: economic and social-cultural that evolved overtime contributing to high housing ownership, social stability, and economic growth. Overall Singapore's public housing policy endeavor to achieve the 1st, 8th, 10th SDG, it led to significant improvement on living condition, addressing poverty, ensuring economic growth, and reducing inequality. While public housing policy are still likely to be a domain for continuous development, it would face some challenges in the future. The authors recommended policymakers to adjust some of the approaches to better encountering the uncertainties in the future. The carbon tax policy in Singapore will significantly increase costs for energy-intensive industries, potentially reducing profitability, delaying expansion plans, and leading to business closures for smaller enterprises with limited resources. Additionally, the absence of a cap-and-trade or rebate system may hinder the carbon tax's ability to effectively meet the country's climate goals by not providing a firm emissions cap or direct mechanism for reinvesting revenue while incentivizing reductions. This paper reviews past literatures to infer the potential effects of Singapore's rising carbon tax on its economy. While implementing a carbon tax can effectively achieve energy conservation and emission reduction goals, it may also impose significant economic costs on enterprises and the country as a whole in the short term. Nevertheless, in the long run, the carbon tax is expected to be beneficial to Singapore's overall performance.

In order to reach greatest economic efficiency, several suggestions are given as follow. On the one hand, the authors recommend utilizing carbon tax rebate, similar to that of Sweden, to offset the costs on different parties, and provide targeted support for vulnerable industries. Additionally, initiating a cap-and-trade system and entering the global market. By adopting these measures and learning from successful examples, Singapore can ensure a sustainable and prosperous future. On the other hand, the paper also suggests the impact of public housing policy on economic and social cultural aspects. Which through government intervention, Singapore successfully attains a robust economic growth, stable and affordable housing market, and harmony community relationships. Although the policy might face several limitations in the future, by modification of several sustainable attempts, the public housing system is anticipated to be valuable for Singapore.

The significance of this research lies in its potential to inform future policy makers and to serve as a case study for other nations facing similar challenges. Singapore's experience with public housing and carbon tax can provide valuable lessons for countries seeking to balance economic growth, social equity, and environmental sustainability in the face of rapid urbanization and climate change. By highlighting the successes and limitations of these policies, this study can help guide the development of more effective and inclusive strategies for achieving the SDGs on a global scale.

While this research provides insights into the impacts of Singapore's public housing and carbon pricing policies regarding the UN's SDGs, there are limitations. The study relies solely on secondary data from institutional reports and scholarly literature, which may not fully capture the complexities of these policies' real-world implementation and effects. Future research could benefit from incorporating primary data sources, such as surveys or interviews with stakeholders directly involved in or affected by these policies. Looking ahead, as the globe collectively strives to achieve the SDGs, Singapore's experience can act as a model for other nations grappling with similar issues of sustainable urbanization, equitable economic growth, and climate change mitigation.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.