1. Introduction

The onset of the Russia-Ukraine military conflict has resulted in a multitude of challenges that have far-reaching implications for the global economy. As countries grapple with the consequences of Russia's invasion of Ukraine, the repercussions extend beyond immediate borders, causing disruptions in commodity markets and supply chains. This conflict not only jeopardizes the macro-financial stability and growth prospects of nations worldwide but also adds complexity to the policy landscape as governments and financial institutions strive to mitigate the impact of these concurrent crises.

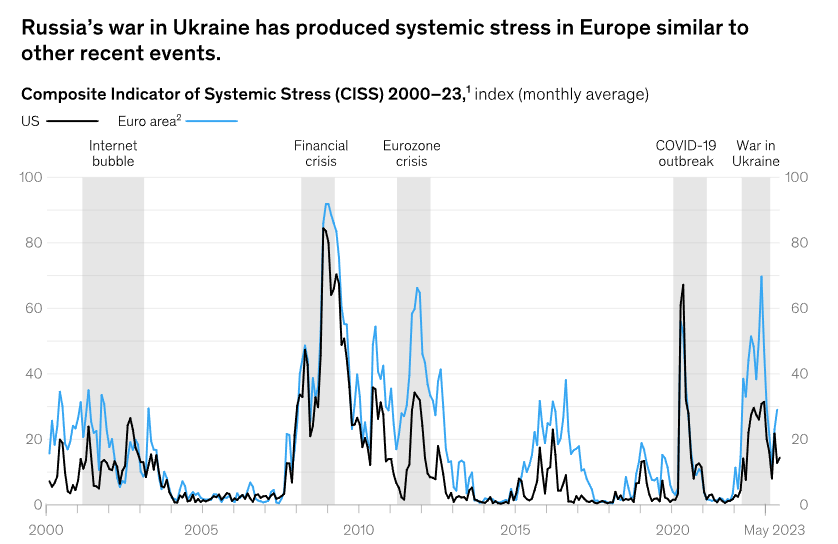

The immediate concern among global markets was evident following the invasion, as indicated by the substantial rise in the European Central Bank's measure of systemic stress [1]. This stress was particularly pronounced in Europe, as depicted in Figure 1. The conflict suggests a potential divide between advanced and emerging market economies, potentially leading to the fragmentation of the global economic order into distinct geopolitical blocs characterized by varying technology standards, cross-border payment systems, and reserve currencies [1].

Figure 1: Composite Indicator of Systemic Stress (CISS) 2000-23, monthly average [1].

This seismic shift poses a significant threat to the rules-based international and economic order that has prevailed for the past 75 years, potentially undoing decades of progress. In April 2022, the International Monetary Fund (IMF) acknowledged the gravity of the situation, revising its World Economic Outlook to forecast a slowdown in global growth from 6.1 percent in 2021 to 3.6 percent for the years 2022 and 2023, directly attributed to the war [2]. These adjustments reflect a downward revision of 0.8 and 0.2 percentage points for 2022 and 2023, respectively, compared to previous projections made in January of the same year [2]. The expected repercussions are not limited to the warring nations, as the IMF predicts a significant double-digit decline in Ukraine's GDP and a substantial contraction in Russia's economic output, with potential spillover effects across various channels including commodity markets, trade, remittances, and finance [2]. The anticipated decline in GDP growth across regions will dampen global demand for agri-food products, while the potential for a sustained appreciation of the USD, particularly against the backdrop of rising interest rates in the United States, could exacerbate the economic challenges faced by developing regions by increasing their debt burdens [2].

Against this backdrop, this essay aims to analyze the hedging strategies employed by the Trafigura Group and Louis Dreyfus Company, leading corporations in the global energy and food sectors. The following sections will delve into the impact of the war on these corporations and their respective strategies to manage related risks, focusing on the utilization of derivatives for hedging purposes. Additionally, this essay will explore the use of gold as a hedging asset before concluding.

2. Energy

2.1. Fuel Price

Due to the ongoing conflict in Ukraine, there has been a notable surge in energy prices and a considerable level of instability in energy markets [3]. Following Russia's invasion of Ukraine, the prices of oil, coal, and gas experienced a sudden and significant increase, subsequently remaining highly volatile [3]. The escalation in energy price volatility began in December 2021, coinciding with reports of a potential Russian invasion. Within the first two weeks following the invasion, oil prices rose by approximately 40%, coal prices skyrocketed by 130%, and gas prices soared by an alarming 180%, as Figure 2 shown [3].

Figure 2: Energy prices before and after the Ukraine conflict [3].

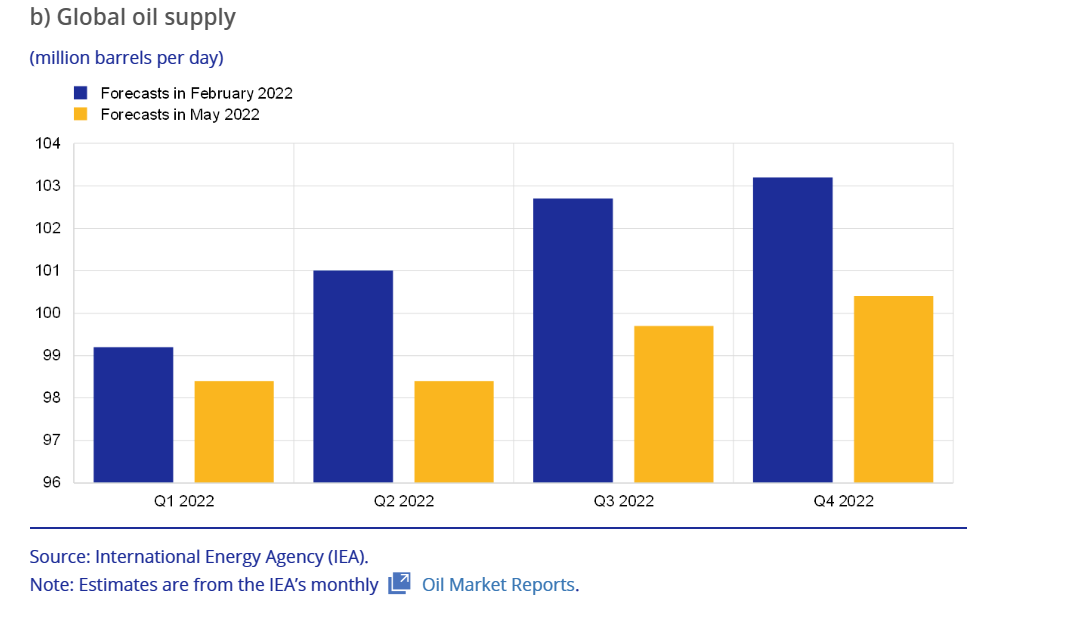

There are notable indications of substantial and ongoing declines in Russian oil production, with projections suggesting a 25% decrease in Russian oil supply in the second half of 2022 compared to the beginning of the year [3]. The sustained low levels of Russian production indicate a growing tightness in the global oil market, unless other major producers accelerate their production. Consequently, global oil supply forecasts for the remainder of the year may need to be revised downward by approximately 3% since the onset of the invasion as displayed in Figure 3 [3].

Figure 3: Global oil supply (millions barrels per day), 2022Q1-2022Q4 [3].

2.2. Impact of Conflict on Trafigura

Trafigura Group, a prominent player in the global commodities industry, ranked 12thin the Fortune Global 500 [4]. Despite a decline in oil trading volume from 7 million barrels per day in 2021 to 6.6 million in 2022, the Singapore-based commodities trader specializing in energy and fossil fuels achieved a remarkable feat [4]. It reported a record-breaking profit of nearly $7 billion in 2022, more than doubling its earnings from the previous year [4]. However, Trafigura faced significant operational and management challenges amidst the outbreak of the war. In anticipation of impending international sanctions in May 2022, the group strategically opted to terminate its long-term contracts with Russian state-owned entities [5]. Moreover, in July 2022, the company successfully executed a transaction to divest its sole investment in Russia, a minority stake of 10 percent in Vostok Oil [5].

The conflict led to extreme volatility in global markets and elevated commodity prices, significantly raising the Group's risk exposure across all areas [5]. In 2022, the average market risk Value at Risk (VaR) at one-day 95 percent confidence level amounted to USD 199.8 million, representing 1.33 percent of the Group's equity, compared to USD 47.9 million in the previous fiscal year, accounting for 0.45 percent of Group equity [5].

Consequently, the company's performance during this volatile period was heavily dependent on the effective implementation of robust risk management and hedging strategies. To manage price risk and secure profit margins, the Group relied on the implementation of effective risk management and hedging strategies. It strategically employed futures contracts, reduced trading volumes, and shifted focus towards higher-margin businesses [5]. These measures allowed the Group to maintain its financial stability and reduce its average Value at Risk (VaR) to below one percent in the final quarter of the year.

2.3. Hedging Strategies of Trafigura

As a company with significant market presence, Trafigura is exposed to a wide array of risks. The Group utilizes derivative financial instruments to mitigate its main market risk exposures, primarily related to fluctuations in commodity prices [5]. It also manages exposure to foreign currency exchange rates and interest rate movements, albeit to a lesser extent [5]. Commodity derivative contracts are employed to hedge against commodity price risks associated with physical purchases and sales contracts, including inventory [5]. The Group strategically utilizes commodity swaps, options, and futures to effectively manage risks related to price and timing, in alignment with its risk management policies [5]. However, the onset of the conflict has presented challenges in effectively mitigating commodity price risk through futures markets. As the largest exporter of natural gas and the second-largest exporter of oil, the Russian Federation had to adapt its energy product export strategies in response to economic sanctions imposed by the international community [6]. Consequently, Russia's withdrawal from the European Union's energy market could lead to a lack of liquidity in derivative markets and disruptions in supply chains [7]. Furthermore, the situation has become more capital-intensive due to significantly increased margin requirements imposed by clearing banks and exchanges.

The group's annual report for 2022 reveals notable changes in derivative assets compared to the previous year. The total derivative assets of the Group witnessed a significant annual growth rate of 181.03%, rising from 2953.5 million in 2021 to 8304.2 million in 2022 [5]. The greatest boost in absolute value was observed in Physical forwards with an increase of $3703.8 million from $1846.5 million in 2021 [5]. The increase indicates a higher volume of hedging activities using physical commodity contracts. This is due to expectations of increased demand of energy products and volatility in the underlying commodities. The largest increase in absolute value was observed in Physical forwards, which saw arise of $3703.8 million from 1846.5 million in 2021 [5]. This increase indicates a higher level of hedging activities using physical commodity contracts, driven by expectations of increased demand for energy products and volatility in the underlying commodities. Over-the-counter (OTC) derivatives also experienced a substantial increase from $543.6 million to $1052.5 million, representing a growth rate of 93.89% and an increase of $508.9 million.

This suggests a greater utilization of customized derivative contracts, reflecting the growing demand for tailored hedging solutions to manage specific risks and safeguard the group′s financial positions in an uncertain geopolitical landscape. Notably, there was a significant annual decrease of 29.94. A notable 29.94% annual decrease in futures from $95.1 million can be attributed to a reduced reliance on standardized exchange-traded contracts, potentially indicating a shift towards more customized hedging instruments or a modification in the group's risk management strategy [5]. Such a proposition is further supported by the substantial increase in OTC derivatives. Additionally, the group experienced a remarkable growth rate of 915.06% in Interest-rate swaps assets, rising from $25.9 million to $263.5 million [5]. This surge suggests an elevated exposure to interest rate fluctuations and a strong imperative to manage interest rate risk, likely driven by the group's financing activities and a desire to optimize its debt structure. However, the cross-currency swaps assets of the commodity trading company witnessed a significant annual decrease of 78.43%, declining from $10.2 million to $2.2 million [5]. This decline signifies a reduced need for managing currency exchange rate risk, potentially attributed to significant shifts caused by the Russian-Ukrainian war, which has had a profound impact on the energy sector. Despite facing various global challenges, Trafigura's adept risk management and hedging strategies played a pivotal role in successfully navigating these obstacles and ensuring the smooth continuation of their operations.

3. Food

3.1. Food Price

The ongoing conflict between Russia and Ukraine is causing significant concern regarding its impact on the global food economy, particularly for major players in the agricultural commodity market [2]. This comes at a time when international food and input prices are already high and increasingly unpredictable. In fact, the FAO Food Price Index (FFPI) reached its all-time high of 159.7 in March 2022, just one month after the outbreak of the military conflict [8].

Both Russia and Ukraine are prominent global producers of agricultural commodities. Prior to the crisis, these two countries accounted for 30% and 20% of global wheat and maize exports, respectively. They were also responsible for nearly 80% of global sunflower seed product exports [2]. However, the war has disrupted these markets, leading to a 40% drop-in combined dry bulk shipping activity from the region compared to the 2021 average [9].

According to FAO simulations, world wheat prices could increase by up to 21.5%, while other cereals and oilseeds may also experience price increases, although to a lesser extent [2]. The damage caused to infrastructure in Ukraine, including transport, storage, and processing facilities, further exacerbates the situation [2]. The concentrated nature of these markets makes them particularly vulnerable to shocks like the ongoing conflict. Therefore, risks such as trade flow disruptions, soaring prices, potential reductions in future harvest production, and logistical challenges must be carefully considered in relation to global food supply [2].

3.2. Impact of Conflict on LDC

Louis Dreyfus Company (LDC), a prominent player in the agricultural and food processing industry, has faced significant challenges in the wake of the Russia-Ukraine military conflict. This crisis has had a profound impact on LDC's operations, particularly in terms of the availability of essential commodities such as wheat, corn, and vegetable oil [10]. As a result, concerns have arisen regarding potential global shortages, leading to heightened market volatility and increased prices [10]. In the fiscal year ending December 31, 2022, products sourced from Ukraine and Russia accounted for approximately 2% of LDC's net sales in dollar terms, compared to less than 4% the previous year [10]. To mitigate its exposure in these conflict-ridden regions, LDC adopts a risk management strategy that includes insuring assets against political and war risks whenever possible.

In Ukraine, LDC primarily operates in the wheat and corn sectors and has implemented measures to ensure the safety of its employees and safeguard its assets [10]. However, the conflict has had adverse effects, with some railcars in the conflict zone being fully depreciated, and wheat inventories in a third-party silo being destroyed [10]. Additionally, operations have been significantly impeded, with maritime exports remaining suspended until August 2022 due to martial law [10]. In response to these challenges, LDC established a new entity in Romania to support its operations, albeit at additional costs. As of December 31, 2022, LDC's Ukrainian operations accounted for assets worth $125 million and liabilities of $62 million, reflecting the financial adjustments made due to the war [10].

In Russia, LDC operates a grains origination business, owning silos and a grain terminal in Azov and co-developing a deep-sea terminal in Taman [10]. However, as a consequence of the conflict, LDC recognized a $156 million impairment on the Taman project, acknowledging uncertainty in the project's future and its financial projections [10]. Initially suspending operations when the crisis began, LDC later cautiously resumed activities in Russia, ensuring compliance with sanctions and regulations [10]. As of the end of 2022, LDC's assets in Russia were $74 million against liabilities of $36 million [10].

3.3. Hedging Strategies of LDC

The Russia-Ukraine crisis has caused significant disruptions to business operations and has added to the uncertainties surrounding the global supply of agricultural commodities [10]. In this challenging situation, Louis Dreyfus Company's risk containment mechanisms and independent risk management department have played a crucial role. The company focuses on proactive risk management by analyzing historical data from futures markets to predict and mitigate future risks, creating a forward- looking risk alert mechanism. The risk management department calculates Value at Risk (VaR) on a daily basis [11].

Louis Dreyfus Company's monthly average VaR has reflected the increased risk resulting from price volatility and supply availability, reaching its highest level in the past five years (0.57%) in March 2022 [10]. The company collaborates with a research institution to collect and analyze market information for global commodity markets. The risk management department is responsible for gathering and organizing this data, establishing databases and IT systems for efficient risk monitoring [11]. Market information is sourced from various channels, including futures markets, electronic trading platforms, financial data providers, and market reports from specialized agencies. Their monitoring platform automates data analysis and risk calculation, generating daily reports for the risk management department. When potential risks are identified, the department formulates risk hedging strategies [11]. Under the risk constraint framework, the company has successfully reduced its VaR for the remainder of the year, achieving an average annual VaR of 0.39% in 2022 compared to 0.42% in 2021 [10]. As part of its standard risk management practices, the Group actively uses a variety of derivative financial instruments to facilitate future settlements. These instruments include futures contracts, forward purchase and sale agreements, as well as option contracts, which are executed either on regulated exchanges or in the over-the-counter (OTC) market [10].

Louis Dreyfus has established itself as a pioneer in using futures markets to hedge risks and achieve stable profits in physical trading [11]. With a strong commitment to sustainable development, the company leverages global asset allocation and investments in logistics assets to achieve scale and efficiency [11]. By engaging in futures markets, Louis Dreyfus not only capitalizes on opportunities for physical arbitrage and risk control but also invests in import-export facilities to ensure efficient trade execution at the most favorable market prices [11]. Their investment decisions in futures are based on meticulous fundamental analysis, enabling them to capitalize on market opportunities arising from global asset allocation [11]. Furthermore, Louis Dreyfus actively encourages the flexible utilization of futures and derivatives to optimize both risk management and returns [11]. To ensure the effectiveness of their hedging strategies, they consistently conduct back testing and closely monitor profitability, making necessary adjustments to their positions in response to market changes [11].

Reviewing LDC's 2022 annual report, it is apparent that the group has reduced its overall trading volume with derivative financial instruments, as evidenced by the decrease of 33.74% and 45.08% in derivative assets and liabilities from 2021 to 2022 [10]. In 2021, LDC had derivative financial instruments recorded as assets at $2,443 million and as liabilities at $2,640 million, resulting in a net derivative position of $-197 million. However, in 2022, assets decreased to $1,619million, while liabilities significantly decreased to $1,450 million, resulting in a net derivative position of $169 million [10]. This shift from a net liability to a net asset position is a positive indicator of performance in derivatives. It suggests that the company maybe in a net gain position on its derivative contracts or is effectively hedging against its exposures. The reduction in both assets and liabilities by LDC indicates a deliberate de-risking approach, which is crucial in light of the intense geo-political crisis in the Eurasia region. This strategic move signifies a decrease in the company's exposure to skyrocketing price volatility. As of December 31, 2022, the Group recorded a provision for derivative assets amounting to $87 million, representing a significant increase of 262.5% compared to the same period in the 2021 when it was $24 million [10]. This heightened provision serves as a risk management tool to address the potential financial implications of unrealized gains on forward agreements that are deemed to be exposed to performance risk. Specifically, these forward purchase agreements have been identified as high-risk due to the ongoing Russia-Ukraine crisis.

While Louis Dreyfus Company has demonstrated success in utilizing derivatives for risk mitigation, it is important to acknowledge that market risks cannot be fully eliminated. Therefore, companies must continually adjust and optimize their hedging strategies based on the latest market conditions. Maintaining flexibility and agility is paramount in adapting to the ever-changing market environment and ensuring the efficacy and efficiency of risk management.

4. Gold

As corporates navigate the complexities of the Russia-Ukraine conflict, it is pivotal to discuss the role of gold as a hedging asset. Gold's historical stature as a store of wealth and medium of exchange, cemented through its ties to the gold standard and its continued status as a reserve asset for central banks, underscores its relevance in contemporary financial strategy. The stability of the gold price through 2021 and 2022, as reported by Statista [12]. Despite only exhibiting fluctuations rather than a marked increase, it suggests its potential as a safe haven during geopolitical upheavals such as the Russia-Ukraine conflict.

Corporate entities might consider gold investment to counteract the vagaries of the market and currency devaluations. For example, in response to the COVID- 19 pandemic, Palantir Technologies purchased $50.7 million in gold bars in August 2021, illustrating the use of gold as a hedge against uncertain economic conditions [13]. The inverse relationship between the nominal price of gold and the strength of the US dollar, implies that gold investment can offer protection against exchange- rate risks—an important consideration for corporates with significant dollar exposure [14]. Furthermore, the counter-cyclical nature of gold indicates that in times of economic downturns or crises, gold tends to perform opposite to the broader market, retaining value when other assets may falter [15]. While Baur and Lucey assert gold's role as a hedge against equities and as a safe haven in times of market stress [16]. The nuanced view presented by Baur and Glover acknowledges that investor behavior, particularly during crises, can impact gold's hedging efficacy [17]. The contagion effects described by Hasman and Samartin further complicate the picture, potentially leading to co- movement of markets even when fundamental economics would suggest otherwise [18]. These insights should temper corporate expectations about gold's behavior during crises. Nevertheless, Klein's research, using a dynamic correlation model, initially affirms gold's role in hedging against stock market indices in the US and Europe, albeit with a noted decline post-2013 [19].

Corporates seeking to include gold in their hedging strategies should consider its historical performance along with current market analyses to gauge its effectiveness under present conditions. This balanced approach could enable companies to integrate gold into a comprehensive risk management portfolio, leveraging its traditional safe haven status while remaining cognizant of the evolving nature of financial markets.

5. Conclusion

The Ukraine conflict has had significant implications for corporates operating in the energy and food sectors. This essay has analyzed the hedging strategies employed by Trafigura Group and Louis Dreyfus Company, two major players in these industries, to manage the risks associated with the conflict.

Trafigura Group, despite facing operational and management challenges, successfully implemented robust risk management and hedging strategies. By strategically utilizing futures contracts, reducing trading volumes, and focusing on higher-margin businesses, Trafigura was able to maintain financial stability and reduce its risk exposure. The company's use of derivative financial instruments, including commodity swaps, options, and futures, played a crucial role in managing commodity price risks.

Louis Dreyfus Company, in the face of disruptions to the global food economy caused by the conflict, demonstrated a strong commitment to risk containment. The company's risk management department implemented proactive strategies, analyzing historical data and utilizing derivative financial instruments to mitigate market risks. Despite the challenges posed by the conflict, Louis Dreyfus Company effectively adjusted its hedging strategies to reduce exposure to price volatility and ensure the continuation of its operations. Furthermore, this essay examined the role of gold as a hedging asset in times of geopolitical turmoil. While gold has historically served as a safe haven and store of value, its effectiveness as a hedge during crises may vary depending on investor behavior and market dynamics. Corporates considering gold as part of their hedging strategies should carefully assess its historical performance and current market conditions to gauge its efficacy.

In conclusion, the Russia-Ukraine military conflict has highlighted the importance of robust risk management and flexible hedging strategies for corporates operating in volatile environments. By carefully analyzing market conditions, utilizing derivative financial instruments, and considering alternative assets such as gold, companies like Trafigura Group and Louis Dreyfus Company have demonstrated their ability to navigate these challenges and protect their financial positions. The lessons learned from their experiences can serve as valuable insights for other corporates operating in volatile environments.