1. Introduction

1.1. Problems facing agriculture

In the realm of agriculture, various factors can pose challenges to the achievement of a prosperous venture. Crop productivity might decrease because of pest infestations, weed growth, extreme temperatures, dry spells, or inundations. Livestock can be vulnerable to diseases, adverse weather conditions, and other external stressors. Moreover, there can be notable price fluctuations, both for agricultural products and the resources essential for production. Farmers’ capacity to effectively handle these risks and lower their expenses below the income they generate enables them to realize profits from their endeavors. A significant portion of the risks faced by farmers and ranchers can be classified into six categories, as described below.

Factors such as weather changes, natural disasters, and disease outbreaks can lead to significant fluctuations in agricultural yields, which negatively affect food supply and food security. Changes in temperature occurring abruptly during distinct periods within the growth season, along with occurrences of hail and strong winds, illustrate weather incidents capable of influencing the progress of crops, their yields, and, ultimately, the income of farms [1].

Price volatility in agricultural markets has a huge impact on farmers' incomes and livelihoods. Weather, climate change, political factors, and fluctuations in market demand, among others, can lead to drastic price fluctuations, making it difficult for farmers to predict and plan output and marketing.

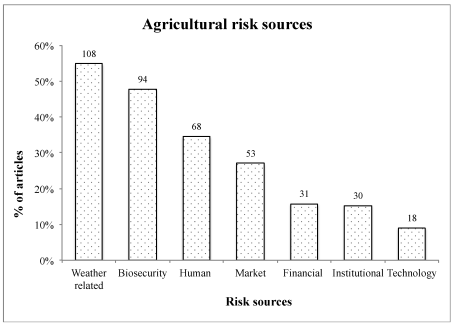

Agricultural markets are often characterized by information asymmetries, leading to a lack of accurate information on market demand and price trends, which makes it difficult for farmers to make informed decisions. Trade barriers, tariffs, and policy changes can affect exports and imports of agricultural products, limiting the openness and development of agricultural markets [2]. Broadly speaking, over half (55%) of the studies indicated that farmers predominantly considered weather and climate change as the primary risk to their agricultural operations. This was succeeded by concerns about biosecurity threats (48%), human-related risks (35%), and market-related uncertainties (27%), with technology being the least frequently cited concern (see Figure 1) [3].

Figure 1: The distribution of agricultural risk sources as identified in the review (n = 174). The numbers above the bars are the number of articles studying risks.

Agricultural risks should, therefore, not only be viewed from the perspective of farmers but also as an early warning to the national economy. To address the problems posed by the agricultural sector, risk management in the sector is essential. Risk management is the practice of risk reduction. Risks are prevalent in all stages of agricultural decision-making despite production and price uncertainties. Therefore, risks must be assessed carefully, and appropriate approaches adopted. Otherwise, farmers’ profits may be reduced due to poor risk management decisions. Therefore, adopting appropriate risk management strategies is essential for farmers to minimize adverse impacts [4].

1.2. Strategies to reduce the risk of agricultural products

An option is a financial contract that gives the buyer (holder) the right but not the obligation to buy or sell an asset at an agreed-upon price (the strike price) at some point in the future or within a specific time period. A future is a standardized contract that specifies the price and quantity of an asset to be purchased or sold on a specific future date. Unlike an option, a futures contract carries an obligation that both the buyer and seller must take delivery of the contract at its expiration at an agreed-upon price. The futures market provides an effective risk management tool for speculators and physical producers. Speculators can buy or sell futures contracts to earn the difference in price fluctuations, whereas actual producers can lock in future sales prices and avoid market risks.

2. The analysis of Hedging Strategies for Agricultural Products

Options and futures contracts form part of the overall risk management strategy employed by farms They have different advantages in the area of agricultural products, depending on the specific situation and the farmer's needs. What follows is a brief comparison of the advantages of options and futures in agricultural commodities. Options are characterized by giving the holder rights but not obligations, meaning farmers can choose to exercise the contract. This flexibility makes options suitable for farmers who are open to price fluctuations. In addition, purchasing options can help farmers hedge against price volatility and market uncertainty, especially if there is uncertainty about price trends. Options are not only suitable for price protection but can also be used to manage yield risk. For example, call options can lock in a minimum price, whereas put options can be used to hedge against the risk of declining yields. In contrast, futures contracts are characterized by mandatory delivery, meaning delivery must occur at the contract's expiration. This ensures that the farmer trades at the price specified in the contract. At the same time, the futures market provides real-time market information and price discovery mechanisms, enabling farmers to better understand market dynamics and make informed decisions. Most importantly, futures are not only suitable for risk management but also for speculation and hedging. Speculators can profit from price fluctuations through futures trading, while farmers can use futures to lock in future sales prices.

Taken together, the choice between options and futures depends on the specific situation faced by the farmer, his risk tolerance, and his objectives. Options offer advantages in terms of flexibility and risk management for farmers who want to retain more options. Futures, on the other hand, excel in terms of mandatory delivery, market transparency, and versatility and are suitable for a wider range of risk management and speculative needs. The best choice should be determined by the farmer’s objectives and risk management strategy. Considering the minimization of risk, introducing futures markets as a risk management and price forecasting tool is an effective way for farmers and agricultural practitioners to cope with uncertainty and volatility. Through the operation of futures markets, the agro-industry can better adapt to changes in the external environment and provide a stable global supply of agricultural products [5].

3. Role of futures in agricultural markets

Futures markets serve two important roles that can benefit farmers: managing risk and finding out prices. Firstly, futures serve as tools to manage risk. Farmers can use futures contracts to secure a specific price for the crops they harvest, either for their entire production or a portion of it. This process is often called "hedging." By doing this, farmers shield themselves from the possibility of their selling prices dropping in the future. Instead of worrying about price fluctuations, they transfer this risk to speculators, individuals, or entities willing to take on it in hopes of making a profit. In essence, farmers are safeguarding themselves against unpredictable price changes by using futures contracts. Secondly, futures also play a crucial role in determining prices. These markets reflect the expectations of both buyers and sellers regarding future prices. This information allows farmers to make educated guesses about the future market prices for their agricultural goods. In markets where prices are constantly shifting, like those for agricultural products, having an estimate of the selling price early in the production process is incredibly valuable for farmers. This dual function of managing risk and helping to predict future prices gives farmers the ability to set their prices in advance, lessen their exposure to risks, and make better decisions about their production and investments [6].

The futures market has price discovery and risk hedging functions. First, futures are risk management tools. Futures contracts allow farmers to "lock in" a certain harvest price for their agricultural production, thereby eliminating the possibility of future declines in sales prices. This method is often referred to as "hedging." As a result, farmers no longer have to deal with the price volatility of these commodities, as the risk of price changes is transferred from farmers to speculators, who are willing to accept this risk in the hope of making a profit.

Second, futures are also valuable as a price discovery tool. Price discovery means that the futures market can report the price of a commodity for a certain period in the future because the futures market gathers many producers, operators, and speculators from all walks of life. These trading bodies make forecasts of prices by collecting information, which is brought together in the futures market to form the futures price. Unlike spot prices, futures prices are predictable, authoritative, and public, reflecting future supply and demand and price changes. This provides an important reference for pricing agricultural prices or income insurance. Therefore, it is most appropriate for farmers to be able to estimate the future spot prices of agricultural products or to use futures prices as the guaranteed price. Estimating selling prices at the beginning of the production process is particularly useful for farmers in unstable agricultural markets. These hedging and price discovery functions enable farmers to determine future prices, reduce risk, and better plan their production and investment decisions.

Market efficiency is a distinct characteristic demonstrating the impact of futures markets on the agricultural sector. The capacity to anticipate forthcoming prices by analyzing trends within future markets contributes to enhancing resource distribution, minimizing inefficiencies, and guaranteeing well-timed production. Additionally, the presence of futures markets cultivates an environment of heightened competition as participants endeavor to precisely predict shifts within the market. This competitive atmosphere acts as a catalyst for the introduction of novel approaches and streamlined processes across the entire agricultural supply network.

4. Future use

In 2016, a substantial number of farms, exceeding 47,000, opted to employ futures or options to mitigate price-related risks. The use of futures and options among larger farms is particularly noteworthy, as illustrated by the data provided. Within the category of medium-sized farms, those with annual sales ranging from $350,000 to $999,999, nearly 12 % adopted these financial tools (see Table 1). Furthermore, a significant 17 % of large-scale farms, defined by annual sales surpassing the $1 million mark, also engaged in the use of futures and options. Delving into specific crop producers, it becomes evident that many medium-sized and large farms involved in corn and soybean cultivation likewise embraced futures contracts. Among medium-sized farms in this category, 17 % sought price risk management through futures contracts, while a notably higher percentage, 27 percent, of large farms engaged in similar practices.

Table 1: Larger farms use futures and options.

Futures contract users | Options users | |||

Gross cash farm income ($) | Farms | Percent | Farms | Percent |

All farms | ||||

Less than 350000 | 13886 | 0.7 | 3498 | 0.2 |

350,000-999,999 | 15174 | 11.8 | 7290 | 5.7 |

More than 999,999 | 10784 | 17.0 | 5532 | 8.7 |

Table 1: (continued). | ||||

All | 39843 | 1.9 | 16323 | 0.8 |

Corn or soybean producers only | ||||

Less than 350000 | 12838 | 4.6 | 2346 | 0.8 |

350,000-999,999 | 14737 | 17.4 | 7061 | 8.4 |

More than 999,999 | 9997 | 27.1 | 4769 | 12.9 |

All | 37572 | 10.4 | 14176 | 3.9 |

Source: USDA, National Agricultural Statistics Service, 2016 Agricultural Resource Management Survey.

Corn and soybean farms that employed futures or options significantly mitigated risk for a significant portion of their production through these financial instruments. To illustrate, in 2016, although merely 10 % of all corn producers engaged in hedging via futures contracts, this selected group managed to hedge 41 percent of their corn production, as indicated in Table 2[7].

Table 2: A minority of farms engaged in corn and soybean cultivation actively employ futures and options.

Corn | Soybean | |

Risk management tool: | Percentage of farms using | |

Futures contracts | 9.9 | 9.3 |

Options contracts | 4.4 | 2.7 |

Futures or options contracts | 11.8 | 10.7 |

Marketing contracts | 21.7 | 24.8 |

Among users of each: | Percentage of production hedged | |

Futures contracts | 41.1 | 47.2 |

Options contracts | 30.9 | 33.0 |

Futures or options contracts | 44.2 | 42.5 |

Marketing contracts | 42.3 | 53.3 |

Source: USDA, National Agricultural Statistics Service, 2016 Agricultural Resource Management Survey

However, these forward-looking strategies play a significant role in safeguarding a considerable portion of their crop production.

5. Risks and shortcomings

As previously mentioned, when functioning effectively, futures contracts can be a valuable tool for mitigating the price risk associated with agricultural products, enabling producers to hedge against adverse price movements. However, it is crucial to underscore that future contracts, in and of themselves, do not inherently diminish price volatility. Price volatility plays a vital role in ensuring the functionality of futures markets. If price fluctuations are minimal or nonexistent, futures markets lose their appeal to speculators seeking to capitalize on these price swings, resulting in illiquidity and dysfunction [8].

Furthermore, futures speculation can exacerbate price volatility, potentially leading to abrupt price spikes. Notably, financial speculation on commodity exchanges has been identified as a significant contributor to the sharp price increases observed during the 2007–2008 and 2010–2011 periods in the food commodities market. During these periods, short-term price fluctuations far exceeded what could be explained by alterations in supply and demand dynamics. For instance, between January and February 2008, wheat prices experienced a substantial 46 % surge, followed by a nearly complete retracement in May, only to surge again by more than 20 percent in June and then decline once more from August. Similarly, over the span of a year, from April 2007 to April 2008, rice prices skyrocketed by an astonishing 165 %. It is plausible that these remarkable price swings were largely instigated by speculative activities rather than fundamental market forces. It is worth noting that extreme price fluctuations of this nature primarily benefit speculators to the detriment of both producers and consumers. Even short-term price hikes seldom prove advantageous to agricultural producers because they convey misleading signals and misinformation for guiding future production decisions. In addition, such fluctuations may pose financial risks to farmers engaged in futures contracts, as their positions may incur substantial costs and losses during episodes of rapid price escalation [9].

6. Conclusion

This paper discusses how futures can be helpful and problematic for the agricultural sector. When exchanges work well, futures can assist farmers by allowing them to secure a selling price for their products in advance, helping them deal with price fluctuations and make better decisions for their farming activities. However, there are downsides to using futures. Farmers can miss out on higher product prices because futures contracts determine the prices. In addition, participating in futures contracts can be costly due to commissions and fees paid to brokers and advisors. If the futures market does not work properly, the futures price may differ from the actual market price, resulting in farmers getting less money than expected. Most importantly, futures on their own do not reduce the price swings of agricultural products, which are important for exchange markets to function well. Instead, excessive speculation in futures can cause temporary price hikes, making price swings even worse for farmers and consumers. In summary, futures are not a solution to reducing price swings but can be a useful tool for managing their negative effects.